THE Securities and Exchange Board of India (Sebi) has banned industrialist Anil Ambani and 24 others from the securities market for five years due to charges of fund diversion from Reliance Home Finance Ltd (RHFL).

In addition, Sebi has imposed a ₹25 crore (£2.2 million) penalty on Ambani and barred him from serving as a director or key managerial personnel (KMP) in any listed company or Sebi-registered entity for the next five years.

Moreover, fines ranging from ₹21 crore (£1.9m) to ₹25 crore (£2.2m) have been imposed on 24 entities involved in the case. Sebi has also prohibited Reliance Home Finance from accessing the securities market for six months and imposed a ₹6 lakh (£5449.69) fine on the company.

The penalties come after Sebi investigated multiple complaints of fund diversion and siphoning within RHFL during the financial year 2018-19.

The investigation revealed that Anil Ambani, along with key officials of RHFL – Amit Bapna, Ravindra Sudhalkar, and Pinkesh R Shah – allegedly orchestrated a fraudulent scheme to divert funds from RHFL, disguising them as loans to entities linked to Ambani.

An email sent to Anil Ambani-led Reliance Group company remained unanswered.

Despite directives from RHFL’s board to halt such lending practices, the company’s management allegedly continued these activities, highlighting a significant governance failure.

Sebi's findings also indicated that various other entities either received the misappropriated funds or acted as conduits in the illegal diversion of money from RHFL.

Sebi said that findings have established the "existence of a fraudulent scheme, orchestrated by Noticee No. 2 (Anil Ambani) and administered by the Key Managerial Personnel of RHFL, to siphon off funds from the public listed company (RHFL) by structuring them as ‘loans’ to credit unworthy conduit borrowers, and in turn, to onward borrowers, all of whom have been found to be ‘promoter linked entities' i.e. entities associated/ linked with Noticee 2 (Anil Ambani)".

Ambani has used his position as 'chairperson of the ADA group’ and his significant indirect shareholding in the holding company of RHFL to orchestrate the fraud.

Sebi, in its 222-page order on Thursday (22), noted the cavalier approach by the company's management and promoter in approving loans worth hundreds of crores to companies that had little to no assets, cash flow, net worth, or revenue.

This suggests a sinister objective behind the 'loans'. The situation becomes even more suspicious when considering that many of these borrowers were closely linked to the promoters of RHFL.

Eventually, most of these borrowers failed to repay their loans, causing RHFL to default on its own debt obligations. This led to the company's resolution under the RBI Framework, leaving its public shareholders in a difficult position.

For example, in March 2018, RHFL's share price was around ₹59.60 (£0.54). By March 2020, as the extent of the fraud became clear and the company was drained of its resources, the share price had plummeted to just ₹0.75 (£0.0068). Even now, over 9 lakh shareholders remain invested in RHFL, facing significant losses.

Accordingly, Sebi has barred these 25 entities including Ambani and former officials from "accessing the securities market and prohibited from buying, selling or otherwise dealing in securities, directly or indirectly, for a period of 5 years".

Ambani and three former officials of RHFL (Bapna, Sudhalkar and Shah) have been "restrained from being associated with the securities market including as a director or Key Managerial Personnel (KMP) in any listed company, or any intermediary registered with Sebi, for a period of five years".

Also, the regulator levied a fine of ₹27 crore (£2.4m) on Bapna, ₹26 crore (£2.3m) on Sudhalkar and ₹21 crore (£1.9m) on Shah.

Additionally, the remaining entities including Reliance Unicorn Enterprises, Reliance Exchange next Ltd, Reliance Commercial Finance Ltd, Reliance Cleangen Ltd, Reliance Business Broadcast News Holdings Ltd and Reliance Big Entertainment Private Ltd have been imposed a penalty of ₹25 crore (2.2m) each.

These fines have been levied on them for either receiving the illegally obtained loans or acting as intermediaries to facilitate the illegal diversion of funds from RHFL. (PTI)

Festival goers at Glastonbury festival 2025Getty Images

Festival goers at Glastonbury festival 2025Getty Images  Pyramid Stage crowd swells ahead of the mystery Patchwork act rumoured to be Pulp Instagram/

Pyramid Stage crowd swells ahead of the mystery Patchwork act rumoured to be Pulp Instagram/ Kneecap welcome as political tension surrounds their setGetty Images

Kneecap welcome as political tension surrounds their setGetty Images Crowds of festival-goers fill the pathways during day three of Glastonbury festival 2025Getty Images

Crowds of festival-goers fill the pathways during day three of Glastonbury festival 2025Getty Images

