THE World Bank is working to slash how long it takes to get financing projects off the ground as part of a push to speed up and scale up the 79-year-old development lender, its president said last Wednesday (3).

It currently takes 27 months, on average, before “the first dollar goes out the door,” Ajay Banga said in an interview in his office in the bank’s headquarters close to the White House.

“If I can bring it down by one third over the first couple of years, that would be pretty good,” he said. “The bank needs to change and evolve.”

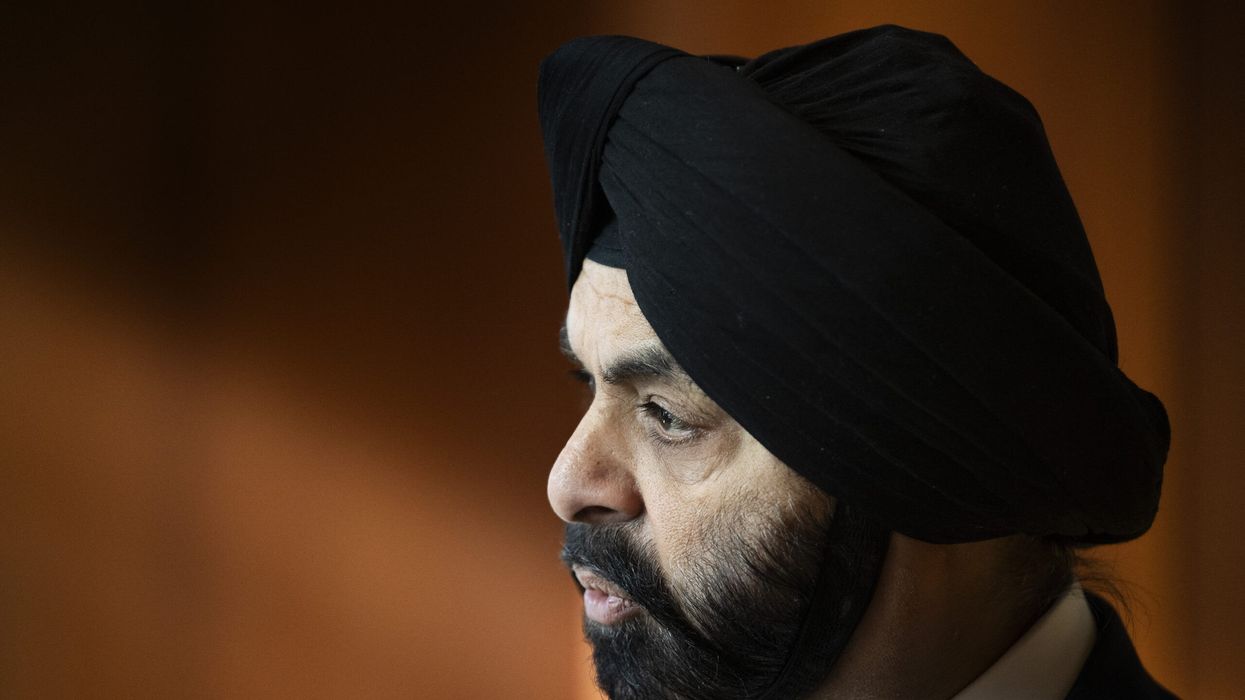

Banga, an India-born, naturalised US citizen who previously ran the payments company Mastercard, took over the management of the bank in June on a pledge to boost its lending firepower by encouraging greater private investment in the fight against climate change.

In the seven months since, the 64-year-old has made some big changes, altering the development lender’s mission statement to include a reference to climate change and setting up a private sector advisory body to recommend solutions to address the “barriers to private sector investment in the emerging markets.”

He’s also explored new ways to “sweat” the bank’s existing balance sheet in order to boost lending capacity without seeking additional funding from donor countries.

Last Wednesday, Banga repeated a previous pledge to “fix the plumbing” of World Bank and said he plans to “create the credibility” needed for the developed world to increase capital investment in it.

“For that, you have to become a better bank. You have to be quicker, faster, more focused on impact, less focused on input,” he said.

As part of a push to increase its climate financing, the World Bank Group recently raised its target for climate-related projects from 35 per cent of its annual financing to 45 per cent.

“I think people in the global south recognise very well that you cannot fight poverty without fighting climate change,” Banga said. “The only difference is, what do you mean by climate change?”

Whereas the developed world tends to discuss climate change in terms of mitigating carbon emissions, “the developing world tends to speak about climate change as adaptation,” he said.

“They see the climate change impact on them in terms of irrigation, rainfall, soil degradation, loss of biodiversity, forestry cover, that kind of thing,” the president added.

To meet both of these challenges, the World Bank has decided that half of the 45 per cent committed to climate financing in the next financial year will go to adaptation and the other half to mitigation.

“You have to find these compromises to enable the donors and the receivers to feel that the bank is navigating in the right way,” Banga said.

However, even if the bank succeeds in raising additional capital from its members and squeezing additional dollars from its balance sheet, it is still unlikely to meet the scale of the challenge posed by climate change alone, Banga said.

The World Bank recently estimated that developing countries will need an average of $2.4 trillion (£1.8tr) each year between now and 2030 in order to address the “global challenges of climate change, conflict, and pandemics.”

Given that the bank’s lending commitments in the most recent financial year were less than $130 billion (£102bn), the only way to get close to this target is by encouraging far greater private sector participation, according to Banga.

“That’s the one that we’re really trying to work on,” he added. The third issue is how to protect investors better from risks like war and civil unrest.

This task is currently split among three different World Bank Group institutions, and is done on far too small a scale, Banga explained.

If the bank is able to boost the amount of political risk guarantees it can provide, and simplifies access, they could play a significant role in unlocking private capital, he said. “The reality is that that gap between tens and hundreds of billions to trillions is not a number that the bank can fill,” he added.

“That’s why you do eventually need the private sector.” (AFP)