THE UK government reduced its 2025 growth forecast by half on Wednesday and announced spending cuts to manage public finances amid economic challenges.

The Spring Statement update comes as the Labour government, which won a landslide election in July, faces slow economic growth and rising borrowing costs.

Britain’s economy is now expected to grow by one per cent this year, down from the two per cent forecast made in October when Labour presented its first budget.

However, the Office for Budget Responsibility (OBR), the UK’s spending watchdog, raised its growth forecast for the following three years.

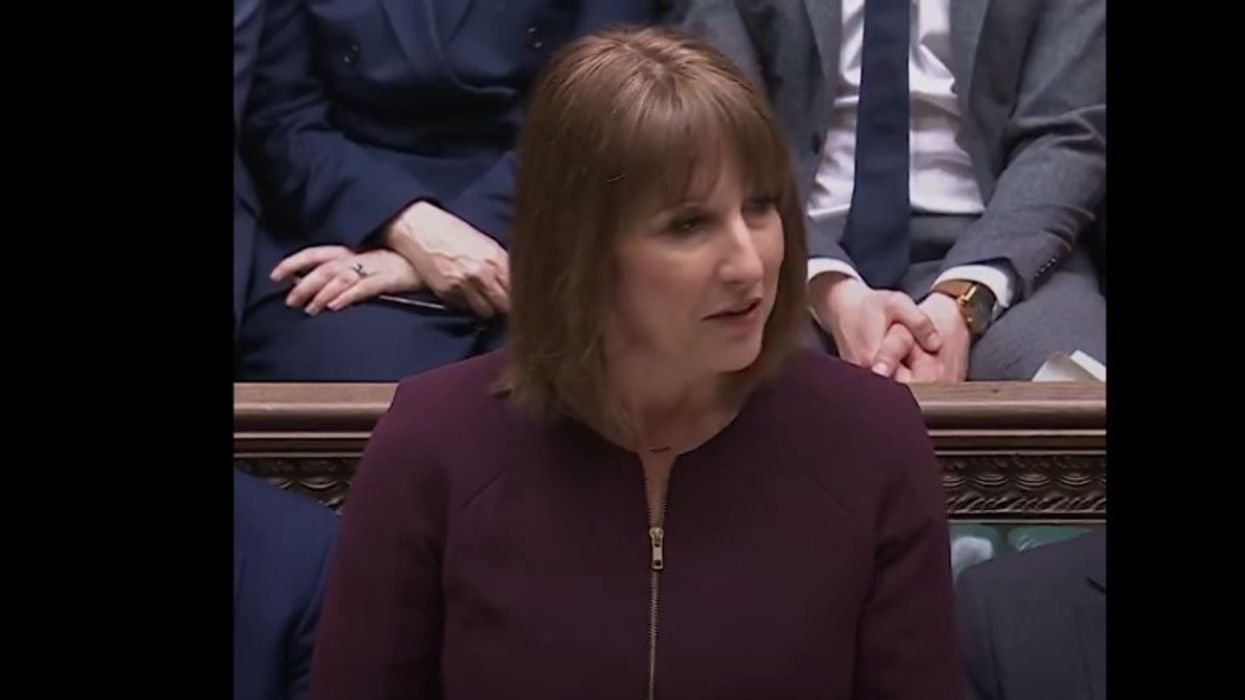

“Our task is to secure Britain’s future in a world that is changing before our eyes,” Chancellor Rachel Reeves told parliament while presenting the update.

Concerns over US tariffs and the war in Ukraine have added pressure to the UK economy, affecting the government’s financial position.

“The threat facing our continent was transformed when (Russian president Vladimir) Putin invaded Ukraine,” Reeves said. She added, “The job of a responsible government is not simply to watch this change, this moment requires an active government.”

Prime minister Keir Starmer has recently pledged to increase defence spending, with the government confirming a £2.2 billion boost next year.

To prevent a budget deficit, Reeves has announced cuts to disability welfare payments and reductions in government departmental budgets, citing global economic uncertainty.

Public spending cuts

Reeves’ plans to stabilise public finances are limited by fiscal rules and a commitment not to increase taxes. The rules prevent borrowing for day-to-day spending and require debt to decline as a share of GDP by 2029-30.

Ahead of the statement, the government announced a 15 percent cut in civil service operational costs over five years, aiming to save around £2 billion annually.

It has also outlined reductions in disability welfare payments, aiming to save billions by the end of the decade.

While Labour has pointed to increased funding for housing, the NHS, and workers’ rights reforms, the spending cuts have drawn the most attention.

The measures follow criticism over the government’s decision last year to scrap a winter fuel benefit scheme for millions of pensioners.

A higher business tax will take effect in April, adding pressure on businesses also facing a minimum wage increase.

In economic data released Wednesday, the UK’s annual inflation rate fell to 2.8 per cent in February, down from 3.0 per cent in January. However, inflation remains above the Bank of England’s two per cent target.

The central bank kept interest rates unchanged last week, citing ongoing economic uncertainty.

(With inputs from AFP)