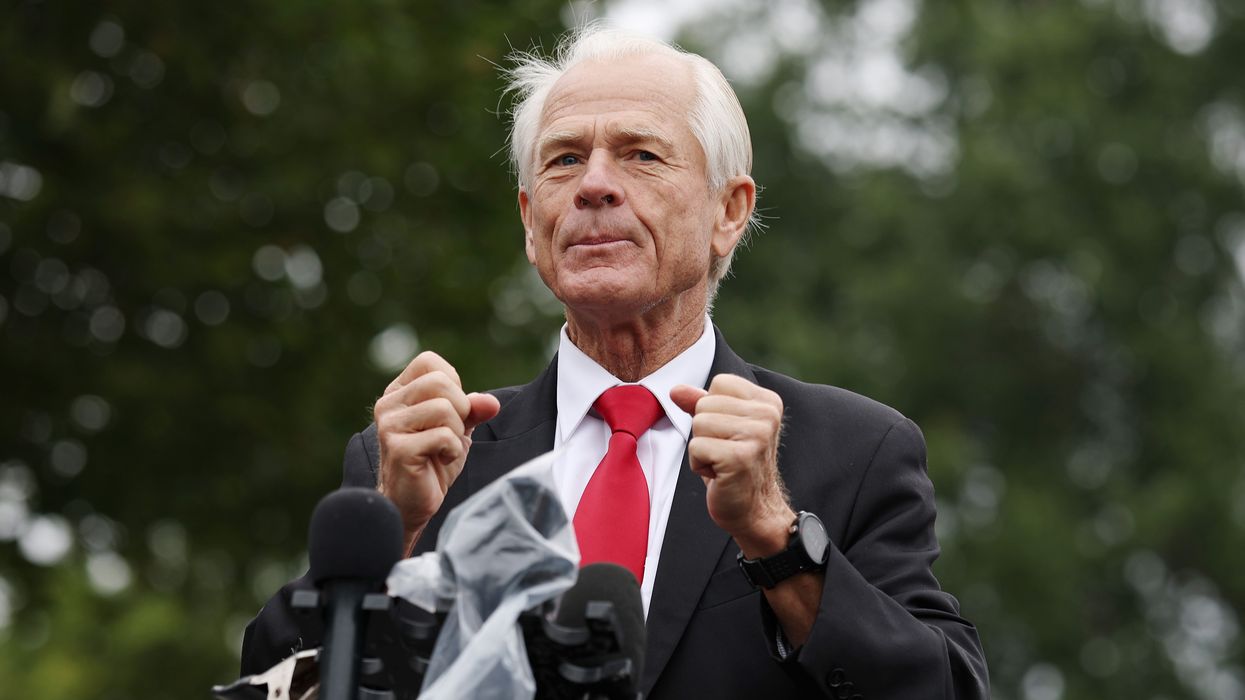

WHITE HOUSE trade adviser Peter Navarro criticised India as being a "Maharaj" in tariffs and claimed it operated a "profiteering scheme" by using discounted Russian crude oil, as a war of words between India and the US continued to escalate.

Navarro's comments came as India’s foreign minister, S Jaishankar, said the US had asked New Delhi to help stabilise global energy markets by buying Russian oil.

India was "cosying up to" Chinese president Xi Jinping, Navarro added.

Meanwhile, China’s ambassador to India, Xu Feihong, said Beijing "firmly opposes" Washington's steep tariffs on Delhi and called for greater co-operation between India and China, BBC reported.

According to the broadcaster, Xu likened the US to a "bully" and blamed Washington for benefiting from free trade.

However, the US was now using tariffs as a "bargaining chip" to demand "exorbitant prices" from other nations, the Chinese diplomat was quoted as saying.

Relations between New Delhi and Washington have become strained after US president Donald Trump doubled tariffs on Indian goods to 50 per cent, including a 25 per cent additional duties for India's purchase of Russian crude oil.

Navarro told reporters in the US, “Prior to Russia's invasion of Ukraine in February 2022, India virtually bought no Russian oil... It was like almost one per cent of their need. The percentage has now gone up to 35 per cent.”

Earlier this week, Navarro wrote in the Financial Times criticising India for its procurement of Russian crude oil.

He dismissed the argument that India needs Russian oil to meet its energy requirement, saying the country acquired cheap Russian oil before making refined products, then sold on at premium prices in Europe, Africa and Asia.

"It is purely profiteering by the Indian refining industry," Navarro said.

"What is the net impact on Americans because of our trade with India? They are Maharaj in tariff. (We have) higher non-tariff barriers, massive trade deficit etc - and that hurts American workers and American business," according to him.

“The money they get from us, they use it to buy Russian oil which then is processed by their refiners,” he added.

"The Russians use the money to build arms and kill Ukrainians and Americans tax-payers have to provide more aid and military hardware to Ukrainians. That's insane.

"India does not want to recognise its role in the bloodshed," Navarro said.

Though the US imposed an additional 25 per cent tariff on India for its energy ties with Russia, it has not initiated similar actions against China, the largest buyer of Russian crude oil.

Defending its purchase of Russian crude oil, India has maintained that its energy procurement is driven by national interest and market dynamics.

India turned to purchasing Russian oil sold at a discount after Western countries imposed sanctions on Moscow and shunned its supplies over its invasion of Ukraine in February 2022.

Consequently, from a 1.7 per cent share in total oil imports in 2019-20, Russia's share increased to 35.1 per cent in 2024-25, and it is now the biggest oil supplier to India.