THE billionaire co-owner of Asda, Mohsin Issa, has stepped back from his role in overseeing the day-to-day operations of the UK’s third-largest supermarket chain.

This shift comes as Asda faced increasing competition and a decline in its market share. Lord Stuart Rose, the current chair of Asda, alongside Rob Hattrell from TDR Capital, the private equity firm with a majority stake in the supermarket, will assume operational control, the firm announced on Wednesday (18).

The decision by Issa to step down from managing Asda marks a strategic refocus on his petrol station enterprise, EG Group, which he co-founded with his brother, Zuber Issa, in 2001.

Zuber Issa (left) and his brother MohsinThe brothers, who acquired Asda from Walmart in a £6.8 billion deal in 2020 alongside TDR Capital, have since worked to strengthen their hold on the supermarket while balancing their interests in EG Group.

Earlier this year, Zuber Issa stepped back from both businesses, opting to sell his Asda stake to TDR, which now holds a 67.5 per cent ownership of the chain. He is expected to formally relinquish his role as co-chief executive of EG Group by October, transitioning into a non-executive director position.

However, Mohsin will continue in his role as the sole chief executive of EG Group, while also remaining a non-executive director at Asda.

He joined Asda’s board in February 2021, following the acquisition of the supermarket by the Issa brothers and TDR Capital. He has played a pivotal role in EG Group's global expansion.

Starting from a single petrol station in Bury, Lancashire, in 2001, EG Group now operates over 6,200 sites across 10 countries. Mohsin has been instrumental in key negotiations with major brand partners and securing capital for the company.

Before founding EG Group, Mohsin held senior roles in various Issa family businesses. In recognition of his business achievements, he along with his brother was honoured in the Queen’s Birthday Honours List 2020.

Asda has struggled in the competitive grocery market, with its share dropping to 12.6 per cent in the 12 weeks leading up to September 2023, down from 13.8 per cent in the same period the previous year.

Walmart, which retains a 10 per cent stake in Asda, has faced challenges in disentangling the supermarket's IT systems from its former US parent company, leading to additional complications.

Lord Rose, in an earlier interview, expressed disappointment at Asda's recent performance and hinted that changes were necessary to reverse its fortunes.

He acknowledged that the supermarket needed fresh leadership and a new approach to revitalise the brand. Rose’s comments follow a period of internal restructuring and the ongoing search for a new chief executive at Asda.

“We respect Mohsin’s decision to move on from his role at Asda where his work is complete to be the sole CEO of EG Group,” Lord Rose said.

“We are very grateful to Mohsin for the role he has played in overseeing Asda, including launching into the growth market of convenience stores and introducing a loyalty app now used by more than six million customers. He has laid the foundations to deliver a world-class IT infrastructure, strengthening Asda for the long term. I look forward to continuing to benefit from his insight as a non-executive director on our Board.”

Mohsin Issa said: “I am very proud of the highly experienced team we have built, and the significant progress made to build a bigger and better Asda over the last three years, as well as our unwavering commitment to provide customers with uncompromising value.

“Given these achievements and the significant strategic steps we have taken, I have decided now is the right time for me to step back from my oversight role at Asda to focus on EG Group as sole chief executive. It is a very exciting time for EG Group, and I am looking forward to focusing on the business while supporting Stuart, Rob and the leadership team in my capacity as a shareholder of Asda.”

