FAMILY-OWNED businesses, built from scratch over decades, could be forced to sell up as a result of inheritance tax changes in last Wednesday’s (30) budget, entrepreneurs have told Eastern Eye.

Businesses and the wealthy will face the brunt of the burden of chancellor Rachel Reeves’s £40 billion tax hikes, the biggest increase in 30 years, according to analysts.

Among the most controversial changes is to inheritance tax relief for businesses. It means family firms passing on assets of more than £1 million will be charged 20 per cent tax from April 2026. There was previously no such tax liability.

Sam Patel, executive director at Day Lewis Pharmacy, an independent chain of pharmacies founded by Sam’s late father Kirit Patel, said the inheritance tax change will have a “disproportionate and unfair impact on family businesses”.

“This is a major issue for family-owned businesses because inheritance tax will need to be funded out of the pockets of the next generation at a time when they may not have cash to pay that tax,” Patel told Eastern Eye.

He added: “It’s not just a 20 per cent tax, it’s effectively 40 per cent, because often that cash will need to come from the business itself. So that will incur an income tax charge first, then an inheritance tax charge on top to pay those bills.”

Monica Daddar, a director at Evelyn Partners whose expertise is in entrepreneurs, privately owned businesses, and international families, told Eastern Eye the move to limit inheritance tax relief on businesses would lead to the “death” of many multi-generational family-run businesses.

Labour’s decision to bring in restrictions to business and agricultural property relief, which has been around for more than 30 years, would come as a shock to companies, she said.

“It gave a complete exemption from inheritance to tax, which really helped to pass a business from one generation to the next generation and enabled that business to continue to grow without having to do a fire sale,” Daddar said.

Dawood Pervez“Now, family-owned businesses will really need to think about planning ahead because if they don’t bring forward what their succession plans will be, it could be hugely detrimental and effectively a life or death matter, because if someone was to pass away prematurely, the recipients of the estate may have to sell that business in order to fund a tax liability which they hadn’t appreciated.”

Day Lewis was launched in 1975, when Kirit and his brother Jayantibhai started out with a single pharmacy. They expanded the chain which now boasts 266 pharmacies, employing more than 2,600 dedicated professionals.

Sam revealed his family’s intention was to keep the business going for generations to come.

“If you think about some of the excellent organisations across many sectors that provide huge employment – run by Asian families – across retail, hotels, healthcare, in many cases, they were intended to be run as long-term entities into second and potentially third generations,” he said.

“Those are all now at risk, with a prospective challenge of having to pay inheritance tax bills. The only way to pay those bills is either raid the company for cash or to sell it. That becomes a major problem for investment for family businesses who look at building in the long term which many Asian family businesses do.”

He added: “It’s an attack on families whose businesses are more than just about profit. They have motivations that are well beyond just making a lot of money. They impact communities. They employ for the long term. They provide a societal good, all of which are reflected in the fact that people don’t just sell when it’s a good time and get out. They ride through cycles – they’re there for the long haul.

Tony Matharu“The aspiration is to build something as a legacy which can be grown over many years and leave a long-standing impact beyond just profit, and all of that is being attacked.”

Prime minister Sir Keir Starmer said the budget would target “those with the broadest shoulders” to spare “working people”.

The budget saw an increase in national insurance (NI) rates as well as a reduction in the threshold at which employers start paying it.

Although there were some exemptions or relief for the smallest firms, the NI increase will have big cost implications for businesses.

It means more than half of the tax rises in the budget will be paid for by employers, with the jump in the amount they pay in NI on workers’ wages set to generate £25 billion a year.

Businesses will also pay more into the public purse as a result of changes to capital gains tax, VAT on private schools and the non-dom tax regime.

Dawood Pervez, managing director at Bestway wholesale, said the rise in NI could have a detrimental impact on the government’s finances.

“Employers’ national insurance contributions are a significant cost increase and will either reduce profitability or lead to inflation. With the market being competitive, I think the former is more likely and will reduce corporation tax receipts,” Pervez told Eastern Eye.

Dr Meena NagpaulThe NHS and the rest of the public sector are exempt from the NI tax rise, but not private care homes or hospices which provide NHS services.

Although yet to be confirmed, it is believed that GP surgeries, many of which are run as small businesses, will also have to pay the added NI costs.

Dr Meena Nagpaul runs the Honeypot Medical Centre in Stanmore with her husband, Dr Chaand Nagpaul. She told Eastern Eye the rise in employer NI contributions could lead to worse outcomes for patient health.

“As employers, this is going to have significant financial implication for us. People may end up hiring less staff, including clinicians, which will obviously impact services,” she said.

“We’re not going to be able to afford to self-fund this hike so we’re going to have to make cuts somewhere to balance the books.”

Nagpaul revealed her shock that GP practices were not exempt from the NI rise, especially after the Darzi report said there should be a shift in the distribution of resources towards community-based primary care services.

“General practice having to foot the bill for this rise in national insurance is going to have the reverse effect – you’re actually taking funding away from general practice not increasing,” said Nagpaul.

“We could see a lot of the smaller practices close down as a result of this. It’s going to potentially have a huge impact on patients.”

