US Treasury Secretary Janet Yellen discussed a shared interest between the US and India to implement a "robust" global minimum tax, the Treasury said after Yellen's call with Indian Finance Minister Nirmala Sitharaman.

"The secretary stressed the importance of partnership with India in the G20 and OECD to seize a once-in-a-generation opportunity to remake the international tax system to help the global economy thrive," the Treasury said in a statement on Tuesday (29).

Nearly 140 countries will haggle over key details of a global corporate tax plan this week, with some concerned about giving up too much and others eager to ensure tech giants pay their fair share.

The Organisation of Economic Co-operation and Development (OECD) is overseeing the talks to find a consensus among these countries.

The proposal will then be taken up by the G20 club of wealthy and emerging countries at a meeting of finance ministers in Italy on July 9 and 10.

The Group of Seven (G7) wealthy democracies approved a proposal to impose a minimum corporate tax rate of at least 15 per cent earlier this month, hoping to stop a "race to the bottom" as nations compete to offer the lowest rates.

It is one of two pillars of reforms that would also allow countries to tax a share of profits of the 100 most profitable companies in the world -- such as Google, Facebook and Apple -- regardless of where they are based.

"I don't think we have ever been so close to an agreement," said Pascal Saint-Amans, director of the OECD tax policy centre.

"I think that everybody has realised that a deal is better than no deal," Saint-Amans told France's BFM Business radio earlier this month, adding that failing to agree would lead to unilateral taxes and US reprisals.

US President Joe Biden has galvanised the issue by backing the global minimum corporate tax, and Europeans want a deal, he said.

Negotiations have gained new urgency as governments seek new sources of revenue after spending huge sums on stimulus measures to prevent their economies from collapsing during the coronavirus pandemic.

While the G7-the US, Canada, Japan, France, Britain, Italy and Germany-approved the plan, it still faces hurdles as the negotiations expand to other nations.

The EU members Ireland and Hungary are not thrilled about it, as their corporate taxes are less than 15 per cent. Ireland has become the EU home to tech giants Facebook, Google and Apple thanks to its 12.5-per cent rate.

But another EU country that has benefited from a low rate, Poland, voiced support for the proposal last week.

However, Yellen said China also has concerns about the proposal.

The world's 100 biggest multinationals would be targeted by the move, but countries in the G24- an intergovernmental group that includes countries such as Argentina, Brazil and India -- say more firms should be added to the list.