Daniel Craig poses as James BondGetty Images

Daniel Craig poses as James BondGetty Images  James Bond casting shortlist revealed with Tom Holland Jacob Elordi and Harris Dickinson in leadGetty Images

James Bond casting shortlist revealed with Tom Holland Jacob Elordi and Harris Dickinson in leadGetty Images Is this the youngest James Bond yet as Tom Holland Harris Dickinson and Jacob Elordi lead casting rumoursGetty Images

Is this the youngest James Bond yet as Tom Holland Harris Dickinson and Jacob Elordi lead casting rumoursGetty Images

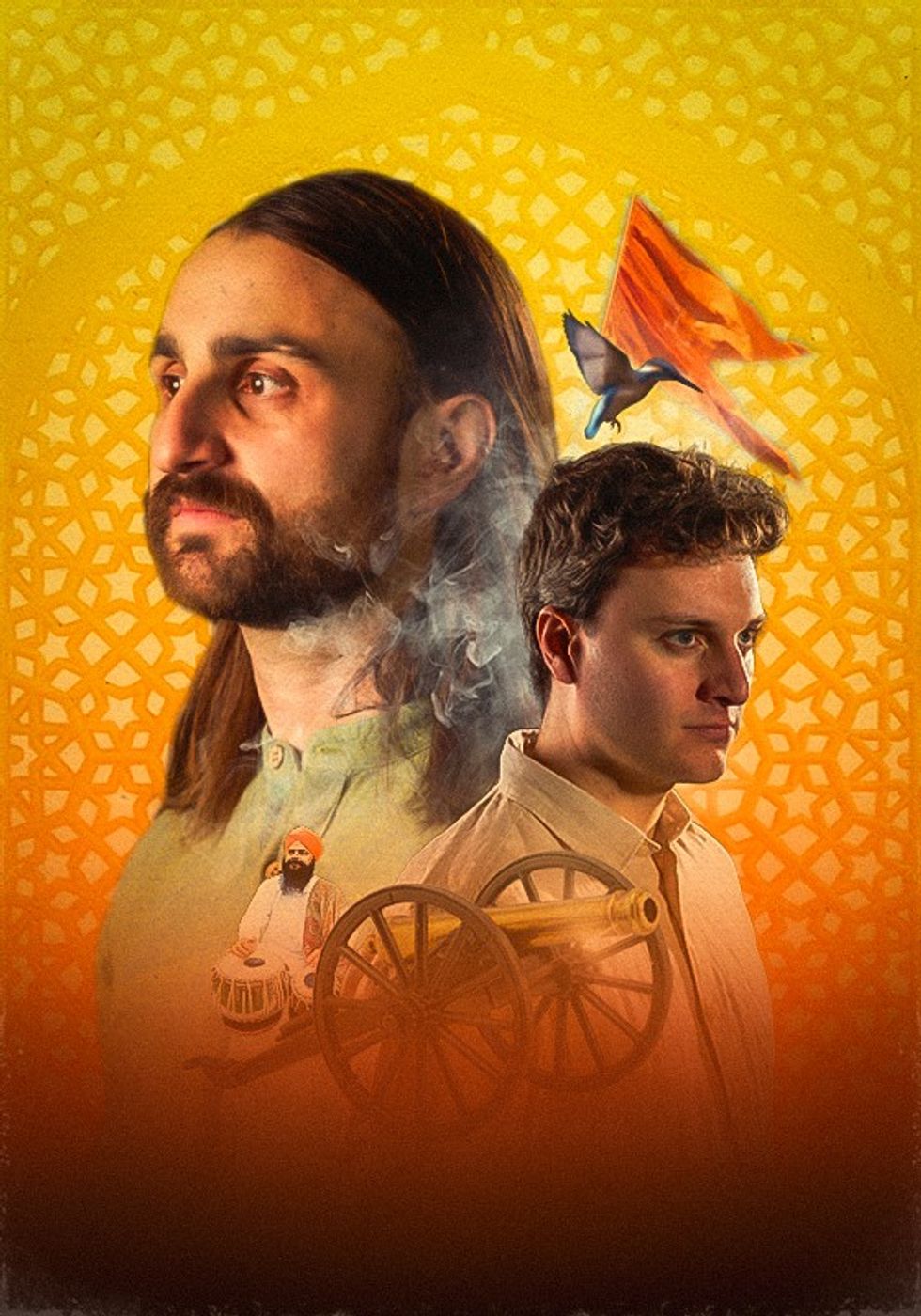

An explosive new play that fuses biting satire, history and heartfelt storytellingPleasance

An explosive new play that fuses biting satire, history and heartfelt storytellingPleasance

Police may probe anti-Israel comments at Glastonbury