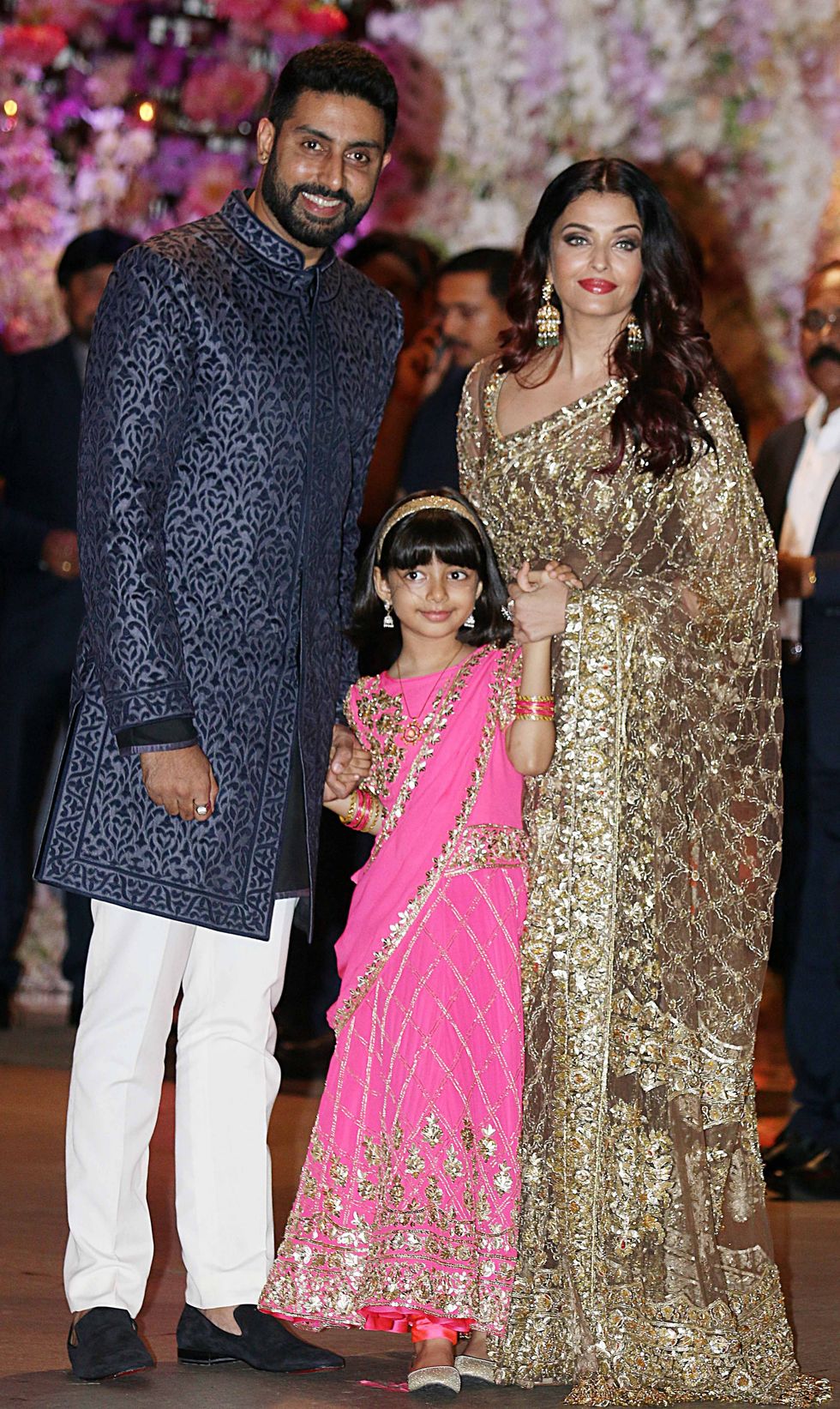

Aaradhya Bachchan has no access to social media or a personal phoneGetty Images

Aaradhya Bachchan has no access to social media or a personal phoneGetty Images  Abhishek Bachchan calls Aishwarya a devoted mother and partnerGetty Images

Abhishek Bachchan calls Aishwarya a devoted mother and partnerGetty Images Aaradhya is now taller than Aishwarya says Abhishek in candid interviewGetty Images

Aaradhya is now taller than Aishwarya says Abhishek in candid interviewGetty Images Aishwarya Rai often seen with daughter Aaradhya at public eventsGetty Images