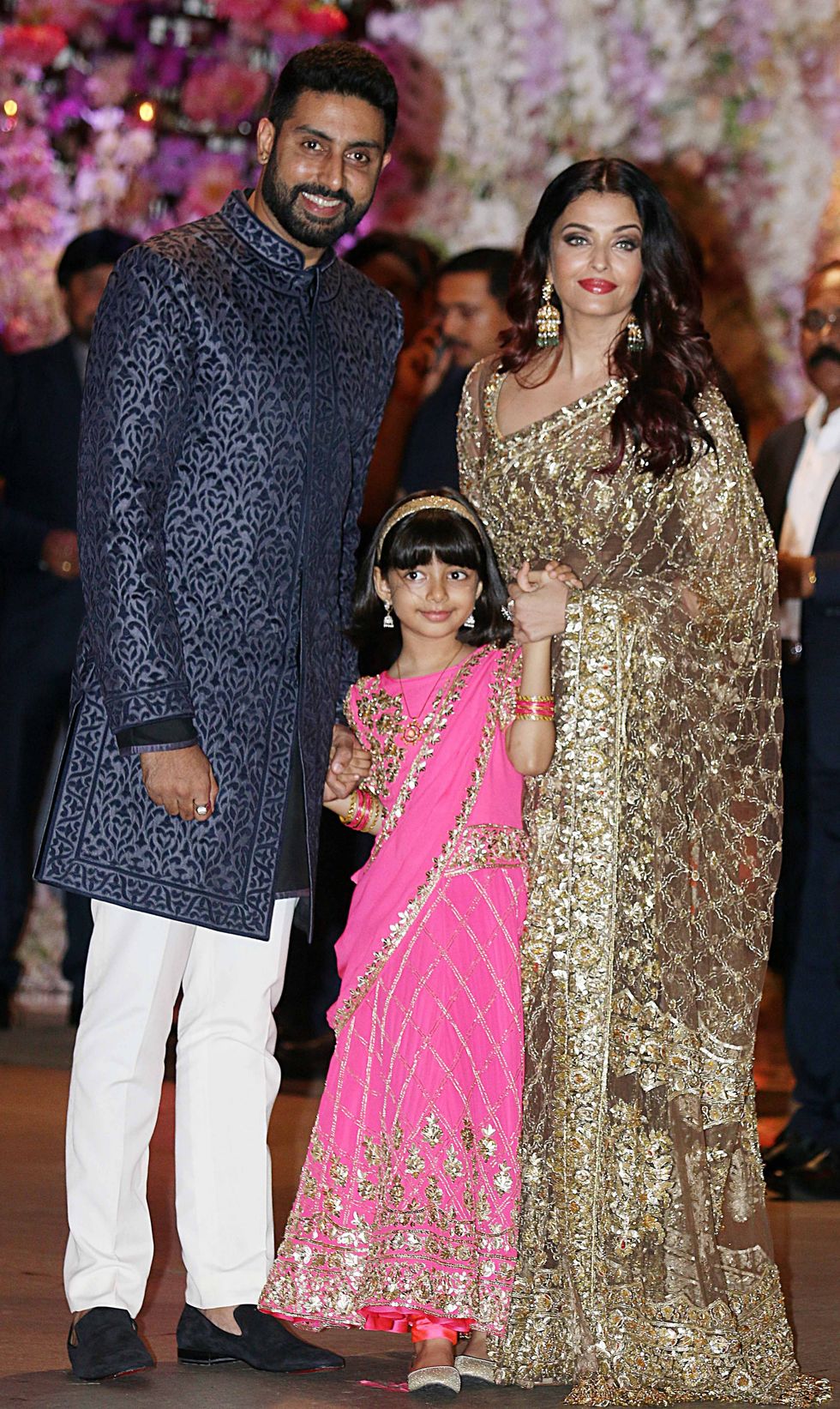

Aaradhya Bachchan has no access to social media or a personal phoneGetty Images

Aaradhya Bachchan has no access to social media or a personal phoneGetty Images  Abhishek Bachchan calls Aishwarya a devoted mother and partnerGetty Images

Abhishek Bachchan calls Aishwarya a devoted mother and partnerGetty Images Aaradhya is now taller than Aishwarya says Abhishek in candid interviewGetty Images

Aaradhya is now taller than Aishwarya says Abhishek in candid interviewGetty Images Aishwarya Rai often seen with daughter Aaradhya at public eventsGetty Images

