THREE former students of Oxford are anticipating a substantial windfall, potentially reaching $100 million ( £79m), following the acquisition of their start-up, Onfido, by a US competitor, reports said.

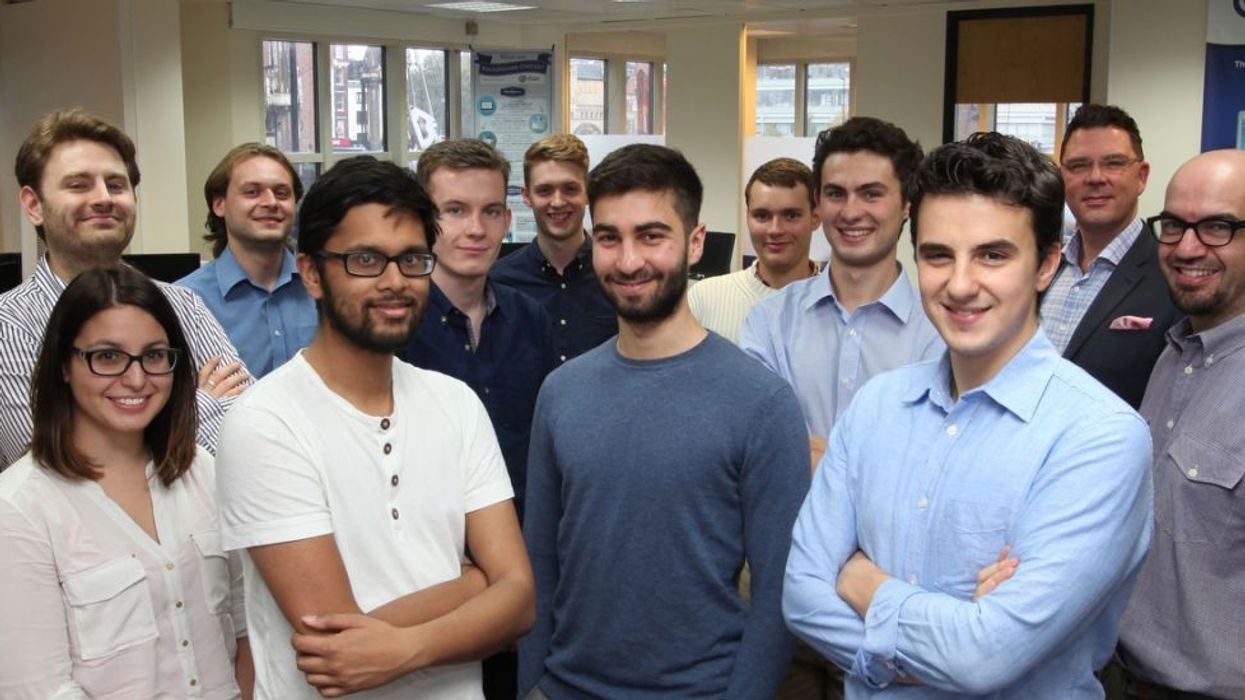

Husayn Kassai, Eamon Jubbawy, and Ruhul Amin founded Onfido, which makes it easy for people to access services through digital verification, when they were students at the university.

The founders, in their 30s, collectively own approximately 15 per cent of the start-up, with Kassai's stake alone valued at over $50m ( £40m), the Telegraph reported.

The company is in advanced talks to sell itself to US based Entrust Corp for $650m ( £516m), two people familiar with the matter told Reuters.

Also, dozens of Onfido employees stand to receive substantial payouts, while Oxford University, an early investor, is also poised to benefit from the sale.

Although Kassai and Jubbawy have moved on to launch new ventures after graduating with degrees in economics, Amin remains actively involved in Onfido as a senior executive. The company is currently under the leadership of Mike Tuchen, an experienced tech executive.

"The ecosystem in the UK has enabled us as founders — two of whom went to underprivileged schools — to get everything they need to build a large company. In that journey we have been lucky to help others to upskill and learn and a sign of that is the fact that more than 14 of the team have gone on to be founders of their own companies," Kassai was quoted as saying by The Times.

Kassai studied at Burnage Academy for Boys in southern Manchester, while Amin went to Mulberry Stepney Green in eastern London, and Jubbawy attended the private institution St. Paul's School in western London.

According to reports, Onfido's technology is widely used by customers during the registration process for digital banking and payment apps, offering ID verification through smartphone cameras and facial recognition.

The potential acquisition comes amid growing concerns about identity fraud, with Entrust CEO Todd Wilkinson highlighting the importance of robust identity verification tools in combating emerging threats such as deepfakes and synthetic identities.

"We're excited to be entering into early and exclusive discussions for Onfido to be acquired by Entrust, a global leader in trusted payments, identities, and data security," Onfido said in a statement.

"We aren't able to comment further until these discussions are finalized, subject to regulatory approval and local law.”

The British company has several external backers including Salesforce's new tab venture capital arm and private equity groups Bain Capital and TPG, opens new tab, according to public filings

Onfido posted an increase in revenue for the year ended Jan. 31, 2023 to £102m and an operating loss of £70m, according to accounts filed at Companies House.

Onfido helps millions access services every week – from billion-dollar institutions to hyper-growth startups. The company has safely processed more than 200 million identity checks with over 2,500 document types and passports from 195 countries.