Hotelier Tony Matharu warned that Labour’s tax rises would ultimately have a negative effect on “working people”, even though it was announced in the budget that minimum wage will increase from £11.44 to £12.21 an hour from April 2025.

Sam Pate“If the cost to keep people in employment continues to rise, businesses will turn to other methods of delivery and offshoring, replacing UK jobs with those outsourced abroad,” he told Eastern Eye.

“Business owners are the lifeblood of the economy, driving growth and creating jobs. They should be recognised, valued and supported, not burdened with increased interference and taxes on their ability to create jobs, stimulate and reward their enterprise. With the recent announcement, businesses have received a tidal wave of anti-business measures.

“The government states its focus is ‘national mission for growth’. Businesses create growth in the UK economy, not the government. The government should be supporting businesses and entrepreneurs if they want to attract investors, grow the economy and create and sustain jobs and livelihoods.”

Reeves justified the tax hikes by pointing to record waiting times in the NHS, children studying in crumbling schools and dysfunctional transport and justice systems.

In her budget speech, she promised to “invest, invest, invest” in order to “fix public services” and announced a £22.6bn increase in the day-to-day NHS health budget.

She went on to pledge major funding drives for housing, schools and major infrastructure projects, including HS2.

Rain Newton-Smith, chief executive of the Confederation of British Industry felt the government should look more at private sector investment to meet their needs to transform the country.

“This is a tough budget for business. While the corporation tax roadmap will help create muchneeded stability, the hike in national insurance contributions alongside other increases to the employer cost base will increase the burden on business and hit their ability to invest and ultimately make it more expensive to hire people or give pay rises,” said Newton-Smith.

Monica Daddar“The chancellor had difficult choices to make to deliver stability for the economy and public finances. A more balanced approach to our fiscal rules which prioritises capital investment should help to unlock private sector investment in our infrastructure and net zero transition over the long-term.

“Only the private sector can provide the scale of investment required to deliver the government’s growth agenda. To achieve this shared mission of growing our economy sustainably, it’s vital the government doubles down on its partnership with business to unlock the investment needed to drive opportunity around the UK.”

Daddar revealed that private investment might be difficult to come by, with a number of her clients already planning to leave the UK as result of the tax changes or moving parts of their businesses abroad.

“I am currently seeing a number of entrepreneurs fleeing from the UK,” she said. “We are seeing people completely deciding to change how their (business) structures are set up. They are thinking, is it worthwhile being in the UK because these tax implications could kill a lot of family businesses overnight.

“This is driving conversations we’re having with clients who are saying, ‘the world is my oyster, where should I be thinking about taking my business?’”

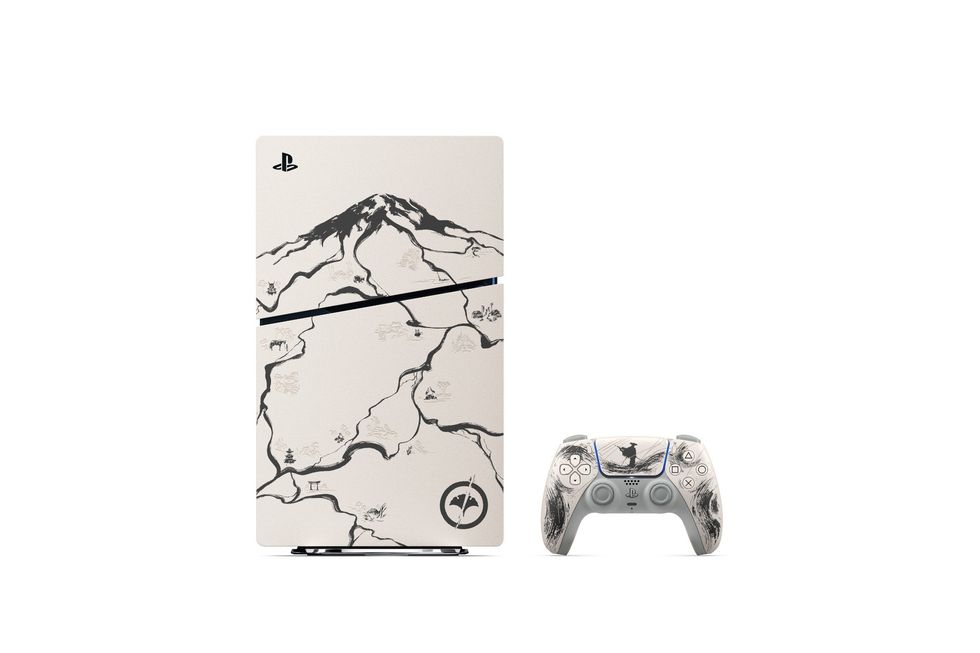

The controller and cover designs have been developed in close collaboration with the PlayStation design teamPlayStation

The controller and cover designs have been developed in close collaboration with the PlayStation design teamPlayStation

Charithra Chandran styled her hair in soft curls for the Ralph Lauren outfitInstagram/

Charithra Chandran styled her hair in soft curls for the Ralph Lauren outfitInstagram/ Charithra’s look was inspired by her character Edwina Sharma from BridgertonInstagram/

Charithra’s look was inspired by her character Edwina Sharma from BridgertonInstagram/