Prime Minister Rishi Sunak's wife Akshata Murty is a shareholder in a UK start-up that was awarded around £350,000 as part of a government scheme to support entrepreneurs, reported The Times.

Murty's Catamaran Ventures UK Ltd has a stake in Edutech firm Study Hall, records at Companies House show.

The start-up received a government grant of £349,976 last year, through Innovate UK, as part of funding to support companies developing new products or services. The Innovate UK grant covers the period August 2022 to August 2023.

Murty’s investment interests raise fresh questions about her business dealings and the potential for a perceived conflict of interest, The Times report said.

Founded by Sofia Fenichell, Study Hall plans to harness the power of artificial intelligence (AI) in schools.

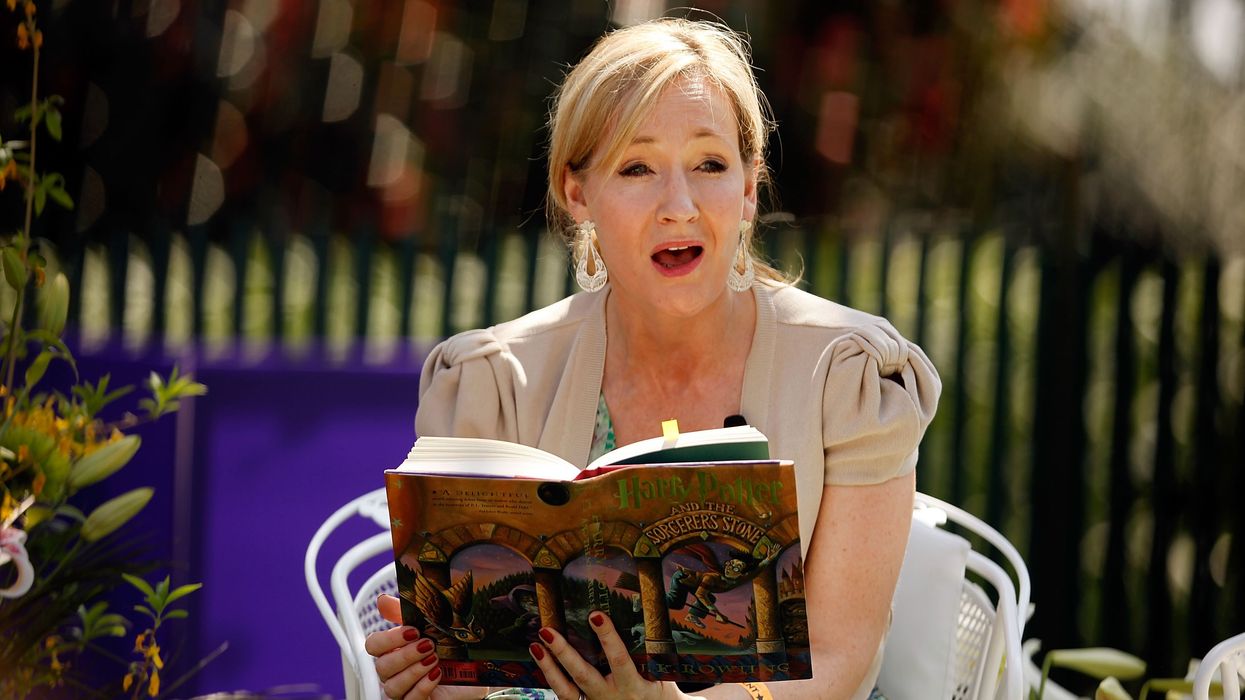

Fenichell's previous venture Mrs Wordsmith, which wanted to promote children’s literacy, collapsed in 2021 just six months after receiving state support.

Mrs Wordsmith received £650,000 of taxpayers’ money as a loan through the government’s Future Fund, which matched funding from private investors in equity-backed start-ups. Catamaran Ventures was also a minority shareholder in the firm.

More than 60 per cent of the funding was spent on paying off existing creditors.

According to Companies House records on August 31, 2022, Catamaran Ventures UK Ltd held 2,474 shares in Study Hall at the time of the confirmation statement. There are no subsequent documents indicating that they have been sold.

