by ANDY MARINO

RAMADAN NOW BIG BUSINESS IN UK

BRITAIN’S Muslim population is just under three million, according to the latest census (2011), and accounts for about five per cent of the total population. It is estimated that a third of the Muslim population lives in London.

This is a nationwide community with an enormously varied but distinct identity, and as Ramadan approaches retailers can expect certain patterns of shopping to emerge.

Fasting during daylight hours will impact retail grocery, but not in a simple way. A drop in normal levels of consumption will be accompanied by other, sometimes higher-value purchases for the evening meal as Muslim families celebrate the end of the daily fast, perhaps by inviting friends or family to the iftar supper and substituting expensive delicacies for affordable staples.

It is estimated that extra spending specifically tied to Ramadan is at least £200 million, half of it in supermarkets – Tesco sees a 70 per cent increase in sales of promotional items, worth on average £30m. Nationally, after Christmas and Easter, Ramadan is the biggest consumer event of the year.

Other areas of the high street will also see patterns of spending, ones that are particular to Muslims and to the period of Ramadan – especially the festival of Eid Ul Fitr, which celebrates its close, with gifts and feasting. Some shopping centres report an increase in footfall of up to 47 per cent during Eid, with fashion and clothing performing particularly well.

In overall terms, “the Muslim pound” – sitting in the wallets and purses of young Muslims, or “Generation M” (more than half of UK Muslims are under 19) – is estimated to be worth £21 billion annually to the UK economy, with £3bn being spent just on halal food. With the size of the UK’s Muslim middle class set to treble by 2030, the only way economically is up.

Until recently, the Muslim community was regarded, and even saw itself, as marginal in this respect: it spent its money primarily with local Muslim retailers and halal outlets.

Now though, the population having doubled since the end of the last century, UK companies are coming to view Britain’s Muslims as mainstream not minority consumers. Of course, not every purchase is specifically Muslim, but Muslim tastes are increasingly catered for.

The effects of the Muslim pound are everywhere, as business attempts to cash in on growing demand and affluence. Haribo confectionery, for example, now sells halal gummies. Brands as varied as Apple, Jeep, Coca-Cola, Nike and H&M have all featured Muslim references and models in their advertising campaigns.

Following Samina Akhter’s innovative Sampure Minerals, new lines of cosmetics guaranteed free of pig and alcohol products, such as The Halal Cosmetics Company and BAKEL, are appealing to Muslim women. Other Islamic consumer brands are starting to appear too – for example fashion outfit Sanzaa and toymakers Ibraheem Toy House, who produce educational playthings and dolls dressed in hijabs.

But with 50 per cent of the Ramadan spend going to supermarkets, it is the responsiveness to – literally – Muslim tastes that is changing the face of grocery retailing, with special Ramadan aisles appearing and a fantastic growth in the range and variety of World Foods overall.

Noor Jahan Ali is a senior buying manager of world foods at Morrison’s, and during her career she has not only witnessed the transformation of world foods landscape, but also played a major part in making it happen.

In 1992, Ali and her brother opened an ethnic supermarket in the UK’s curry capital, Bradford. It was a great success and eventually they sold it. She joined Asda next and by 2007 worked her way up to ethnic buyer for world foods, launching 1,200 new lines into the category. By 2012 Asda’s world foods sales were up 300 per cent.

Morrison’s snapped her up, and she soon made deals with 85 suppliers to expand that supermarket chain’s world foods, offering from 500 to more than 1,350 lines. Sales shot up nearly 150 per cent annually, and last year Ali was awarded the British Empire Medal to balance on top of the pile of other awards she has previously received.

Ali said: “Since creating the world foods category in 2007, something I am extremely proud of, the category has become more and more interesting every year,” adding that the market is growing more sophisticated, with the demand for authentic products widening.

“We see more and more new suppliers – and new entrepreneurs on this area. As a local business driver, we are keen to see small businesses develop and grow, and we realise the extra support and coaching for these smaller suppliers.”

The key to world foods seems to be to live locally: Ali’s success with suppliers involves staying closely involved with the community. “[It’s] something I am personally also passionate about and go out presenting to help develop where possible – most recently at the Manchester Growth Hub – where I was able to share with small business on working with retailers and offering any advice and support. I also mentor prisoners on running a business and entrepreneurship.”