Aishwarya Rai often seen with daughter Aaradhya at public eventsGetty Images

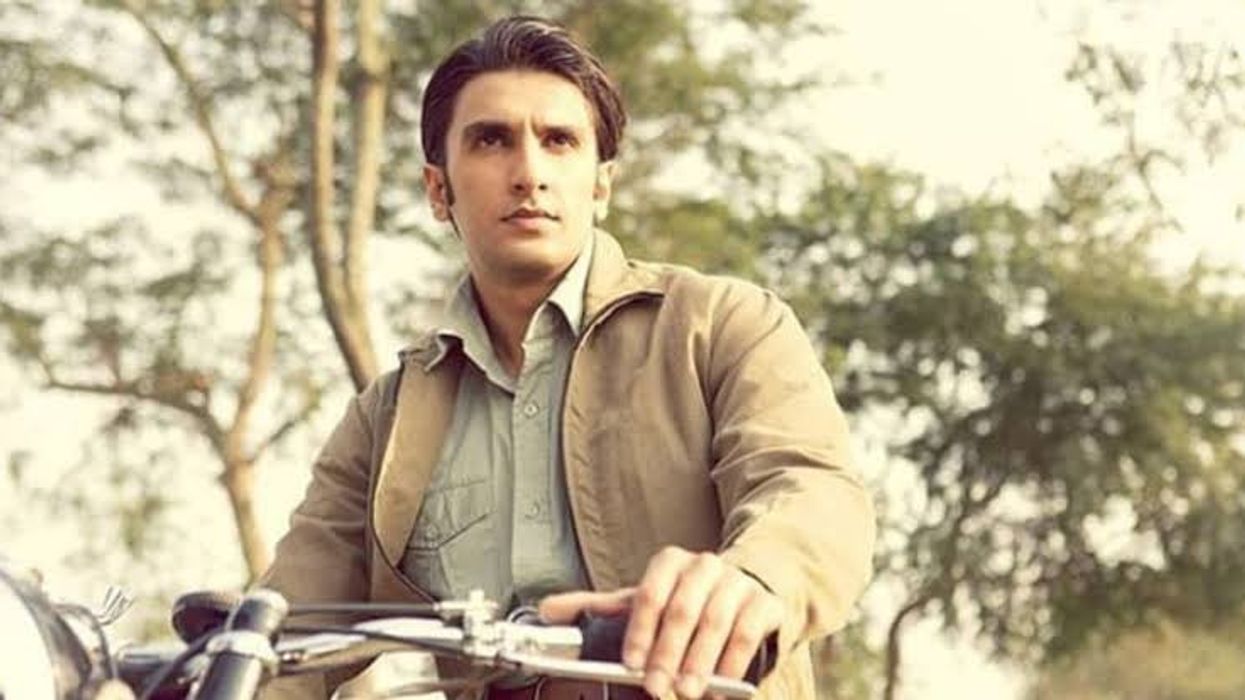

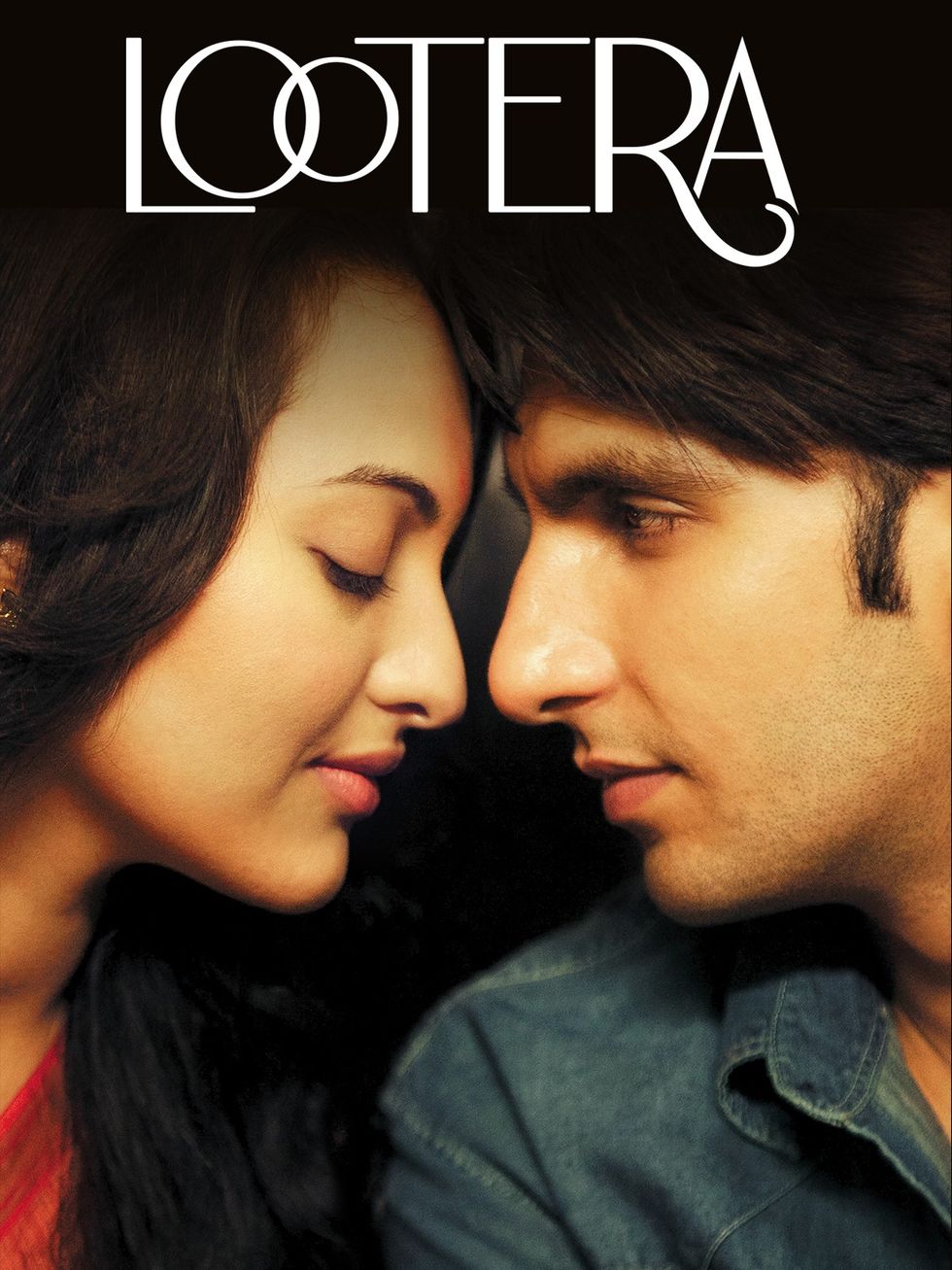

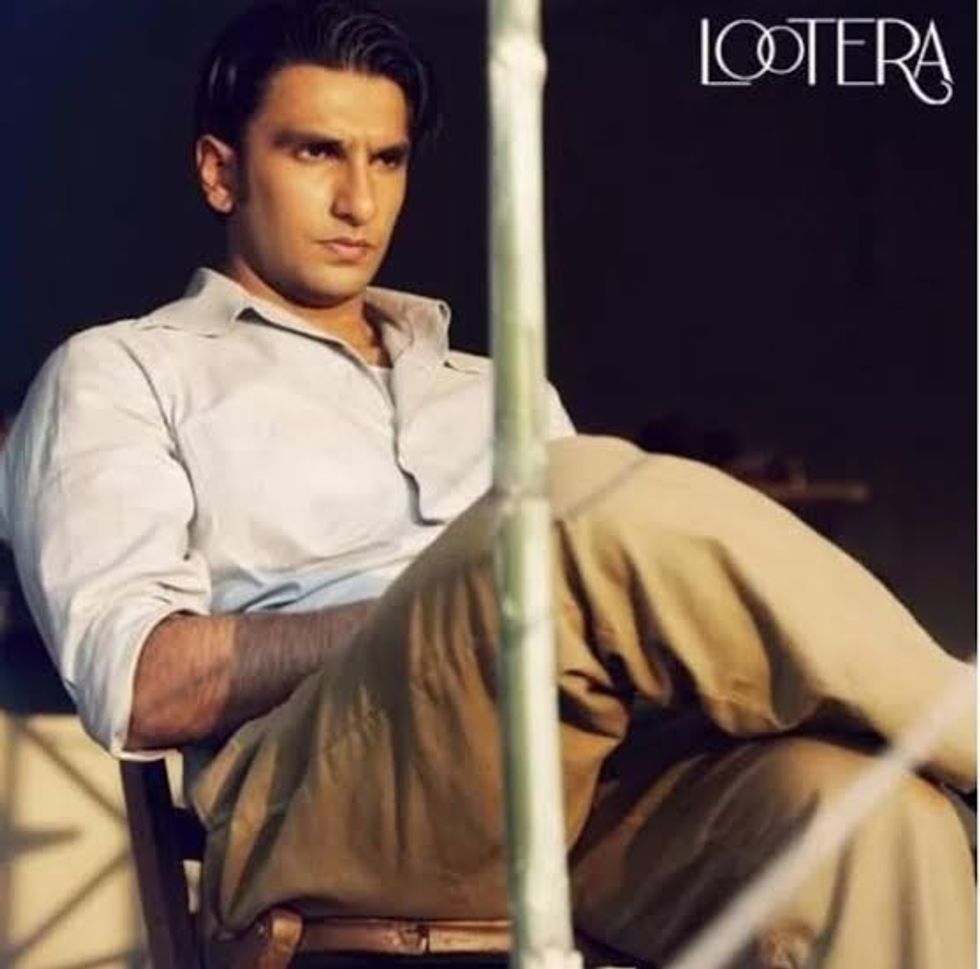

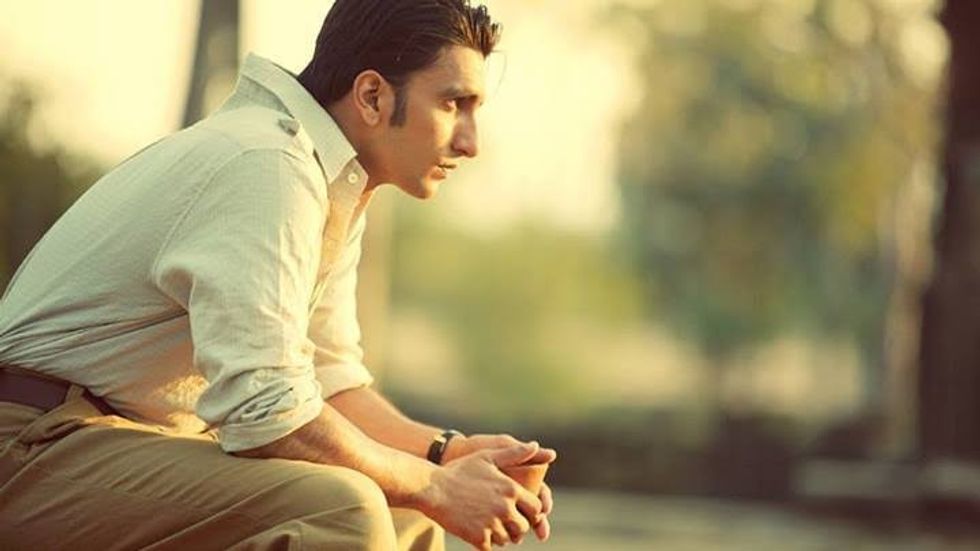

Lootera released in 2013 and marked a stylistic shift for Ranveer Singh Prime Video

Lootera released in 2013 and marked a stylistic shift for Ranveer Singh Prime Video  Ranveer Singh’s role as Varun showed he could command the screen without saying much

