THE World Bank on Friday (10) provided Sri Lanka $150 million to underwrite savings of millions of depositors in a move that highlights the bankrupt country's financial fragility as it recovers from a crisis last year.

The country's rupee currency plunged almost 50 per cent last year after the government declared bankruptcy and defaulted on its $46 billion foreign debt.

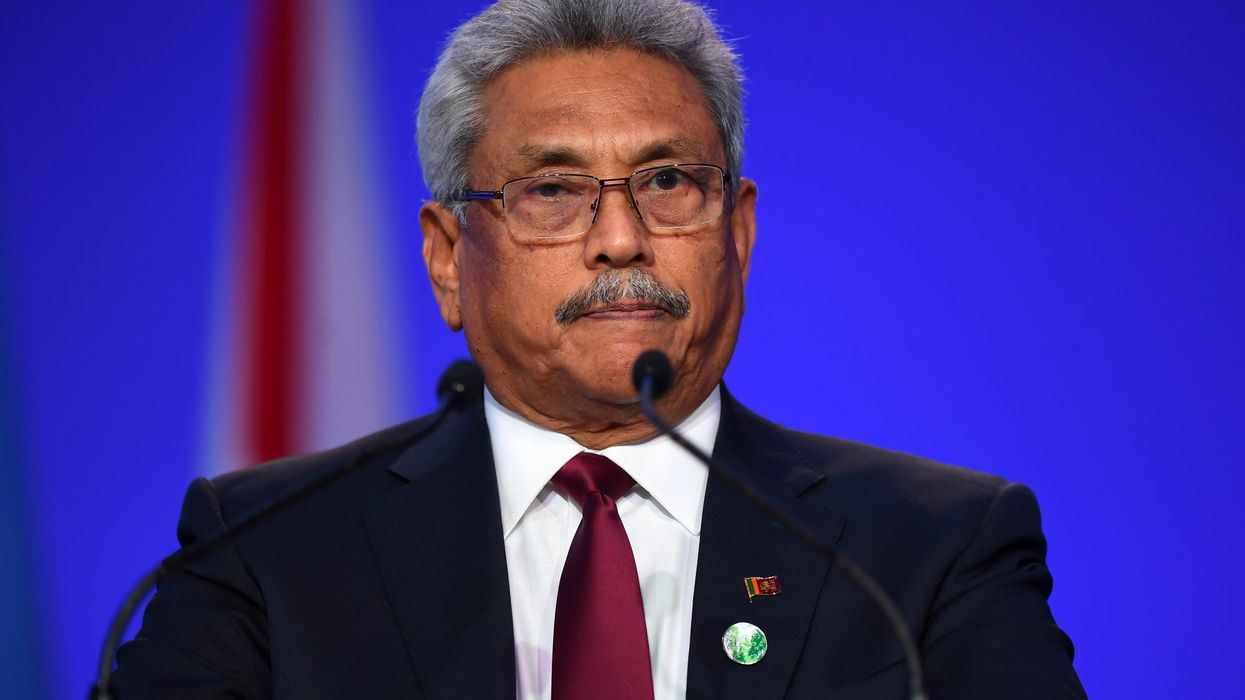

Acute shortages of food, fuel and medicines led to months of violent protests that forced then-president Gotabaya Rajapaksa to step down and flee the country.

"Sri Lanka’s economic crisis highlights the need for strong safety nets to support the financial sector," the World Bank's country director Faris Hadad-Zervos said.

The money will go towards a deposit insurance scheme to protect small savers with less than Rs 1.1 million ($3,400), who account for 90 per cent of deposits.

The economy is expected to contract in 2023 but it has stabilised since the crisis, with inflation falling below two per cent after peaking at nearly 70 per cent more than a year ago.

Colombo secured a 48-month $2.9 billion bailout from the International Monetary Fund in March, but the latest instalment of $330 million has been held up since September as foreign debt restructuring remains inconclusive.

(AFP)

World Bank offers prop for Sri Lanka's stressed banks

$150 million will go towards a deposit insurance scheme to protect small savers