THE UK and India have announced £400 million in trade and investment deals aimed at boosting economic growth.

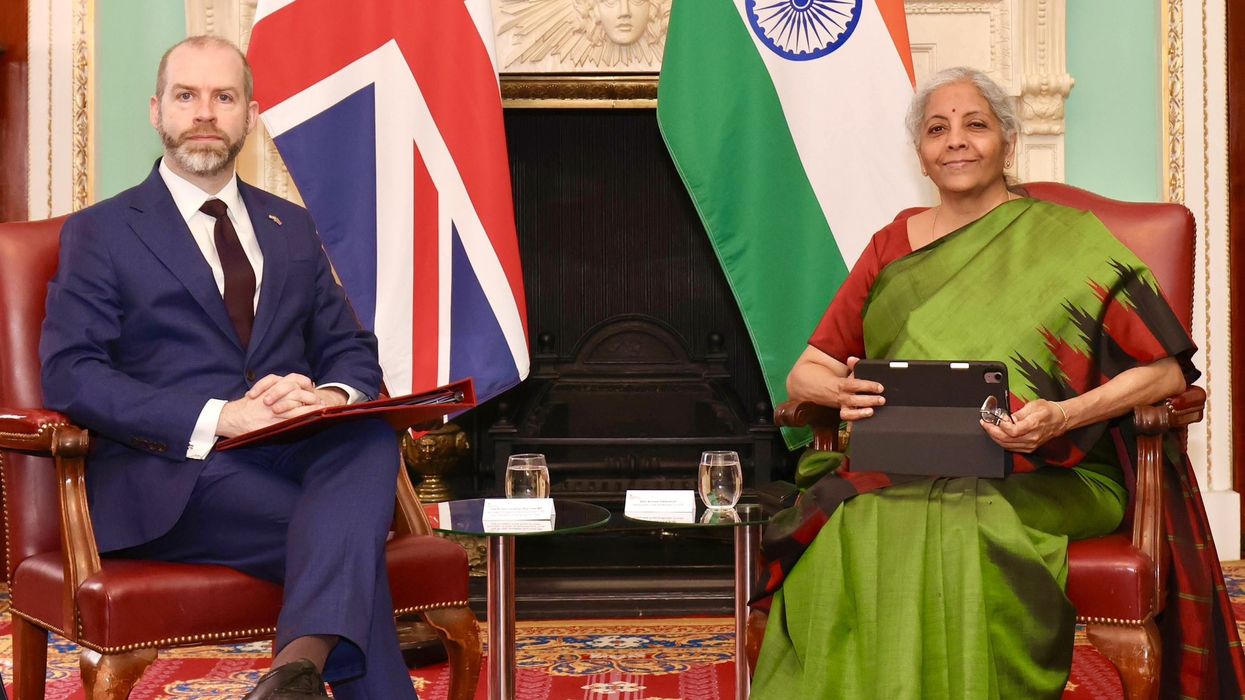

The announcement was made during the 13th UK-India Economic and Financial Dialogue in London, where chancellor Rachel Reeves and Indian finance minister Nirmala Sitharaman discussed efforts to strengthen economic ties and move forward on a Free Trade Agreement and Bilateral Investment Treaty.

Reeves said: “In a changing world, it is imperative we go further and faster to kickstart economic growth. We have listened to British businesses, which is why we’re negotiating trade deals with countries across the world, including India, so we can support them and put more money in people’s pockets as part of our Plan for Change. Our relationship with India is longstanding and broad and I am delighted with the progress made throughout this dialogue to develop it further.”

The joint statement signed during the talks covers cooperation in sectors including defence, financial services, education, and development. The statement also focuses on governmental collaboration on growth, economic resilience and international financial issues.

At the London Stock Exchange, both ministers outlined plans to expand financial services ties and policy cooperation on areas such as tax, sustainable finance and illicit finance.

The commercial package includes new export deals and investments worth £128 million and recent deals worth £271m.