Still a relatively new category, the world foods aisles are expanding fast, Ali said. “As our ethnic demographics grow, the ethnic cuisines are also becoming more prominent, with restaurants of various cuisines now developing.”

Which are the growth areas? “Asian, African and Caribbean, Far Eastern, to name a few, are still key cuisines,” she said. “However, we have recently launched Portuguese and Brazilian ranges.”

The Muslim pound is playing an important part, along with the other ethnic highlights of multicultural UK.

“Ramadan is a very important time for our Muslim colleagues and customers. We activate world foods events as part of our religious calendar in the relevant stores – Passover and Diwali. We plan these events by listening to our customers, colleagues and suppliers on what suggestions they have to either improve on the previous year or for ideas on what we can bring new into the event.”

Each year is different, and Ali tempts customers with professional expertise. “For our world foods events and festivals, a complete marketing package – advertising on ethnic TV, ethnic media, point of sale on relevant products in store, POS signage if in seasonal aisle, etc. This year we developed and launched a Ramadan countdown calendar which has proved really popular,” she said.

Most interesting are the changing ways world food is consumed. It seems everybody is happily sampling everybody else’s cuisine.

“Research shows all customers in the UK are becoming more adventurous and are keen to try different things,” Ali said. “Where we have lines within our world foods category that have that wider foodie appeal, we make them available to more stores.”

Cornish curry-lovers and Glaswegian taco-aficionados should be gladdened by this news.

UK grocery sales are forecast to grow by 15 per cent to £213 billion in 2022 (IGD). As Ali knows only too well, an increasing proportion of that growth will be composed of items in the world food category. Online will slurp a disproportionate amount of the increase, with the discounters and convenience following closely behind.

Convenience could in fact do very well, with independent, local retailers responsively stocking and updating new world food lines according to their local customer profiles and demand. The discounters must keep prices low by stocking an edited range of lines.

Everything will be impersonally available online, of course, but the role of the small retailer as curator and genial host of the impulse buy, food-to-go and top-up shopping trip might actually help c-stores become new masters of the world food revolution.

Naeli and the secret song

Naeli and the secret song

Jamie Lloyd’s Evita with Rachel Zegler set for Broadway after London triumphInstagram/

Jamie Lloyd’s Evita with Rachel Zegler set for Broadway after London triumphInstagram/

