Produced in partnership with UK Government

SHOPKEEPER EXPRESSES RELIEF AS GOVERNMENT GRANTS HELPED COVER EXPENSES IN LOCKDOWN

AN ASIAN businessman facing an uncertain future after he was forced to close his textiles shop due to the pandemic lockdown has spoken of how financial support from the government has been a “big relief”.

Bilal Majeed, 37, runs A&M Textiles in High Wycombe, Buckinghamshire, which deals with fabric, haberdashery and upholstery products.

As the coronavirus spread and lockdown was imposed across the UK, Majeed closed his shop on March 20.

“We lost all our business. We were panicking in the first week,because the government funding wasn’t announced at the time. We didn’t know how long we would be closed for and how long we were going to manage all the expenses, including the rent and invoices,” Majeed recalled.

Days later, in April, because NHS staff needed scrubs, and people started making masks and, also, unfortunately, some people needed funeral fabrics, Majeed said he started to get a few customers, with enquiries coming through Facebook or Whatsapp.

“But our shop was closed and we lost 99 per cent of our sales.”

To support businesses through the lockdown, chancellor Rishi Sunak unveiled a series of massive packages to help those affected.The government stepped in to back up employee wages under the “furlough” jobs retention plan, while also providing tax holidays to businesses.

In April, “bounce back” loans of up to £50,000 for small businesses hit by the coronavirus fallout were launched, with interest paid by the government for the first year.

Majeed applied for small business grant relief, which provides businesses with a £10,000 grant per property, for each of their properties in receipt of Small Business Rates Relief or Rural Rates Relief.

“That was a big relief, some sort of money to cover expenses. It doesn’t cover everything, at least it was something coming in to cover invoices and rent,” he said.

Applying for the grant was “straightforward and we had the money within a week, or two”, according to Majeed.

“For our business, this grant helped us. When we went into lockdown, it was March when we have mostly winter stock. After that, it’s summer stock, up until about September.

“So by the time we reopen [in] mid-June, we have to change our stock. The grant will really help.”

Majeed applied for the Coronavirus Business Interruption Loan Scheme (CBILS), which is available for loans or other forms of finance of up to £5 million, and also the bounce back loan.

“We had two applications running at the same time. We got an email from the bank saying they would cancel our CBILS application. We are waiting for the funds to clear,” he said.

The 37-year-old father of two is among several small business owners who are at the heart of their local communities.

He described how his shop played a part in charitable efforts undertaken by members of the public and companies, large and small, and helping key workers and frontline health staff during the lockdown.

“We sell polycotton, which was in demand for scrubs. A huge demand came through, for maroon and green coloured fabric.

“We had a lot of volunteers, customers and charities involved in crowd-funding efforts or collecting donations, everybody at home making scrubs, bags for scrubs and masks.

“That was quite good. I felt really honoured. They are real heroes, they are on the frontline, and we have donated so much fabric. It was good to be a part of it, giving back to them for the efforts they have been doing.”

Once the lockdown is eased, Majeed said his business will have a larger virtual presence. “We can invest in the online business and in social media. People will not be able to come out (as they did before the lockdown), so it is better for them to be able to access the textiles online.”

Support to save jobs and economy

The Coronavirus Job Retention Scheme

■ Businesses can put employees on a period of furlough and apply for a government grant to cover 80 per cent of those workers’ usual monthly wage costs, up to a cap of £2,500 a month. Self-Employment Income Support Scheme (SEISS)

■ Eligible self-employed individuals can claim a taxable grant of 80 per cent of their average monthly trading profits, paid out in a single instalment covering three months, and capped at £7,500 in total. Statutory Sick Pay

■ The Coronavirus Statutory Sick Pay Rebate Scheme will repay employers the current rate of Statutory Sick Pay (SSP) that they pay to current or former employees for periods of sickness starting on or after March 13, 2020. VAT deferrals

■ If you’re a UK VAT-registered business and have a VAT payment due between March 20, 2020 and June 30, 2020, you have the option to either defer the payment until a later date, or pay the VAT due as normal. Business rates holiday and eviction protection

■ The government has introduced a business rates holiday for the retail, hospitality and leisure sectors and nurseries, meaning eligible properties in England will pay no business rates this year. This relief is worth almost £10 billion.

■ Commercial tenants who cannot pay their rent because of coronavirus will be protected from eviction. Grants

■ The Small Business Grant Fund (SBGF) provides businesses* with a £10,000 grant per property, for each of their properties which are in receipt of Small Business Rates Relief or Rural Rates Relief.

■ The Retail, Hospitality and Leisure Grant Fund (RHLGF) provides businesses with grants of up to £25,000 per property, for each retail, hospitality or leisure property with a rateable value below £51,000.(*applicable only in England)

Loans

■ The government’s Bounce Back Loans Scheme provides loans of up to £50,000 to small businesses,with a 100 per cent governmentbacked guarantee for lenders. These loans will be provided interest free for the first 12 months.

■ The Coronavirus Business Interruption Loan Scheme is available for loans or other forms of finance of up to £5 million.