Aishwarya Rai often seen with daughter Aaradhya at public eventsGetty Images

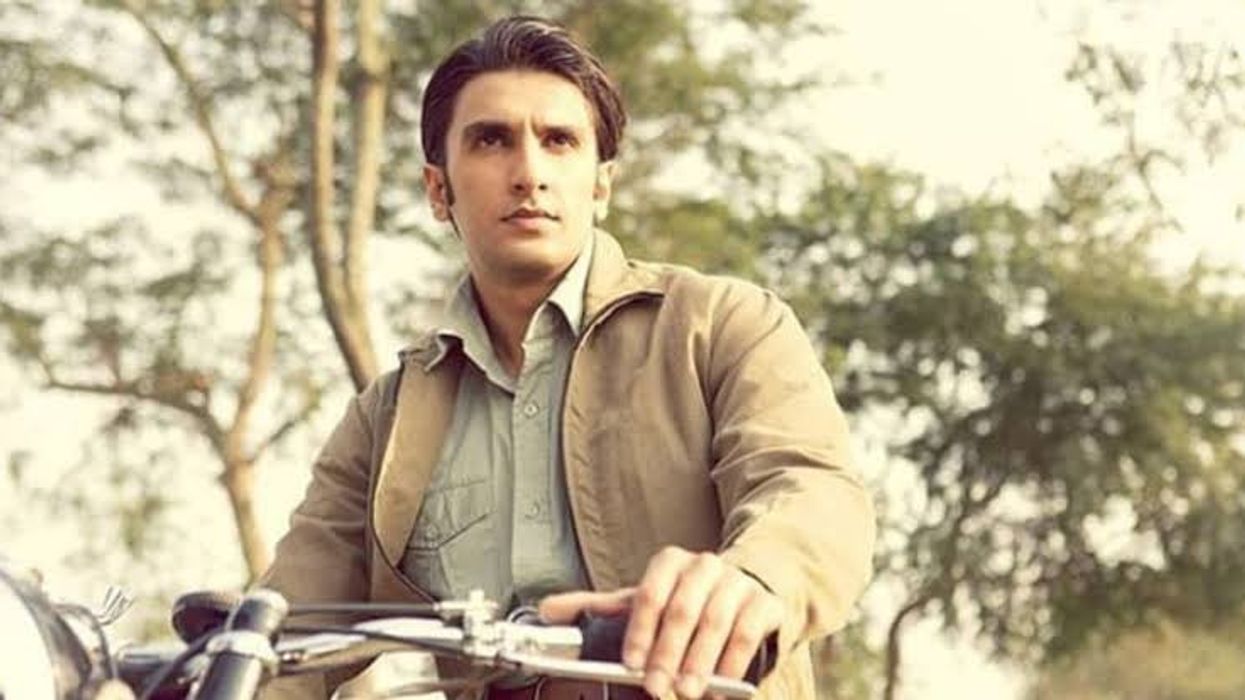

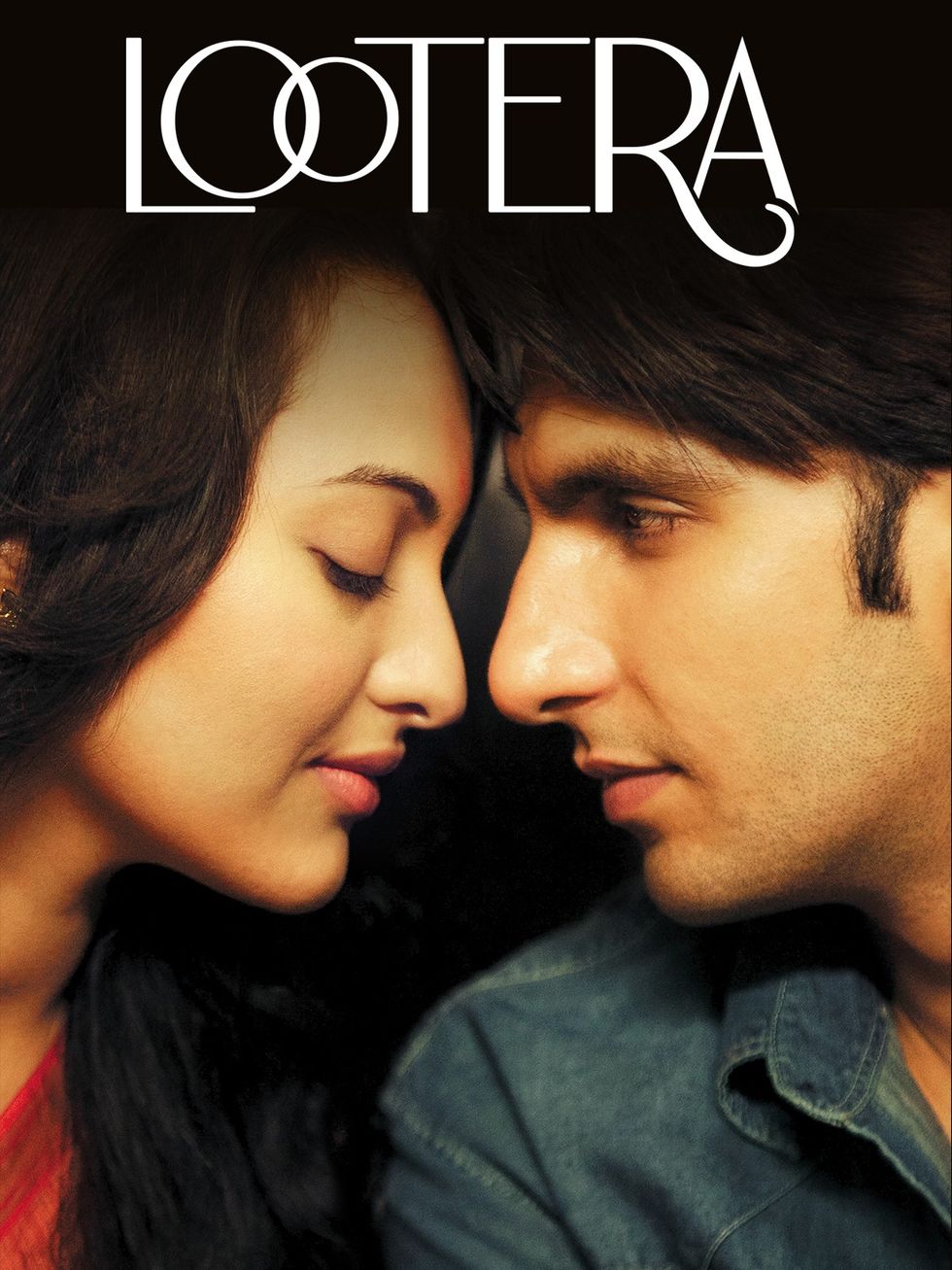

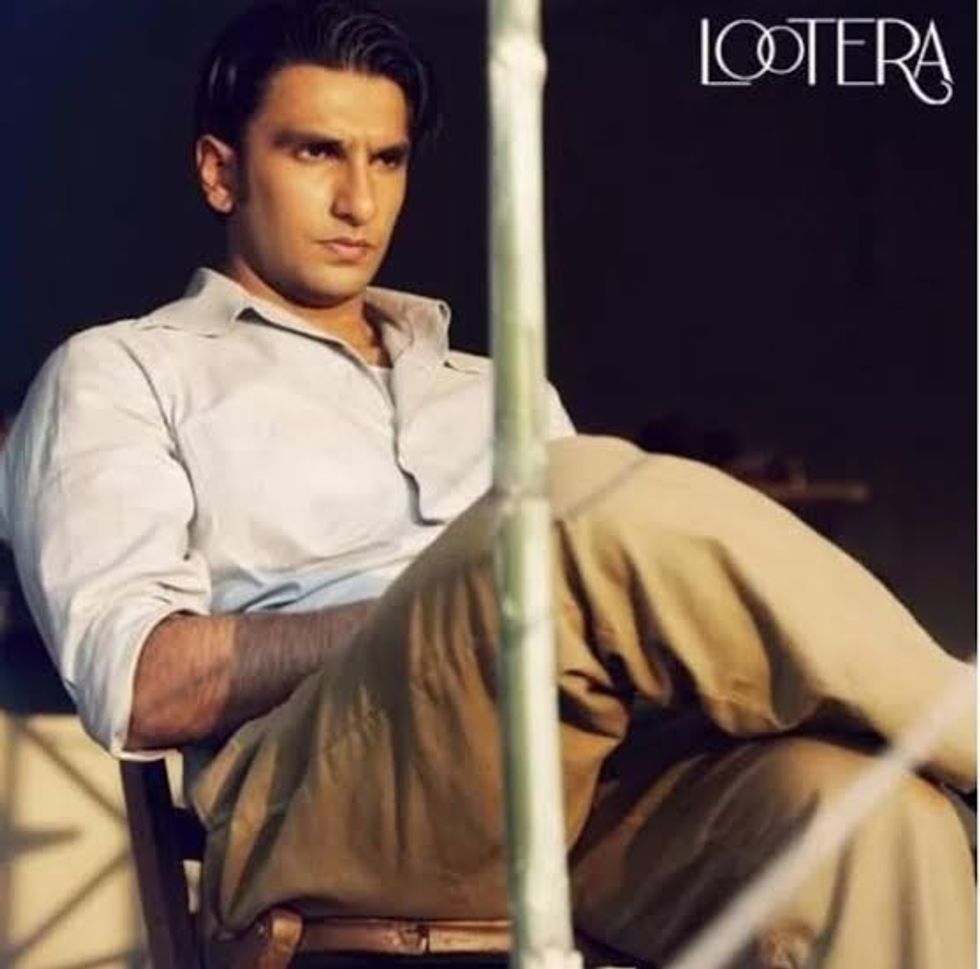

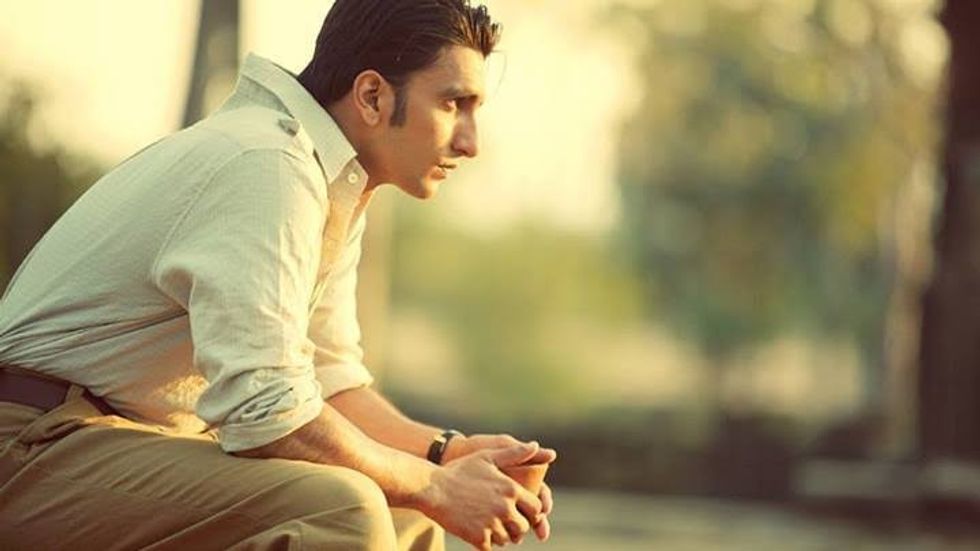

Lootera released in 2013 and marked a stylistic shift for Ranveer Singh Prime Video

Lootera released in 2013 and marked a stylistic shift for Ranveer Singh Prime Video  Ranveer Singh’s role as Varun showed he could command the screen without saying much

Ranveer Singh’s role as Varun showed he could command the screen without saying much The period romance Lootera became a turning point in Ranveer Singh’s career

The period romance Lootera became a turning point in Ranveer Singh’s career Ranveer Singh’s performance in Lootera was praised for its emotional restraint

Ranveer Singh’s performance in Lootera was praised for its emotional restraint Ranveer Singh and Sonakshi Sinha starred in the romantic drama set in 1950s BengalYoutube/Altt Balaji Motion Pictures

Ranveer Singh and Sonakshi Sinha starred in the romantic drama set in 1950s BengalYoutube/Altt Balaji Motion Pictures  Lootera’s legacy has grown over the years despite its modest box office runYoutube/Altt Balaji Motion Pictures

Lootera’s legacy has grown over the years despite its modest box office runYoutube/Altt Balaji Motion Pictures