ONLINE fashion retailer Boohoo’s decision to exclude Frasers Group from key investor meetings has stirred tensions with its largest shareholder, Mike Ashley.

New CEO Dan Finley, appointed last month, plans to meet with major shareholders, including Schroders, but no session is scheduled with Frasers, which now owns a 27 per cent stake in Boohoo, reported the Times.

Frasers alleged that Boohoo ignored multiple requests for meetings, despite claims of openness by Boohoo, labelling the company’s communication as insincere.

“Claims that they have tried to engage is a complete fabrication. Frasers has asked several times to meet with their new CEO and all requests have been met with silence," a source close to Frasers told the newspaper.

The dispute between the two retailers has been building, with Ashley previously pressing for the CEO role himself after what he calls Boohoo’s “dismal performance” and falling share value.

Instead, Boohoo promoted Finley, formerly head of Debenhams, a decision Frasers criticises as hasty and ill-advised. Frasers also raised concerns over Boohoo’s recent refinancing, calling it poorly executed.

Boohoo and Frasers remain sceptical of each other’s motives. Frasers claims it seeks to support Boohoo’s recovery, as the fashion retailer has lost around 90% of its market value due to increasing competition.

However, Boohoo said Frasers may be acting in self-interest, urging Ashley to clarify whether he intends to purchase any of Boohoo’s brands, such as Debenhams or Karen Millen, if Boohoo’s struggles continue.

Also, the firm has shown willingness to appoint a Frasers-nominated non-executive director under specific conditions. Meanwhile, Frasers has requested a shareholder meeting to propose Ashley as CEO, although no date has been set for this vote.

Both Frasers and Boohoo spokespeople declined to comment

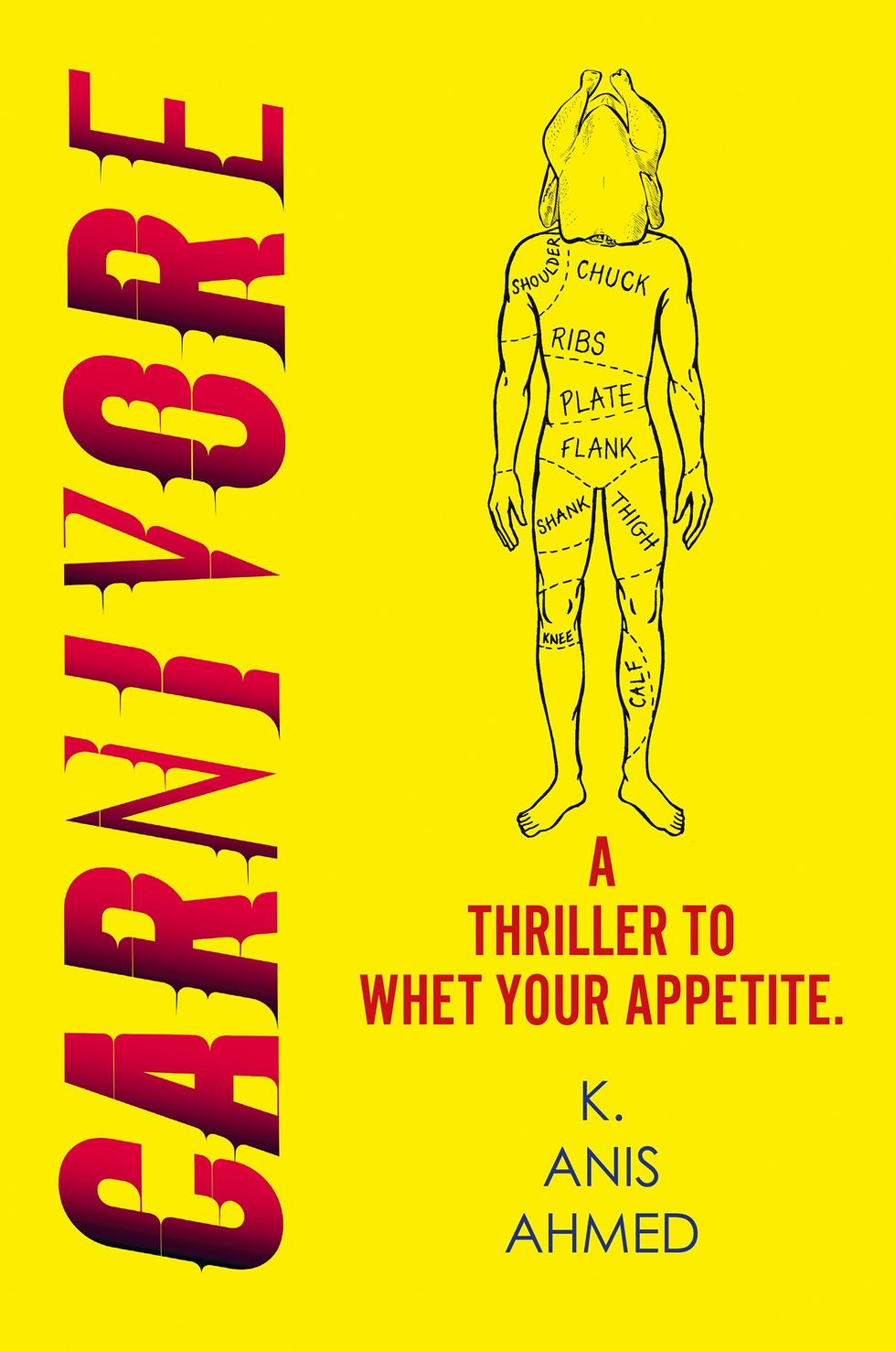

A compelling premise, layered and unpredictable charactersAMG

A compelling premise, layered and unpredictable charactersAMG Anyone who enjoys a gripping story with a diverse cast and unexpected twistsHarperFiction

Anyone who enjoys a gripping story with a diverse cast and unexpected twistsHarperFiction

As WCL enters its second season, Sharma is scaling upwclegends.uk

As WCL enters its second season, Sharma is scaling upwclegends.uk

Scarlett Johansson opens up about breaking free from early typecastingGetty Images

Scarlett Johansson opens up about breaking free from early typecastingGetty Images  Johansson reflects on her childhood stardom and evolving careerGetty Images

Johansson reflects on her childhood stardom and evolving careerGetty Images  From Avengers to auteur Scarlett Johansson embraces creative control Getty Images

From Avengers to auteur Scarlett Johansson embraces creative control Getty Images