■ The Coronavirus Large Business Interruption Loan Scheme (CLBILS) supports large businesses with an annual turnover of over £45 million per year to apply for up to £25 million of finance.

Talal Qureshi redefining the sound of Pakistani music

Talal Qureshi redefining the sound of Pakistani music Talal Qureshi sets fire with his track Aag

Talal Qureshi sets fire with his track Aag A proud moment Qureshi's tracks featured in Ms Marvel

A proud moment Qureshi's tracks featured in Ms Marvel

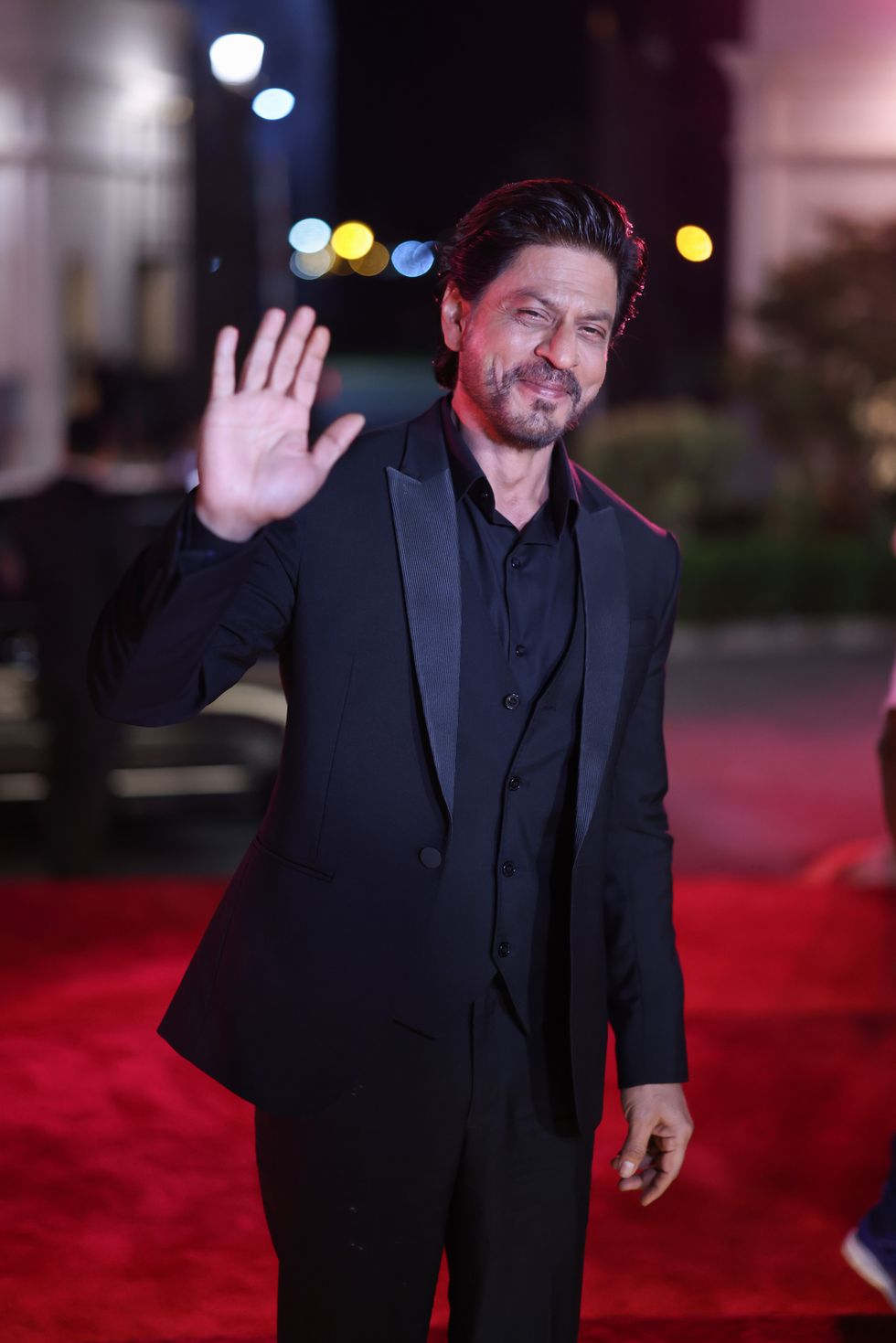

Khloe Kardashian admires Shah Rukh Khan's Sabyasachi designed Met Gala ensembleGetty Images

Khloe Kardashian admires Shah Rukh Khan's Sabyasachi designed Met Gala ensembleGetty Images

Dua Lipa lead a coalition of artists calling for stronger copyright protections against AI exploitationGetty Images

Dua Lipa lead a coalition of artists calling for stronger copyright protections against AI exploitationGetty Images  Elton John join over 400 artists demanding legal action to safeguard creative work from AI misuseGetty Images

Elton John join over 400 artists demanding legal action to safeguard creative work from AI misuseGetty Images