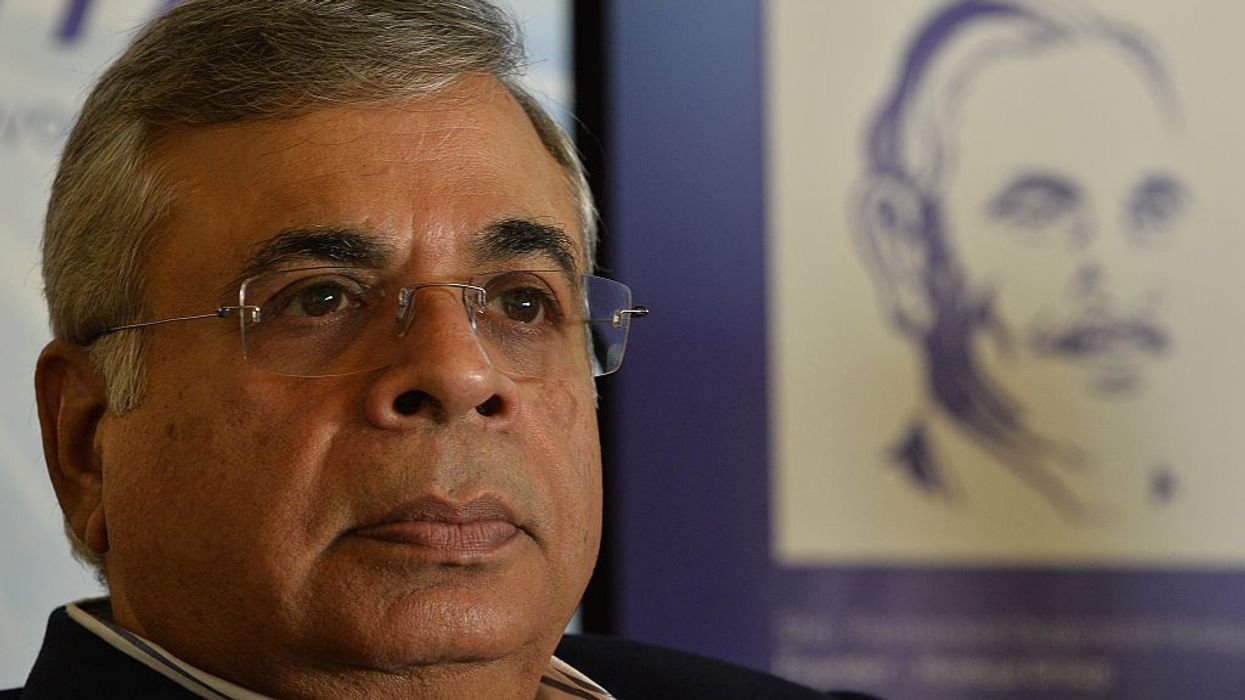

HINDUJA group firm IndusInd International Holdings (IIHL) is yet to get a nod from India's insurance watchdog for its acquisition of Reliance Capital for £930 million, its chairman Ashok Hinduja has said.

Stating that IIHL has been in touch with the Insurance Regulatory and Development Authority of India (Irdai) since November on the deal, he said IIHL is "hopeful" of the nod coming as soon as possible and added that usually, such a go-ahead comes in 2-3 months.

Hinduja said IIHL will be able to pay the sum it has bid for within 48 hours of the regulator's nod and complete the deal.

With a little over three weeks to go before the National Company Law Tribunal's May 27 deadline for executing the acquisition of Reliance Capital comes to a close, Ashok Hinduja said the Mauritius-based IIHL has tied up £717m from a clutch of banks for the acquisition.

Declining to specify any details about the banks who have committed the funds, Hinduja said there is a lead bank which will organise the funds once the time arises, and added that there has been an "over-subscription" among the lenders in offering money.

Hinduja said the remaining portion will be equity from IIHL.

On February 27, the NCLT's Mumbai bench approved the resolution plan submitted by IIHL for taking over Reliance Capital, which also includes the general and life insurance businesses.

In the absence of the required approvals for the deal, no buyer will make the final payment, he said, adding that it will approach for an extension if the nod does not come through till the May 27 deadline.

The deal has received the go-ahead from RBI, Competition Commission of India and capital markets regulator Sebi, he said, adding that while IIHL has been interacting with the RBI for over two decades and has also qualified under its 'fit and proper' criteria, it is new on the insurance space.

As per recent media reports, the Irdai has certain concerns about the deal including potential violations of foreign direct investment caps in insurance companies, reliance on borrowings to buy insurance entities and also opacity in IIHL's structure.

Hinduja declined to comment on the media reports, but wondered how confidential communication comes into the open.

He said IIHL is based in Mauritius and owned by 600 high-net individuals.

The Hinduja family is the promoters of IIHL who got the platform together but have less than 10 per cent in it, he said, adding that he does not have any holding in the firm.

To a question about Torrent Investments, the other bidder for the Reliance Capital resolution, challenging the NCLT's decision in the Supreme Court, Hinduja said IIHL will go ahead with the payment even if the SC verdict is pending and added that the the apex court has not given a stay on the process.

A set of teams from IIHL are already interacting with Reliance Capital businesses and formulating strategies, he said, adding that all the talent at the company will be retained.

There are retirements or end of terms of some senior officials in few of the entities within the Reliance firm including board members, and the same will see replacements, he said.

Once the takeover is complete, IIHL plans to divest the real estate investments which also come along with the transaction, Hinduja said, adding that this will fetch it around £24m.

The plan is to grow the general and life insurance arms, he said, adding that it is also in touch with Japanese partner Nippon. To a query on whether the Japanese partner would want to increase its holding beyond the present 49 per cent, Hinduja said IndusInd Holdings generally prefers having majority ownership in its businesses.

The Hinduja firm will also launch the health insurance business for which Reliance Capital had the license, he said, adding that eventually the branding will also be changed.

The near-term objective is to maximise the value for IIHL's shareholders, the chairman said.

IIHL, which is also the promoter of IndusInd Bank, said it is now aiming for the overall valuation of the financial services businesses owned or promoted by it in India to cross $50 billion (£40bn) by 2030, up from the $30bn (£24bn) it expected a year-ago before the Reliance Capital buy.

A majority of the valuation will come from the gains in IndusInd Bank shares, he said, while the rest will be spread to other businesses including the insurance arms and the newly acquired asset management business.

A senior group official said IndusInd Bank's market capitalisation stands at about $14bn (£11.2bn) at present, and the plan is to take the overall valuation of all businesses to $20bn (£16bn) in three years and then to £40bn by 2030.

Hinduja said IIHL will also be looking at a listing on the fundraising platform Afrinex in the next few years, but declined to give a timeline.

When asked about the proposal for increasing its stake in IndusInd Bank to 26 per cent from the present 15 per cent, Hinduja said IIHL has been in touch with the RBI and will be making a final application to raise the stake in the next few weeks.

He said it would like to increase the stake in phases as per the growth capital requirements at the lender, and added that once the procedural requirements get completed, it will immediately buy £1,595m worth of stock from the market.

(PTI)