INFLATION remained unchanged at 2.2 per cent in August, according to data released by the Office for National Statistics (ONS) on Wednesday.

The stable Consumer Prices Index (CPI) level, the same as in July, has strengthened expectations that the Bank of England (BoE) will hold interest rates steady during its upcoming policy meeting this week.

The BoE cut interest rates to 5 per cent in August, marking the first rate cut since the start of the Covid-19 pandemic in 2020.

Inflation briefly met the central bank’s target of 2 per cent in May but has since edged up. Despite this, inflation remains far below the four-decade highs seen almost two years ago. However, the central bank had forecast a slight increase to 2.4 per cent for August, indicating a discrepancy in expectations.

"Years of sky-high inflation have taken their toll; and prices are still much higher than four years ago," Darren Jones, a senior official at the Treasury, said in response to the data.

The ONS report also highlighted movements within the services sector, where inflation rose to 5.6 per cent in August from 5.2 per cent in July.

This rise in services inflation, closely watched by the BoE as an indicator of domestic price pressures, was driven primarily by a 22.2 per cent increase in airfares between July and August, particularly for European destinations.

This was offset by lower fuel prices and falling costs at restaurants and hotels, noted Grant Fitzner, the ONS chief economist.

Commenting on the data, Yael Selfin, chief economist at KPMG UK, stated, "Today’s data are unlikely to unlock another rate cut by the Bank of England tomorrow. While we expect the Bank to look beyond the anticipated higher headline inflation, services inflation remains elevated."

Sterling strengthened against the dollar after the inflation data was released, with investors trimming their bets on a rate cut from the BoE this week. Financial markets now place the chance of a cut at roughly 28 per cent.

The Labour government under Keir Starmer, which is working to accelerate economic growth, welcomed the data, pointing out that inflation has become more manageable compared to the peaks seen two years ago. However, the government acknowledged that prices remain high, impacting households across the country.

Core inflation, excluding more volatile categories such as energy, food, and tobacco, also showed an increase on both a monthly and yearly basis, adding further pressure on the BoE's upcoming rate decision.

(With inputs from agencies)

(Photo credit: PTI)

(Photo credit: PTI)

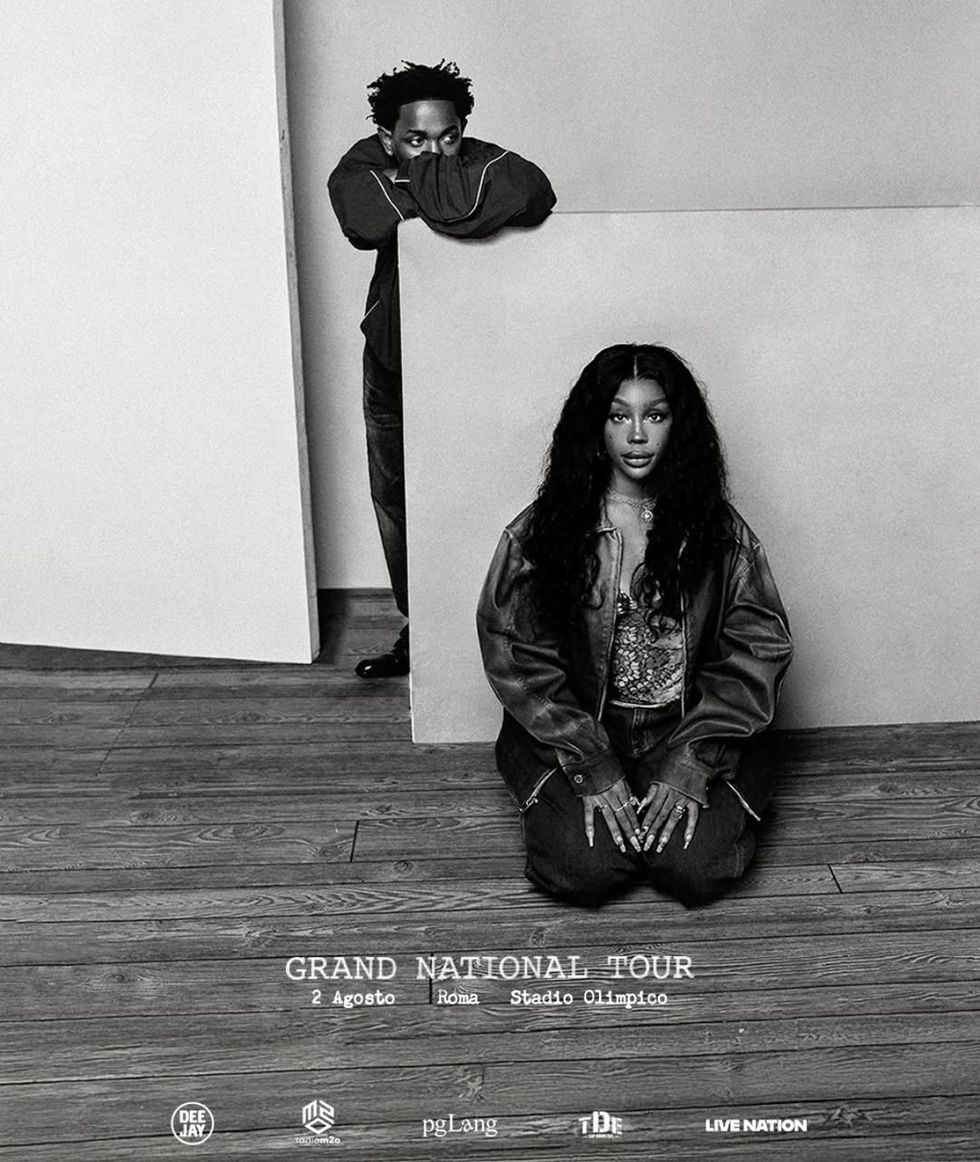

Kendrick Lamar and SZA commands the stage at Villa Park during his explosive opening setInstagram/

Kendrick Lamar and SZA commands the stage at Villa Park during his explosive opening setInstagram/