by Lord Jitesh Gadhia

AM delighted to be back in Cambridge address- ing two of this university’s most illustrious socie- ties – the Marshall Society and India Society – both of which I was a proud member of during my time here as an economics student.

The India Society is thought to have been found- ed by independent India’s first prime minister, Jawaharlal Nehru, during his time at Trinity College between 1907-1910. In fact, some historical ac- counts show that it was first founded in 1891 as the Cambridge Majlis. And another Indian prime minister, Dr Manmohan Singh, himself a distinguished economist, was a member of both societies while studying at this college – St John’s.

I have been fortunate to join parliament at a defining moment in history, as we grapple with the new realities facing the UK with Brexit. As one of the younger members of the House of Lords, the dilemmas and trade-offs involved in Brexit are more meaningful as I will hopefully be around for several decades and in a position to see how our decisions today will impact upon future generations such as yours.

However all-consuming Brexit might seem at present, the topic of today’s discussion about the ‘Asian economic century’ will, I believe, have even more profound and lasting consequences for us all.

China has enjoyed double digit GDP growth for several decades until recently. The key drivers of its progress have been a cocktail of favourable demographics, productivity and investment. However, the Chinese economy has been slowing down since the start of this decade. GDP per capita is expected to continue on a positive trajectory, helped by the slowdown in population growth, which is expected to peak at just over 1.4 billion in 2029.

The Chinese government has embraced slower economic growth, referring to it as the “new normal” and acknowledging the need for China to adopt a new growth model that relies less on fixed investment and exporting, and more on private consumption, services and innovation.

In the meantime, India’s population is expected to continue growing until the 2050s, and current estimates are that it will peak somewhere around 1.7 billion in the second half of this century.

The rise of the so-called BRIC countries – Brazil, Russia, India and China – is essentially built upon the premise that these large emerging economies can benefit from their demographic advantage – provided that, crucially, they can convert their rising populations into a productive workforce.

That is why India holds so much potential in driving the next wave of expansion in the Asian economic century, picking up the baton from Chi- na as the main engine of growth.

The Asia 2050 report by the Asian Development Bank contained one important observation and caveat. It noted that Asia’s rise is “by no means pre- ordained” and warned of the “middle income trap” whereby countries achieve a certain economic level, but begin to experience sharply diminishing econo- mic growth rates because they are unable to adopt new sources of economic growth, such as innovation.

So what does India need to do to achieve its much-heralded potential?

I would like to draw upon a research paper writ- ten by my colleague Lord Jim O’Neill when he was at Goldman Sachs, called Ten Things for India to Achieve its 2050 Potential. It’s a paper we both dis- cussed with India’s prime minister Narendra Modi when he was the chief minister of Gujarat.

First, India needs to turn its very large, young population – half of which is under the age of 28 – into a demographic dividend. That means development of human capital at all levels – investing in basic as well as advanced and higher education.

But there is also a huge requirement for vocational skills from the 270 million Indians entering the workforce over the next 20 years. So the risk of job- less growth is India’s number one challenge right now, if it fails to skill people rapidly enough.

Second, as well as building human capital, India needs to raise investment in physical assets and R&D to deliver on its ambitious plans to spend almost $1 trillion on infrastructure over the next five years to support its inexorable urbanisation.

Many of these plans have consistently run be- hind target, which is a big contrast to China. Much of it is due to lack of planning, unnecessary bureaucracy and legal delays and the absence of invest- ment frameworks which provide political and financial certainty. Also, total R&D spending is woe- ful at only 0.6 per cent of GDP, compared 2.1 per cent in China, 2.8 per cent in the US, 4.2 per cent in Korea and 4.3 per cent in Israel.

Third, India needs to accelerate the reform of its banking system and capital markets. The public sector banks still hold too many non-performing loans which has restricted new lending to support the economy. The introduction of a new Insolvency and Bankruptcy Code and associated resolution process has started to address this issue so that defaulting companies can be sold and restructured.

Similarly, the bond markets in India have lagged behind the rest of the world, so there is a gap in providing alternative sources of funding for the corporate sector and investment opportunities for savers and institutions.

Fourth, the Indian government needs to stay the course on governance reforms. To achieve these, India needs to draw upon a deeper bench of capable, well-paid civil servants, which it currently lacks. Fifth and finally, every country needs an X-factor, and for India there is an innate spirit of entrepreneurship and frugal innovation which needs to be fully unleashed. The start-up culture has been transformed in recent years, attracting more risk takers and funding, but there is still a gap compared to Silicon Valley, where ironically many of the key players are originally from India.

In conclusion, Asian economies remain well placed to deliver the highest economic growth in the coming century. If India can even get “half its act” together, then it will be in prime position to be- come a pivotal player in the next 30-40 years.

Yet, as always, one should be careful about predicting the future. I would make two important caveats.