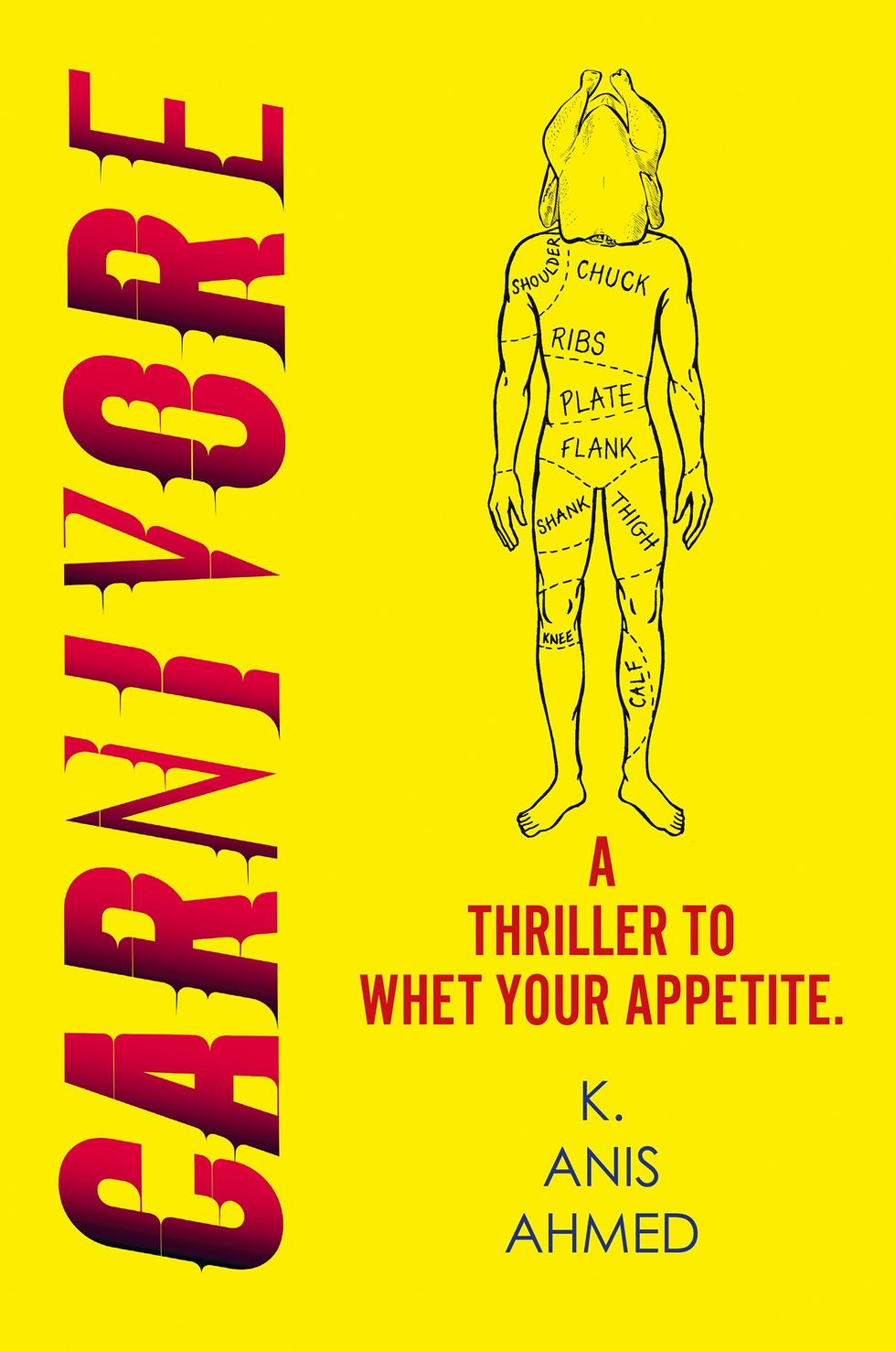

A compelling premise, layered and unpredictable charactersAMG

A compelling premise, layered and unpredictable charactersAMG Anyone who enjoys a gripping story with a diverse cast and unexpected twistsHarperFiction

Anyone who enjoys a gripping story with a diverse cast and unexpected twistsHarperFiction