Ranveer Singh’s role as Varun showed he could command the screen without saying much The period romance Lootera became a turning point in Ranveer Singh’s career

The period romance Lootera became a turning point in Ranveer Singh’s career Ranveer Singh’s performance in Lootera was praised for its emotional restraint

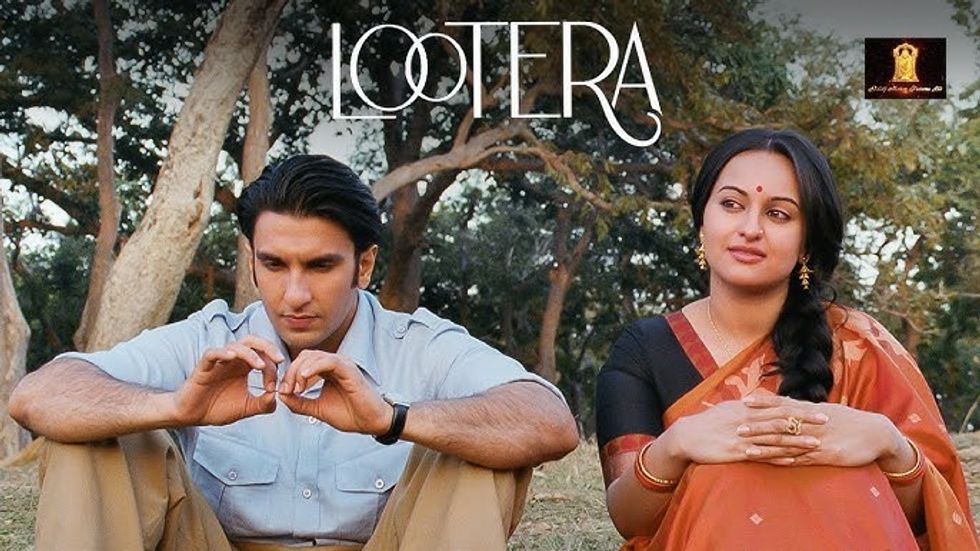

Ranveer Singh’s performance in Lootera was praised for its emotional restraint Ranveer Singh and Sonakshi Sinha starred in the romantic drama set in 1950s BengalYoutube/Altt Balaji Motion Pictures

Ranveer Singh and Sonakshi Sinha starred in the romantic drama set in 1950s BengalYoutube/Altt Balaji Motion Pictures  Lootera’s legacy has grown over the years despite its modest box office runYoutube/Altt Balaji Motion Pictures

Lootera’s legacy has grown over the years despite its modest box office runYoutube/Altt Balaji Motion Pictures