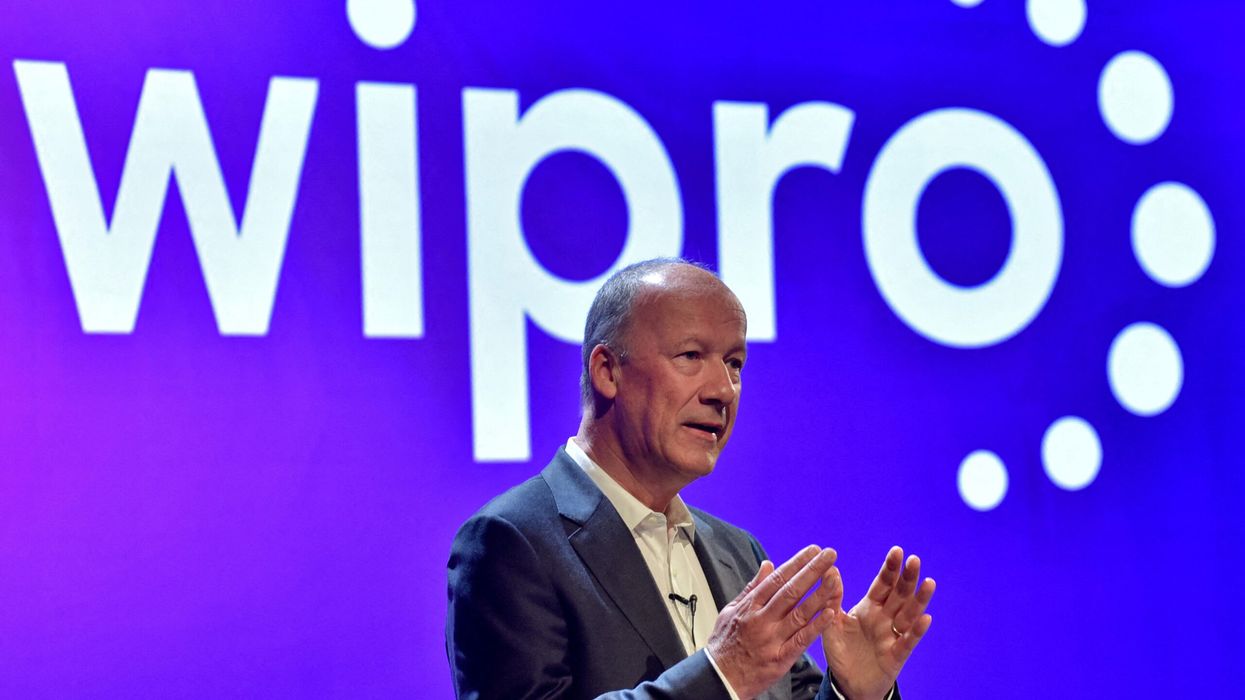

INDIAN IT major Wipro has announced the resignation of Thierry Delaporte as CEO and named Srinivas Pallia as the new Chief Executive Officer of the company.

The announcement was made in a Bombay Stock Exchange (BSE) filing on Saturday (6), and it comes days before the Bengaluru-headquartered company is scheduled to announce its Q4 and full-year earnings for 2023-24 on April 19.

Wipro has been trailing its peers on the performance front with subdued report card and weak guidance and saw a spate of senior-level departures including CFO Jatin Dalal and chief growth officer Stephanie Trautman last year.

According to a Wipro release, Pallia brings to the CEO role extensive institutional and industry knowledge, as well as a strong track record of leadership through some of the most significant technological shifts the industry has seen.

In a BSE filing, Wipro said its Board noted the resignation of Delaporte with effect from April 6, 2024, and went on to add that he will be relieved from the employment of the company with effect from the close of business hours on May 31.

"At their meeting held on April 6, 2024...pursuant to the recommendation of the Nomination and Remuneration Committee, the Board of Directors has approved the appointment of Srinivas Pallia as the Chief Executive Officer and Managing Director of the company with effect from April 7, 2024, for a period of five years, subject to the approval of shareholders and the Central Government as may be applicable," Wipro informed in an exchange filing.

Before taking over the reins of Wipro as its CEO in July 2020, Delaporte worked with Capgemini.

Delaporte's annual salary of over Rs 800 million at Wipro had made headlines last year.

The $11.2 billion global information technology, consulting and business process services company competes in the global outsourcing market with Tata Consultancy Services, Infosys, HCL Technologies, Cognizant and other international and domestic IT players.

Pallia joined Wipro in 1992 and has held many leadership positions, including President of Wipro's Consumer Business Unit and Global head of Business Application Services.

He holds a bachelor's degree in engineering, and a master's in management studies from the Indian Institute of Science, Bangalore. He graduated from Harvard Business School's Leading Global Businesses executive program, and the Advanced Leadership Program at McGill Executive Institute. (PTI)