BOOHOO has claimed that Mike Ashley’s Frasers Group is leveraging its significant stake in the online retailer, as well as its interests in other companies, to further its own “commercial self-interest” rather than acting in the interests of all shareholders.

Ashley, a Boohoo shareholder with a 27 per cent stake, has been pressing for a seat on Boohoo’s board since the company announced a strategic review of its operations, which include brands like PrettyLittleThing, Karen Millen, Oasis, and Warehouse.

Recently, Ashley called for limits on any asset sales without prior shareholder approval, citing this as necessary to “protect the interests of Boohoo, its shareholders, and stakeholders.”

Boohoo, currently undergoing a strategic review following CEO John Lyttle’s announcement to step down, stressed its commitment to transparent communication with shareholders while expressing reservations about Frasers' influence due to its stakes in competing brands like ASOS.

Last week, it appointed Dan Finley as its new chief executive. Finley, previously the CEO of Debenhams since 2022, has taken over immediately from Lyttle, who led the fast-fashion company since 2019.

Boohoo has requested several commitments from Frasers to prevent any conflicts of interest, including assurances that Frasers’ representative would not influence decisions at Boohoo’s competitors.

A similar pledge was made by Boohoo’s co-founder Mahmud Kamani, who holds a significant stake, confirming he has no intention to make an acquisition offer for Boohoo, effectively restricting such actions for six months.

Kamani, along with his son, Umar, has about 15.5 per cent of the shares in the online retailer.

Boohoo said that recent actions clearly demonstrated Kamani’s commitment to maximising value for all shareholders. The company urged Frasers to make similar commitments or to clarify any reasons for being unwilling or unable to do so.

The retailer stressed that any board appointment would be restricted to a suitable non-executive director, with necessary governance safeguards in place to protect commercial decisions.

Frasers has criticised Boohoo's board for the recent fall in share price and, in a letter published on Wednesday (6), accused the board of ignoring shareholder concerns.

Boohoo responded by stating that Frasers’ “ongoing legal challenges and public statements are unhelpful” to creating value for all investors and urged Frasers to engage constructively with the board.

Frasers did not immediately respond to requests for comment.

