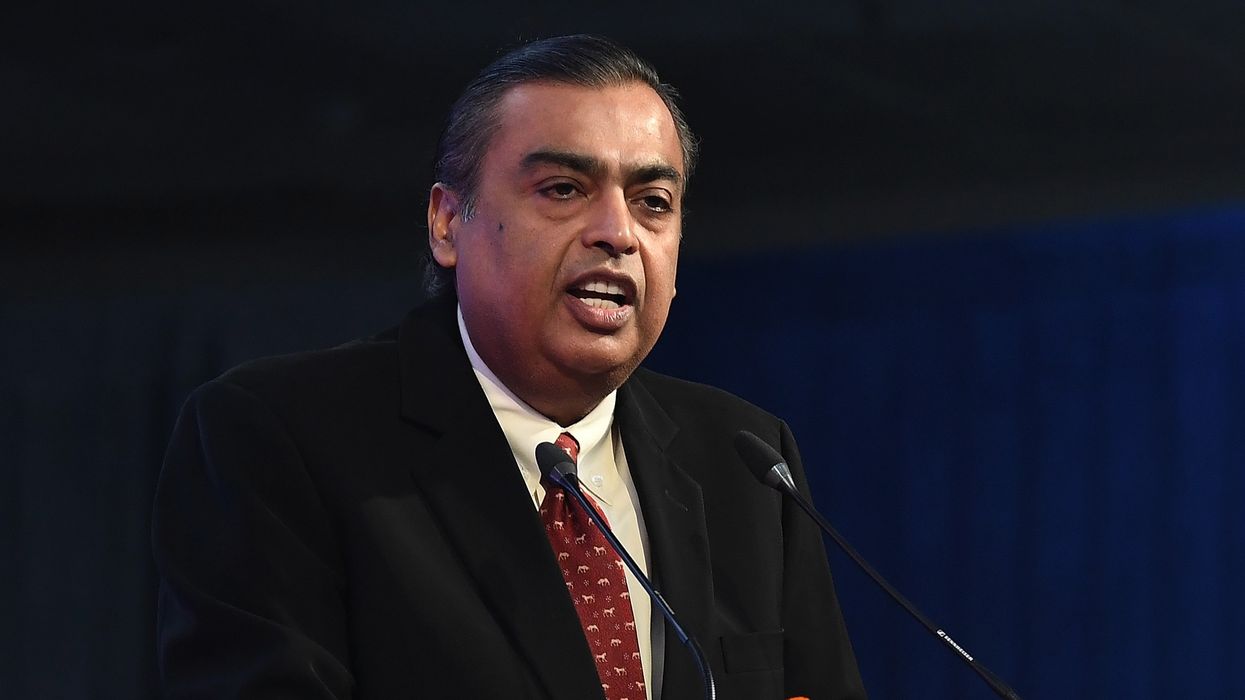

India’s entertainment industry, already a powerful force, is now being seen as a serious engine for economic growth and not just culture. At the WAVES 2025 summit in Mumbai, Reliance Chairman Mukesh Ambani painted a clear picture: what is today a £22 billion (£1.83 lakh crore) industry could cross £80 billion (£6.67 lakh crore) in the next decade. But he says this growth will not happen on its own, it needs the right backing.

Ambani is not talking about small steps. He envisions India building advanced content hubs across the country, supporting creators with world-class training in animation, visual effects, gaming, and AI-led storytelling tools. In his words, this could unlock millions of jobs, spark new businesses, and bring global attention to Indian content.

He also emphasised that regulation should not be restrictive. Instead, the industry needs policies that encourage experimentation, protect creative ownership, and value diverse voices. Without that, the momentum could stall.

For Ambani, Indian storytelling is not just culturally important, it is a strategic advantage. He believes no other nation can compete with the depth, variety, and emotion in India’s stories, from ancient epics to regional gems. These stories, he says, are not just entertainment. They offer hope, connection, and perspective in a divided world.

India’s edge, according to him, lies in how it has combined its storytelling roots with modern technology. AI and immersive tools are already helping creators leap across language and geography. With the right skills and infrastructure, Ambani believes India’s next generation of creators can produce blockbusters for global audiences.

His remarks came just as the WAVES summit, which brings together media professionals from nearly 90 countries, got underway in Mumbai. Prime Minister Narendra Modi opened the event, calling it a turning point for India's creative economy.

Ambani ended on a note of confidence, saying this was “New India” in action: fast-moving and ready to raise the bar worldwide. If his vision plays out, India’s entertainment industry may soon become one of its biggest exports, powered not just by revenue but by storytelling that resonates far beyond its borders.