CAN TATA-OWNED JLR, PLUS NISSAN, HONDA, BMW AND TOYOTA STAY IN UK?

AUTOMAKERS in Britain could benefit from medium and long-term opportunities after the UK’s vote to leave the European Union (EU), business minister Sajid Javid said on Tuesday (28).

The auto industry, which punches above its weight in manufacturing jobs and lobbying clout, employs 770,000 people in the UK, where car sales are expected to tumble 10 per cent by the end of 2016 as consumers shun big-ticket purchases, according to Evercore ISI, an independent investment banking advisory firm.

Javid met representatives from the business trade associations as he chaired a meeting on Tuesday, his first since the June 23 EU referendum vote.

“Because of last week’s decision, of course there are some short-term challenges for businesses, but we must also remember there are medium-term and long-term opportunities for business as well, and that includes the auto industry,” Javid told Parliament during a regular question session.

He also said Britain should start “em- bracing” the opportunities provided by Brexit, or Britain’s vote to leave the EU.

“Free-trade agreements with many more countries is just one of those – Australia, I think, is an excellent example, it is exactly the thing we should be working on,” he said.

Britain’s biggest carmaker, Jaguar Land Rover (JLR), is owned by India’s Tata Motors and relies on Europe for about 20 per cent of its global sales.

In a statement last Friday (24), a company spokeswoman said the Indian auto- maker’s British luxury arm will remain committed to all its manufacturing sites and investment decisions, stating: “Europe is a key strategic market for our business… We remain absolutely committed to our customers in the EU.”

However, sources suggest JLR has estimated its annual profit could be cut by £1 billion by the end of the decade as a result of Brexit.

“The big question for automakers . . . is what kind of trade deals with the EU would be negotiated. That is the big unknown,” a second executive at a global automaker said.

JLR is Britain’s largest carmaker, followed by Nissan, which has been in the UK for three decades and makes 475,000 cars a year in the UK, most of them for export inside the EU and beyond.

Aside from Tata, Nissan and Toyota, others manufacturing in Britain include BMW, GM and Honda.

Nissan and Toyota voiced fierce opposition to Brexit ahead of the vote as most of their UK production goes to Europe.

Carmakers rely heavily on smaller manufacturers to provide them with vehicle parts so the economic consequences of last week’s vote will radiate wider.

Honda produces around 140,000 vehicles per year, including the CR-V crossover SUV and Civic sedan at its plant in Swindon. Half of its production is exported to the EU.

Toyota said in a statement that it would analyse the impact of the vote on its UK operations. Nissan did not comment, though chief executive Carlos Ghosn said last week the company would question its UK position in the event of Brexit.

At least one country saw a silver lining in Brexit. India’s auto industry body, the Society of Indian Automobile Manufacturers, said it could presage a better trade deal for India with Britain. (Reuters/AFP).

Dhatt with sons Jasvinder and Parminder

Dhatt with sons Jasvinder and Parminder Dhatt as a young soldier

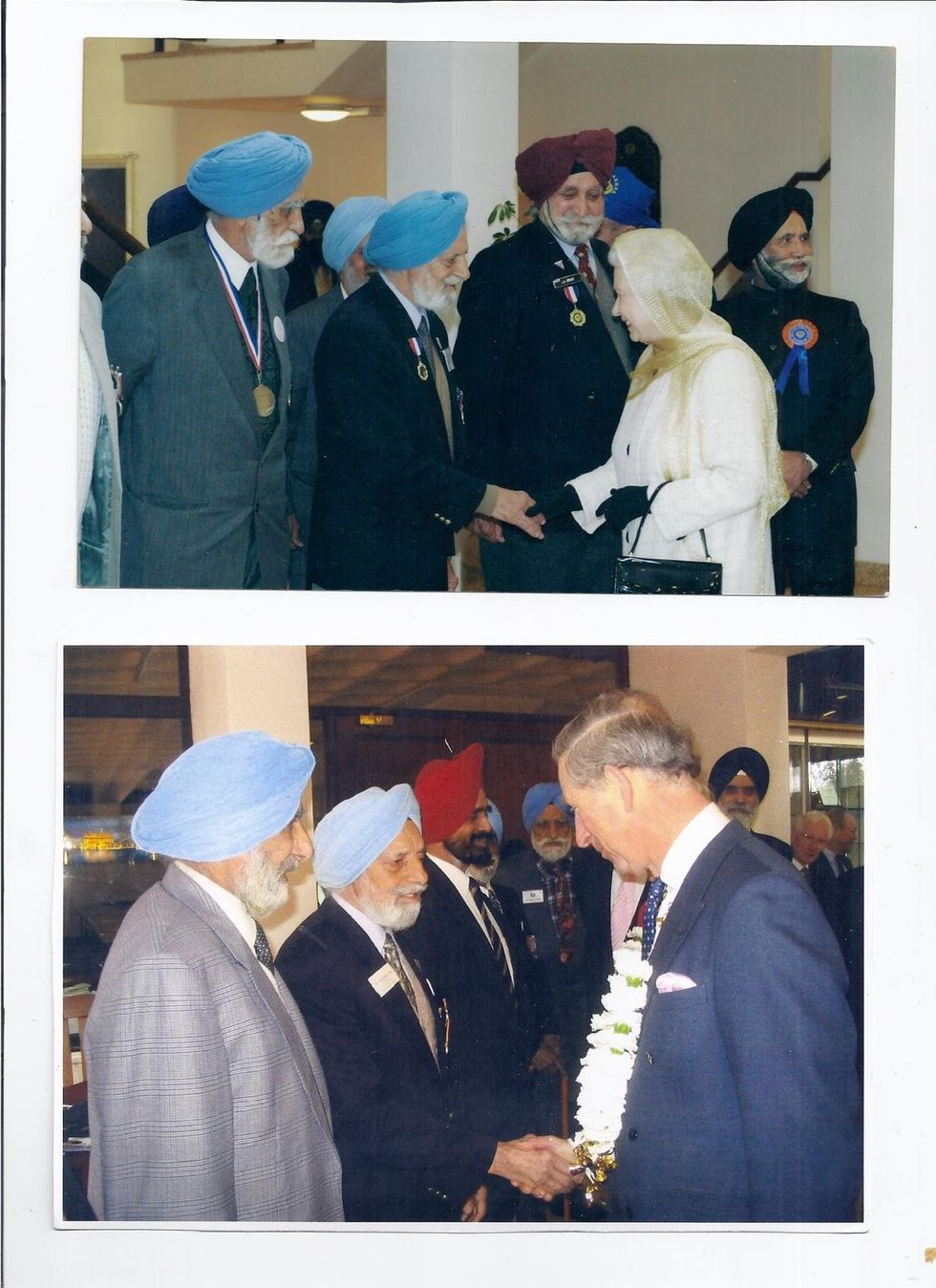

Dhatt as a young soldier Dhatt with the then Prince of Wales, and the late Queen

Dhatt with the then Prince of Wales, and the late Queen Dhatt gardening at home

Dhatt gardening at home Dhatt with his granddaughter Amrit

Dhatt with his granddaughter Amrit