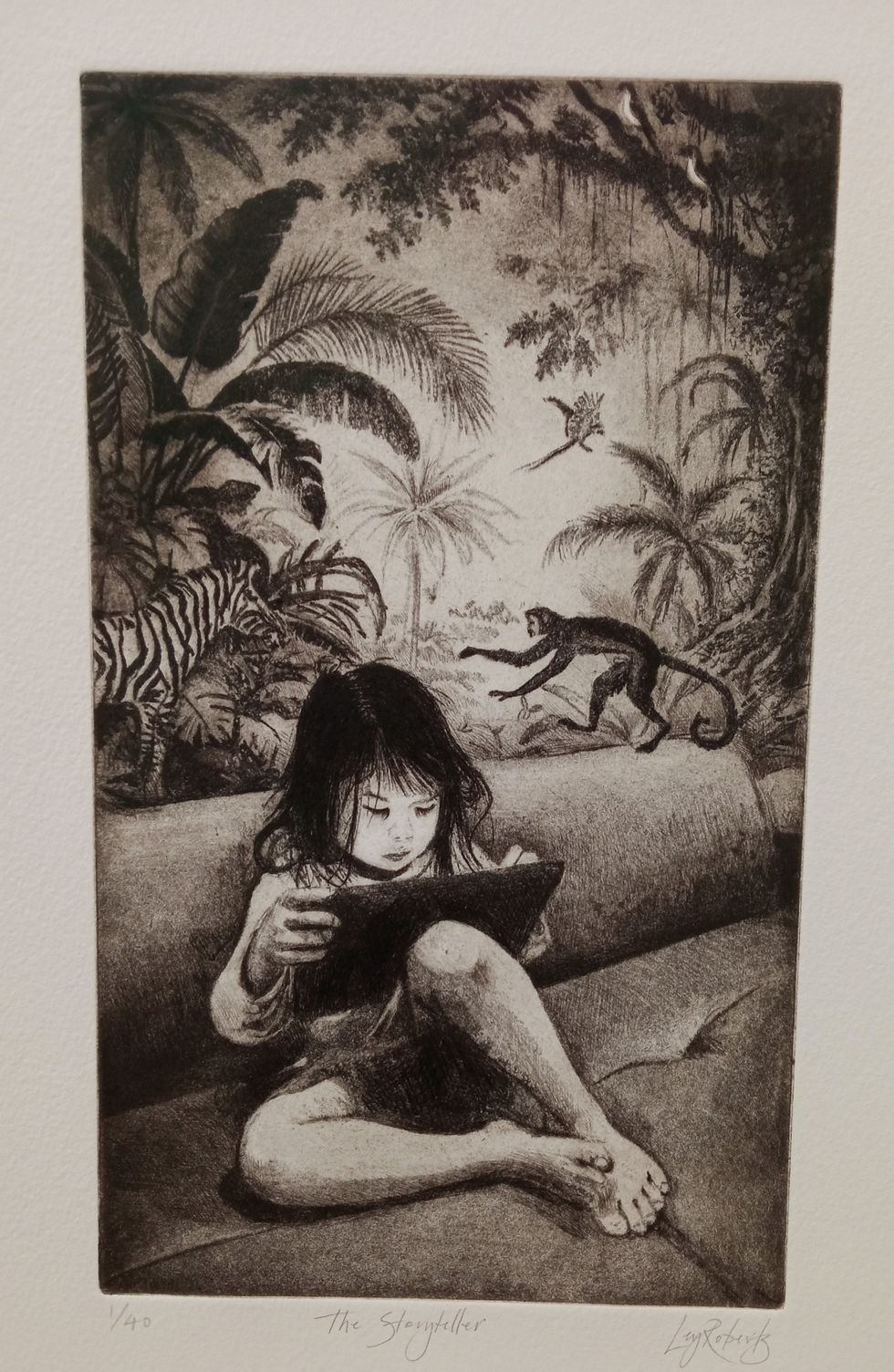

The Story Teller by Ley Roberts

The Story Teller by Ley Roberts Summer Exhibition coordinator Farshid Moussavi, with Royal Academy director of exhibitions Andrea Tarsia in the background

Summer Exhibition coordinator Farshid Moussavi, with Royal Academy director of exhibitions Andrea Tarsia in the background An installation by Ryan Gander

An installation by Ryan Gander A sectional model of DY Patil University Centre of Excellence, Mumbai, by Spencer de Grey

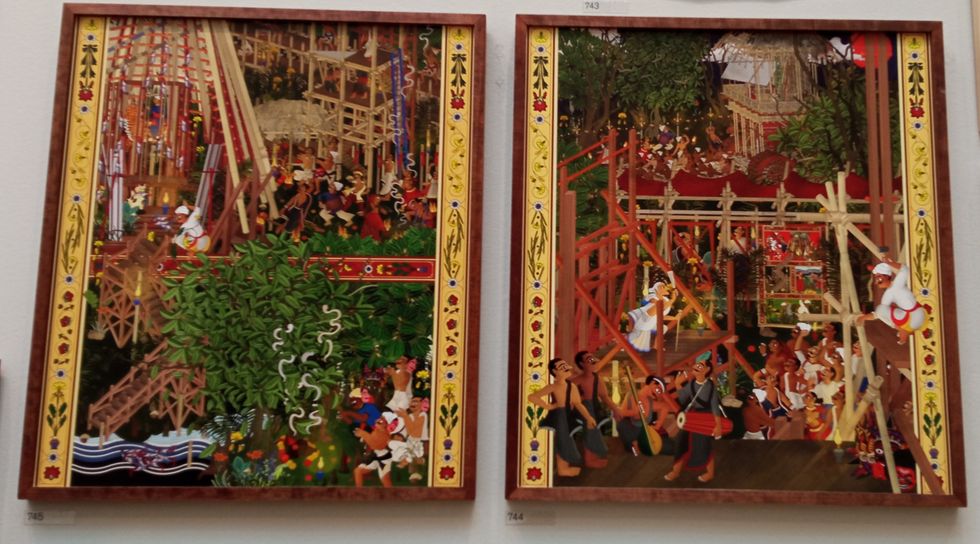

A sectional model of DY Patil University Centre of Excellence, Mumbai, by Spencer de Grey Rituals and Identity and Theatre of Resistance by Arinjoy Sen

Rituals and Identity and Theatre of Resistance by Arinjoy Sen