Paytm announced plans to invest in the UK. Barclays Bank PLC India said it would inject over £210m into its Indian operations. HSBC announced it would expand from 14 cities to 34 in India. Standard Chartered moved to a larger office at GIFT City.

Mphasis is setting up a quantum centre in London and exploring an office in Nottingham. British International Investment is committing $10m to Grow Indigo, an agritech start-up in India.

WNS plans to expand its London headquarters and open an AI hub. Revolut is preparing to launch in India. Wise is opening an office in Hyderabad.

Prudential is launching a global services hub in Bengaluru and a joint venture for health insurance in India. BII is also investing $15m in an inclusion-focused vehicle in India.

The UK welcomed India’s move to allow international listings by Indian firms and noted the publication of the report ‘Catalysing Bilateral Growth: Connecting India and the UK’s Equity Capital Markets’ by the India-UK Financial Partnership.

Coventry University announced plans to open a campus in India’s GIFT City. LSE announced a corpus grant from Tata Trusts to support scholarships for Indian students.

Both countries agreed to continue working together as co-chairs of the G20 Framework Working Group.

New goals were set for joint investments in green enterprises, tech start-ups and climate adaptation, following the UK-India Green Growth Equity Fund.

Business secretary Jonathan Reynolds and Indian finance minister Sitharaman also hosted a roundtable with business leaders from Tide, HSBC, Aviva, Vodafone, WNS and Mizuho International.

Reynolds said: “I was delighted to meet with Minister Sitharaman, hear from businesses, and discuss how we can strengthen the strong economic bonds between our two nations. Both the UK and India are committed to delivering economic growth and giving businesses the confidence and stability they need to expand. That is why we are continuing to negotiate towards an ambitious trade deal that unlocks opportunities both at home and abroad for British businesses and supports our Plan for Change.”

Areas for collaboration on defence were discussed, with both sides looking ahead to the finalisation of the India-UK Defence Industrial Roadmap.

Minister for the Indo-Pacific, Catherine West, said:“Driving economic growth is the first mission of this Government, which is why we are supercharging our relationship with India.

“The UK’s offer to India is strong – stability, an open economy, and reforms that make it easier to do business. And today, we are going one step further to unlock new business opportunities between our two countries.

“India and the UK share an enduring living bridge. Only by working together can we continue to deliver opportunities for Indians and Brits alike.”

Keshav R Murugesh, Group CEO of WNS, said: "The UK and India stand as natural partners, and this re-energized trade and investment relationship marks a pivotal stride in our already strong alliance. The potential before us is immense. By formalising our collaboration in pioneering fields like AI, we will not only fuel innovation and generate high-skilled jobs in both our nations, but also solidify our joint leadership in this transformative era. This is indeed a thrilling chapter for the UK-India partnership.”

Bill Winters, Group Chief Executive of Standard Chartered, said: “In the face of global developments, it is imperative that we think creatively and act in partnership. The UK and India’s focus on strengthening financial ties and deepening cooperation between our governments, regulators, industry leaders and experts, plays an important role in driving economic progress, setting global benchmarks for stability and innovation and paving the way for greater trade and investment in both countries.”

The Lord Mayor of London, Alderman Alastair King, said: “We had a highly constructive discussion with Hon. Minister Nirmala Sitharaman and The Rt. Hon. Jonathan Reynolds, joined by leaders from across the financial services sector. There is a strong, shared commitment to deepen our economic partnership and drive greater prosperity—particularly in key areas such as green finance, infrastructure investment, and fintech. Global trade is entering a new era, where strategic alliances and trade agreements are more crucial than ever. As we look ahead to the UK-India Economic and Financial Dialogue and continue FTA negotiations, our focus remains on sustaining momentum and delivering tangible outcomes in the months to come.”

David Schwimmer, CEO of LSEG, said: "LSEG is honoured to host the 13th UK-India Economic and Financial Dialogue at the London Stock Exchange as part of our continued support for initiatives that promote collaboration and connectivity between UK and Indian financial markets. Through deepened partnership, the governments and regulators from both countries can help to build an environment which delivers real benefits to their financial markets and economies."