MOHSIN ISSA's EG Group has significantly reduced its debt, paying off hundreds of millions of pounds by selling parts of its petrol station and convenience store empire.

The company announced it had cleared its immediate debt obligations following the sale of multiple forecourts and stores, including the remaining part of its UK business to Zuber Issa, Mohsin’s brother, reported the Telegraph.

This transaction has marked a formal split between the Issa brothers in their business ventures.

Earlier this month, EG also sold 19 Mini-Mart convenience stores in the US, together with the UK forecourts sale generating around £315 million. These funds were used to reduce the company’s substantial debt, which, as of recent figures, stands at $5.27 billion (£4.2bn)—significantly down from the $10bn (£7.98bn) owed in early 2023.

This improved financial standing led rating agency Moody’s to upgrade EG Group’s credit outlook from negative to stable.

Over the past few years, EG Group has been under scrutiny for its high debt levels, accumulated as the Issa brothers expanded rapidly into one of the world’s largest independent petrol forecourt and convenience store chains.

By 2021, they had established a vast network of sites across the US and Europe. However, rising interest rates have made their debt more expensive, prompting EG to divest significant parts of its business.

In a major shift last year, EG Group sold most of its UK petrol stations to Asda, a supermarket chain also owned by the Issas, in a £2.3bn deal. This marked the start of the brothers’ efforts to divide their empire, with Zuber stepped down as co-chief executive of EG Group in June, leaving Mohsin to lead the company independently.

Zuber also reduced his involvement in Asda, selling a 22.5 per cent stake to TDR Capital, which now controls 67.5 per cent of the supermarket chain.

Mohsin retains a 22.5 per cent stake, with Walmart holding the remaining 10 per cent. Zuber now runs the UK forecourts acquired from EG Group as non-executive board member and shareholder.

(Photo credit: PTI)

(Photo credit: PTI)

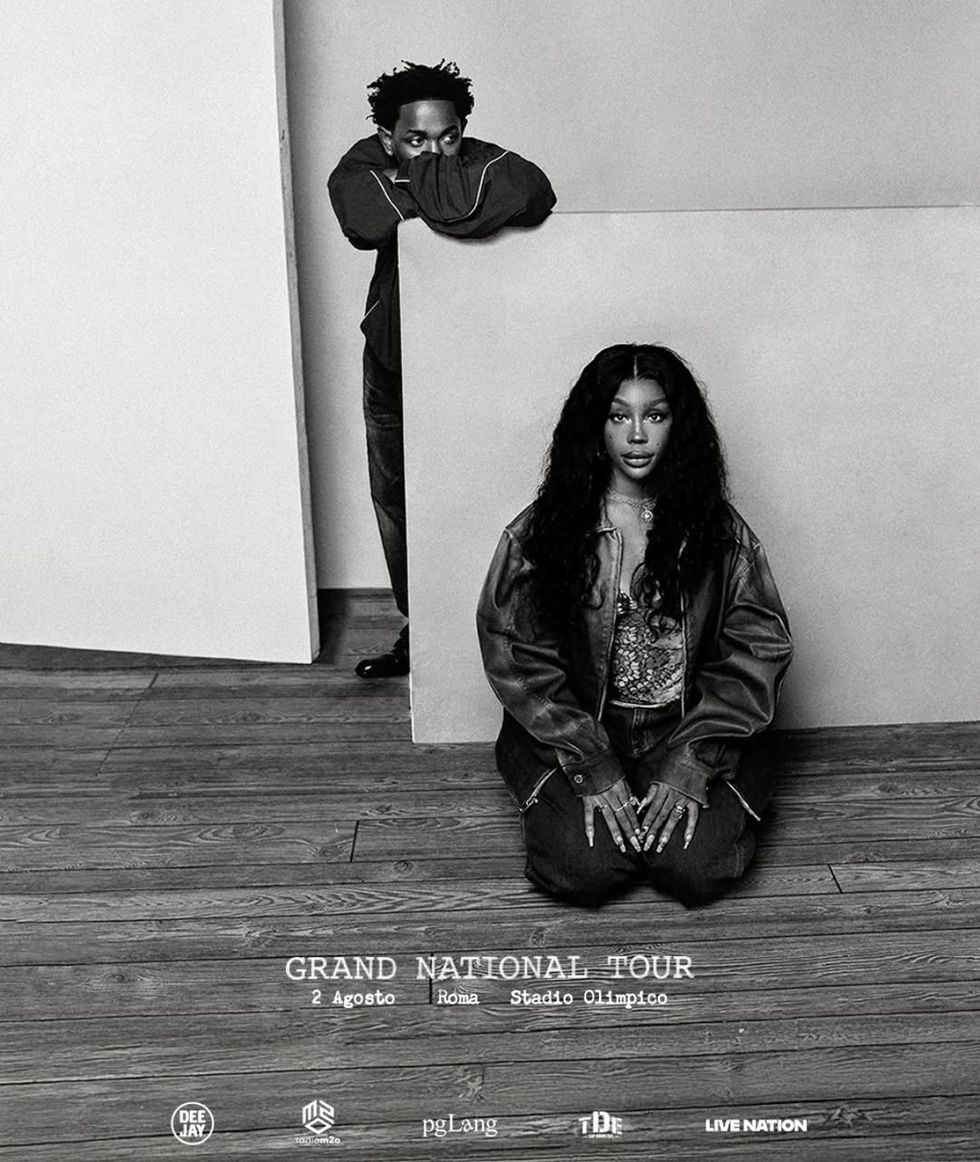

Kendrick Lamar and SZA commands the stage at Villa Park during his explosive opening setInstagram/

Kendrick Lamar and SZA commands the stage at Villa Park during his explosive opening setInstagram/