Sunak was criticised in March for failing to declare his wife’s shares in a childcare agency called Koru Kids that could benefit from policy announced in the budget.

The parliamentary watchdog responsible for upholding standards is investigating whether Sunak was open and frank when he declared his interests.

The prime minister subsequently updated the register of ministerial interests to include his wife's shares in a venture capital investment firm, Catamaran Ventures UK Ltd. However, there was no mention of her involvement in Study Hall.

The independent adviser on ministers' interests, Sir Laurie Magnus, has emphasised the need to be cautious when deciding which interests held by family members should be made public in the register to avoid unnecessary intrusion into their lives.

A spokesperson from Downing Street has stated that all interests were declared to the independent adviser, who has reviewed declarations made by ministers and is satisfied that any actual or potential conflicts have been or are being addressed.

Study Hall was incorporated in September 2021, six months after Mrs Wordsmith went into administration and just five days before the company was officially wound up.

When the company collapsed, the taxpayer was expected to receive only around £40,000 on its £650,000 investment, as its key assets were acquired by a hedge fund tycoon based in Monaco.

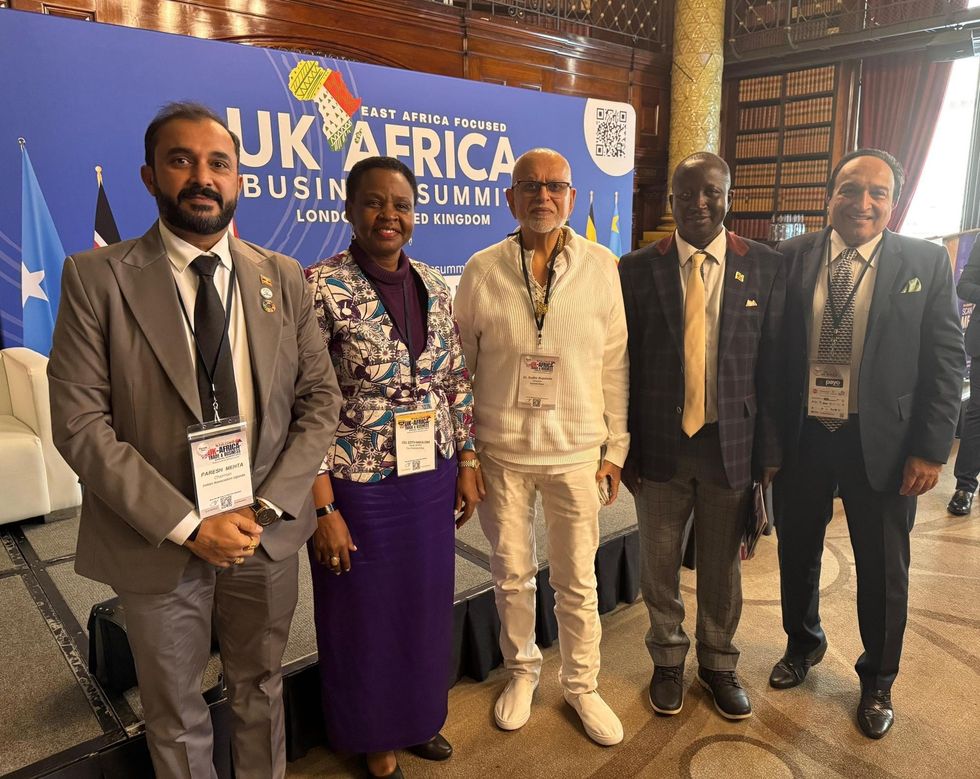

UK–Africa business summit 2025

UK–Africa business summit 2025  UK–Africa business summit 2025

UK–Africa business summit 2025 UK–Africa business summit 2025

UK–Africa business summit 2025 Spiritual leader Sant Trilochan Darshan Das Ji, head of Das Dharam-Sachkhand Nanak Dham, graced the summit as Honorary Chief Guest

Spiritual leader Sant Trilochan Darshan Das Ji, head of Das Dharam-Sachkhand Nanak Dham, graced the summit as Honorary Chief Guest UK–Africa business summit 2025

UK–Africa business summit 2025