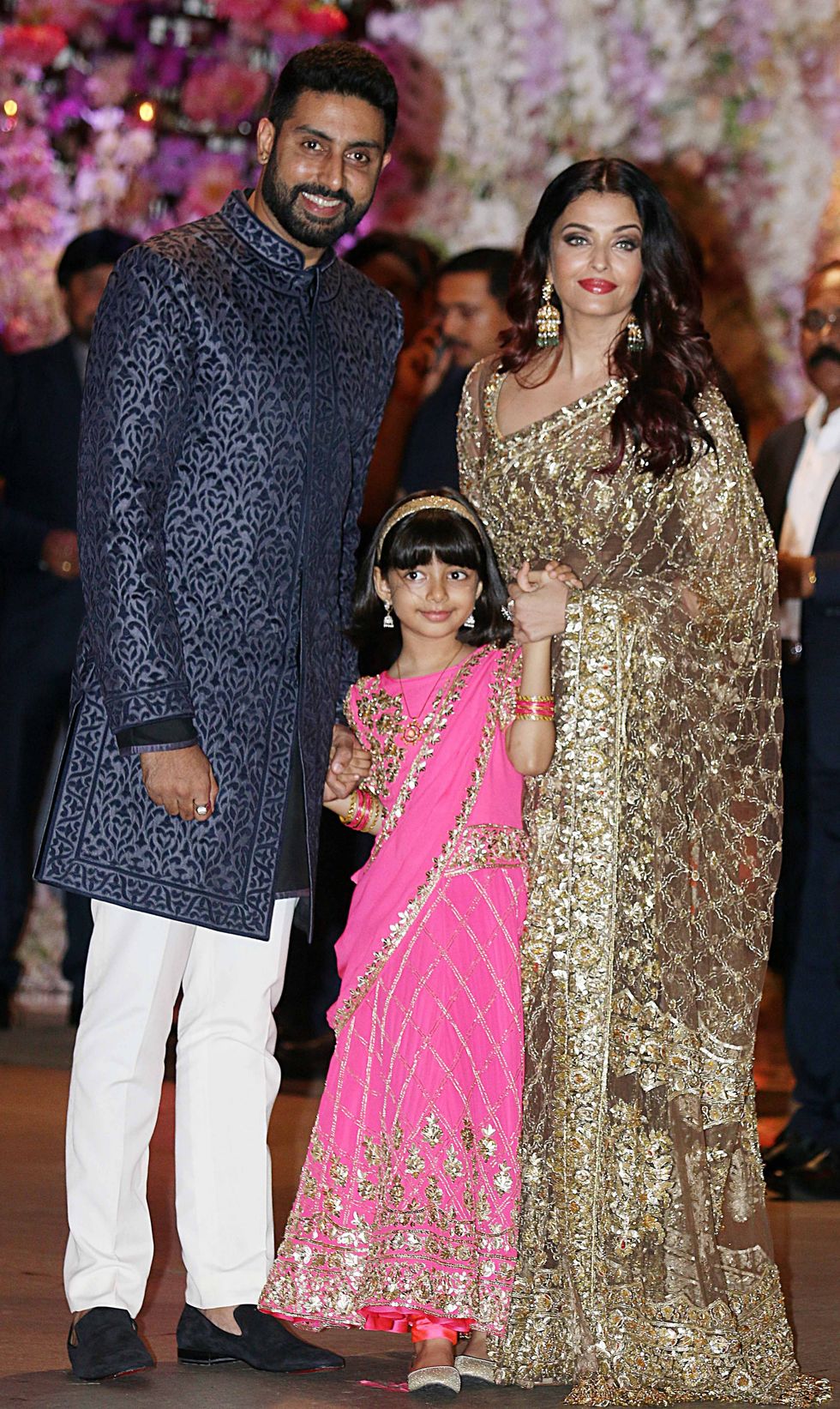

Aaradhya Bachchan has no access to social media or a personal phoneGetty Images

Aaradhya Bachchan has no access to social media or a personal phoneGetty Images  Abhishek Bachchan calls Aishwarya a devoted mother and partnerGetty Images

Abhishek Bachchan calls Aishwarya a devoted mother and partnerGetty Images Aaradhya is now taller than Aishwarya says Abhishek in candid interviewGetty Images

Aaradhya is now taller than Aishwarya says Abhishek in candid interviewGetty Images Aishwarya Rai often seen with daughter Aaradhya at public eventsGetty Images