First, it is worth remembering that, at Cambridge, economics used to be known as political economy. The economic potential and power of Asia is intertwined with the ability of governments to facilitate this growth in a way which maintains social cohesion and macro-economic stability. The trajectory of Asia’s rise is unlikely to be smooth. Economic history teaches us that there will be crises – financial, economic or political – and how countries

navigate through them will decide Asia’s fortunes. Fortunately, with each crisis, Asia has demonstrated a growing capacity to manage instability. For example, the region’s enhanced resilience to external shocks was demonstrated during the financial crisis, as it became the first region to recover.

Second, to achieve its full potential, Asia must overcome the threat of deglobalisation as the larger western economies lose their hegemony and start to become more protective and insular. We have already seen this manifest itself in Trump’s ‘America First’ policy and the resulting Sino-American trade disputes.

This is just the start of what happens as we move to a more complex multi-polar world. Put starkly, politics means that economic progress does not always move in a straight line. So India will need to learn to navigate these political challenges in order to truly drive Asia’s economic century.

- Excerpts from Lord Gadhia’s address to the Cambridge University Marshall Society and India Soci- ety, St John’s College, on February 25, 2019

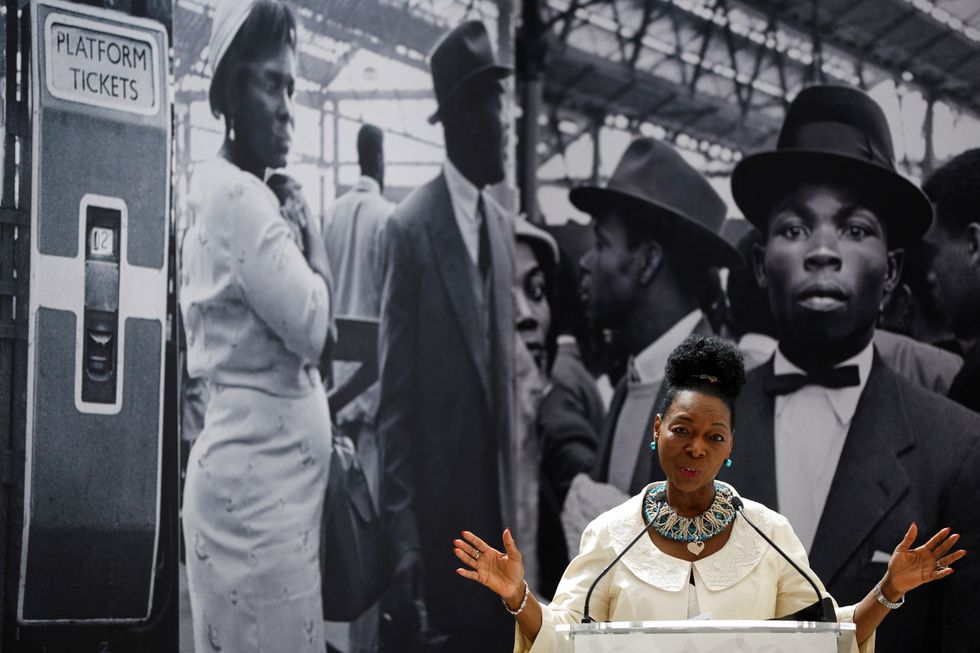

LONDON, ENGLAND - JUNE 22: Baroness Floella Benjamin speaks during the unveiling of the National Windrush Monument at Waterloo Station on June 22, 2022 in London, England. The photograph in the background is by Howard Grey. (Photo by John Sibley - WPA Pool/Getty Images)

LONDON, ENGLAND - JUNE 22: Baroness Floella Benjamin speaks during the unveiling of the National Windrush Monument at Waterloo Station on June 22, 2022 in London, England. The photograph in the background is by Howard Grey. (Photo by John Sibley - WPA Pool/Getty Images)

Ed Sheeran and Arijit Singh

Ed Sheeran and Arijit Singh Aziz Ansari’s Hollywood comedy ‘Good Fortune’

Aziz Ansari’s Hollywood comedy ‘Good Fortune’ Punjabi cinema’s power-packed star cast returns in ‘Sarbala Ji’

Punjabi cinema’s power-packed star cast returns in ‘Sarbala Ji’ Mahira Khan

Mahira Khan ‘Housefull 5’ proves Bollywood is trolling its own audience

‘Housefull 5’ proves Bollywood is trolling its own audience Brilliant indie film ‘Chidiya’

Brilliant indie film ‘Chidiya’  John Abraham

John Abraham Hina Khan and her long-term partner Rocky Jaiswal

Hina Khan and her long-term partner Rocky Jaiswal  Shanaya Kapoor's troubled debut

Shanaya Kapoor's troubled debut Sana Yousuf

Sana Yousuf