Aishwarya Rai often seen with daughter Aaradhya at public eventsGetty Images

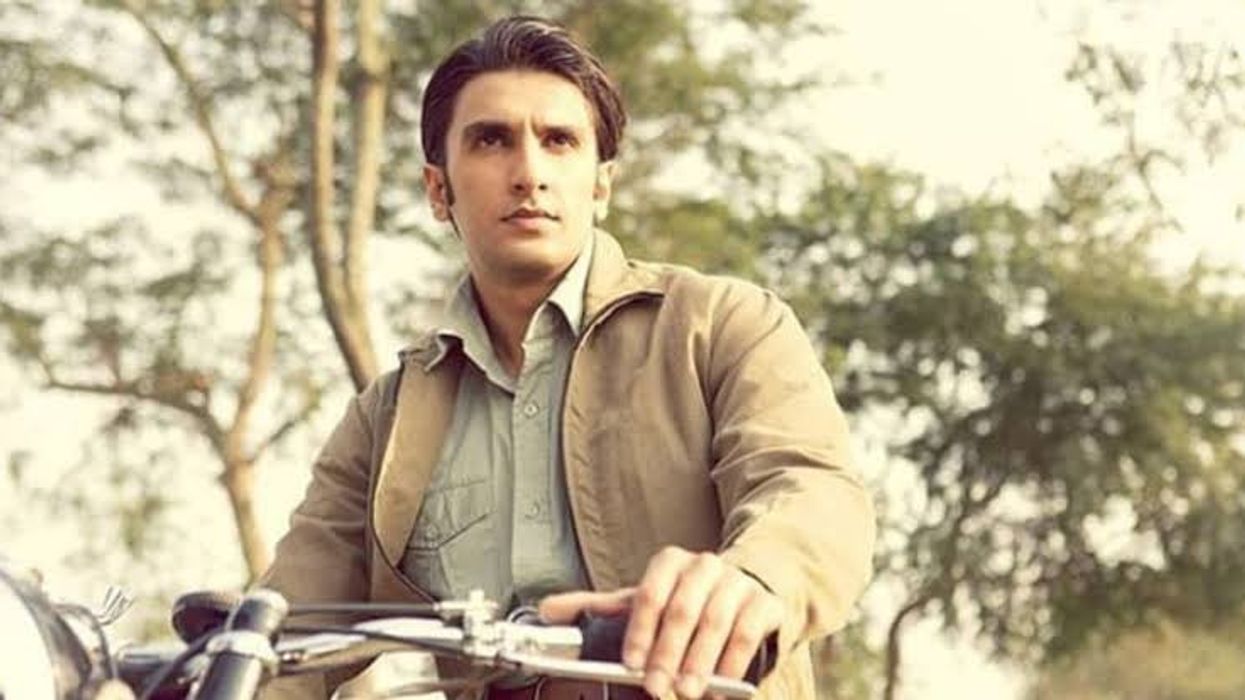

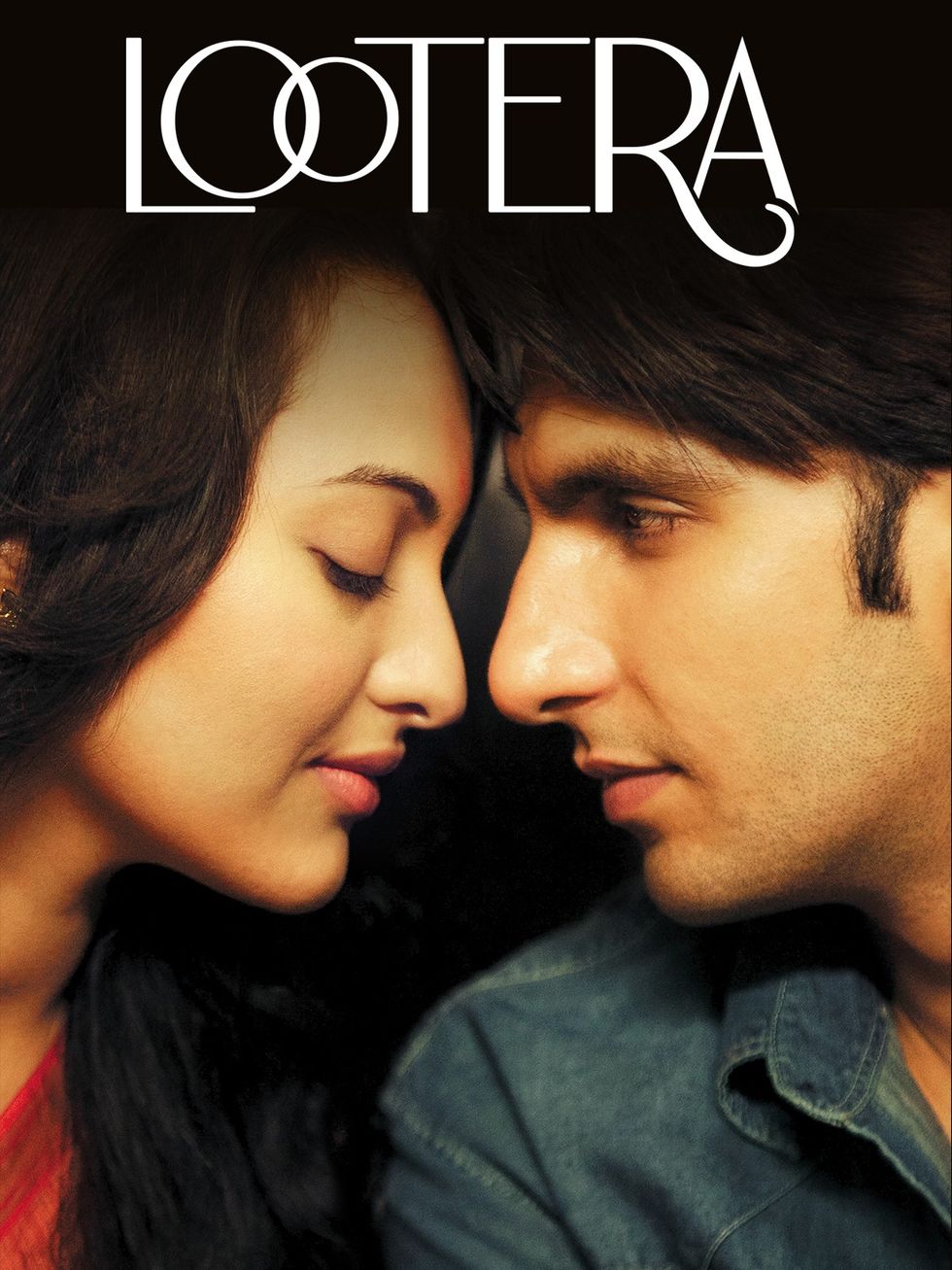

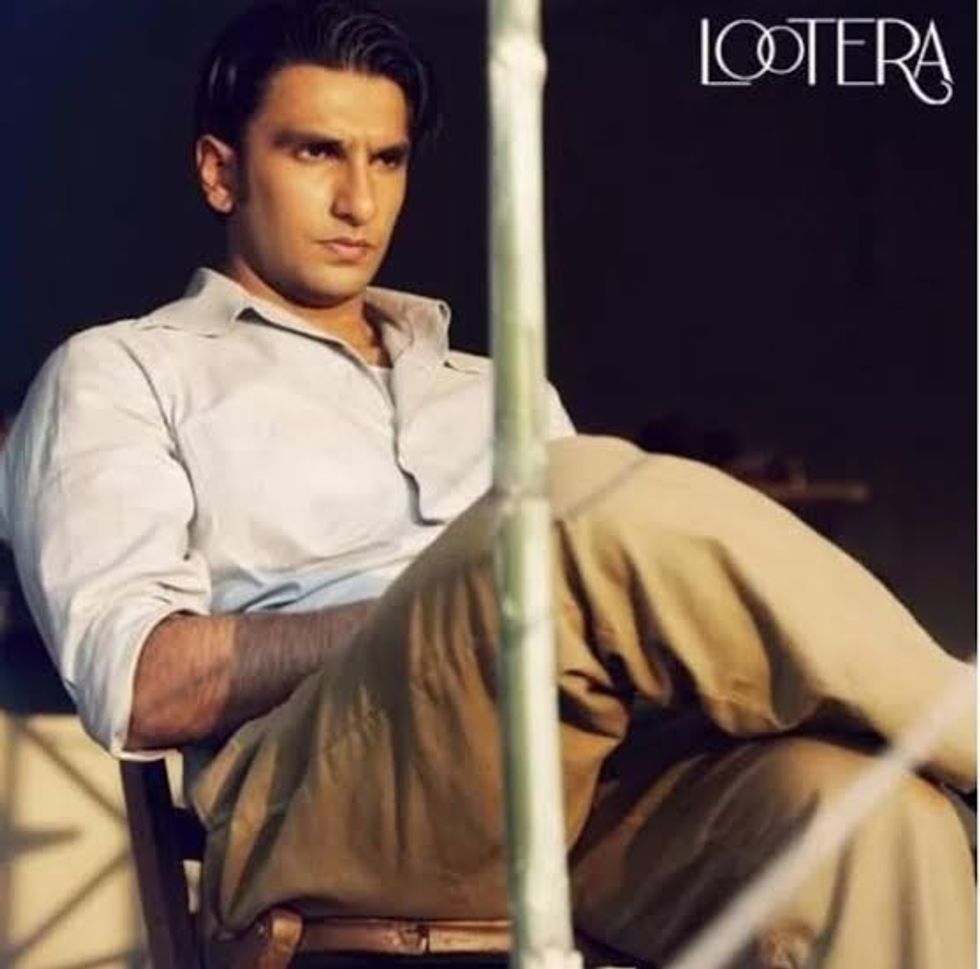

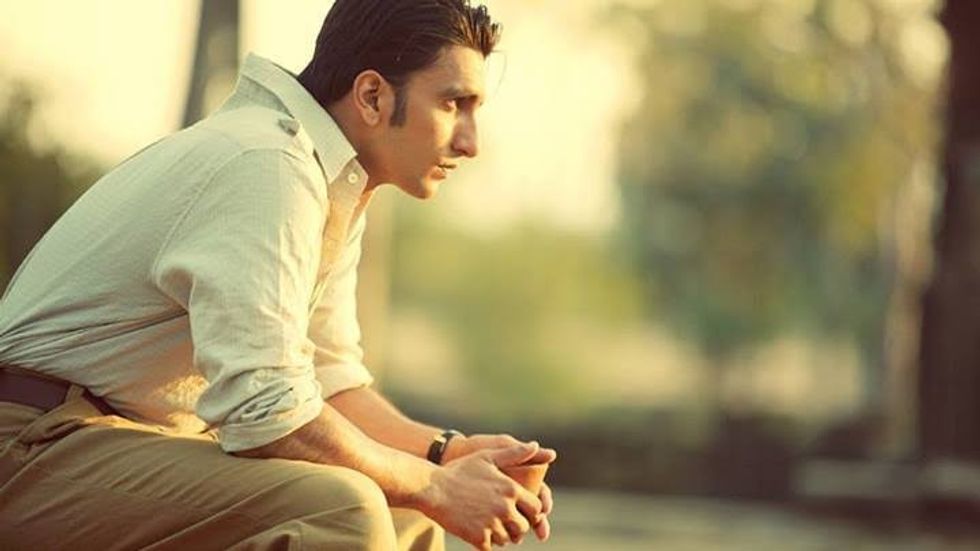

Lootera released in 2013 and marked a stylistic shift for Ranveer Singh Prime Video

Lootera released in 2013 and marked a stylistic shift for Ranveer Singh Prime Video  Ranveer Singh’s role as Varun showed he could command the screen without saying much

Ranveer Singh’s role as Varun showed he could command the screen without saying much The period romance Lootera became a turning point in Ranveer Singh’s career

The period romance Lootera became a turning point in Ranveer Singh’s career Ranveer Singh’s performance in Lootera was praised for its emotional restraint

Ranveer Singh’s performance in Lootera was praised for its emotional restraint Ranveer Singh and Sonakshi Sinha starred in the romantic drama set in 1950s BengalYoutube/Altt Balaji Motion Pictures

Ranveer Singh and Sonakshi Sinha starred in the romantic drama set in 1950s BengalYoutube/Altt Balaji Motion Pictures  Lootera’s legacy has grown over the years despite its modest box office runYoutube/Altt Balaji Motion Pictures

Lootera’s legacy has grown over the years despite its modest box office runYoutube/Altt Balaji Motion Pictures