CHANCELLOR Rachel Reeves could secure at least £10 billion annually through a significant overhaul of pension tax relief that would make the system less favourable to higher earners, a report from a thinktank has revealed.

The Fabian Society said that pension tax breaks have become increasingly costly for the government. The proposed reforms could address half of the £22bn deficit identified in the public finances by the chancellor, according to the Guardian analysis of the report.

Reeves has hinted at a stringent, revenue-raising budget set for 30 October but has committed to not increasing income tax, VAT, or national insurance.

Andrew Harrop, general secretary of the Fabian Society and author of the report, suggested that Reeves should consider reducing pension tax relief and redistributing it to ensure it is more equitable, particularly for lower and middle earners.

The report noted that tax relief on pension contributions amounted to £66bn in 2022-23, a 55 per cent increase since 2016-17. Although tax is eventually paid when individuals draw their pensions, this generated only £22bn for HMRC in 2023.

While higher and top-rate taxpayers made up 19 per cent of those paying taxes, they received an estimated 53 per cent of the pension tax relief in 2022-23. Additionally, only 35 per cent of the tax relief went to women.

Harrop pointed out that Reeves has several strategies to consider, any of which could potentially generate at least £10bn annually. One option is to introduce a flat rate of tax relief on pension contributions for both individuals and employers, replacing the current system where relief varies depending on an individual's tax band.

Another approach could involve imposing employee national insurance on employer pension contributions, with a compensatory higher government top-up on the initial £7,500 of annual pension savings.

Additionally, reducing the maximum tax-free lump sum to either £100,000 or 25 per cent of the pension value—down from the current allowance which can exceed £250,000—could also contribute to the revenue increase.

Another possibility is to apply inheritance tax and income tax to all inherited pensions to ensure a fairer taxation system. Finally, charging employee national insurance on private pension incomes, with exceptions for smaller pensions, could be an option if it results in the cancellation of the planned cut to winter fuel payments.

"Pension tax relief is costly and disproportionately benefits higher earners. It drains over £60bn from the exchequer annually, with more than half of this going to higher and top-rate taxpayers. Given the significant pressure on public finances, the UK cannot sustain such an expensive and poorly targeted system," Harrop was quoted as saying.

He added that Reeves needs to find ways to increase revenue while protecting family living standards and adhering to Labour's manifesto commitments. Introducing reforms to pension tax relief as part of her October budget could save money and shift taxpayer support from wealthier individuals to low and middle earners.

Other measures Reeves is reportedly considering include raising additional revenue from capital gains tax and inheritance tax, which would impact those with higher incomes.

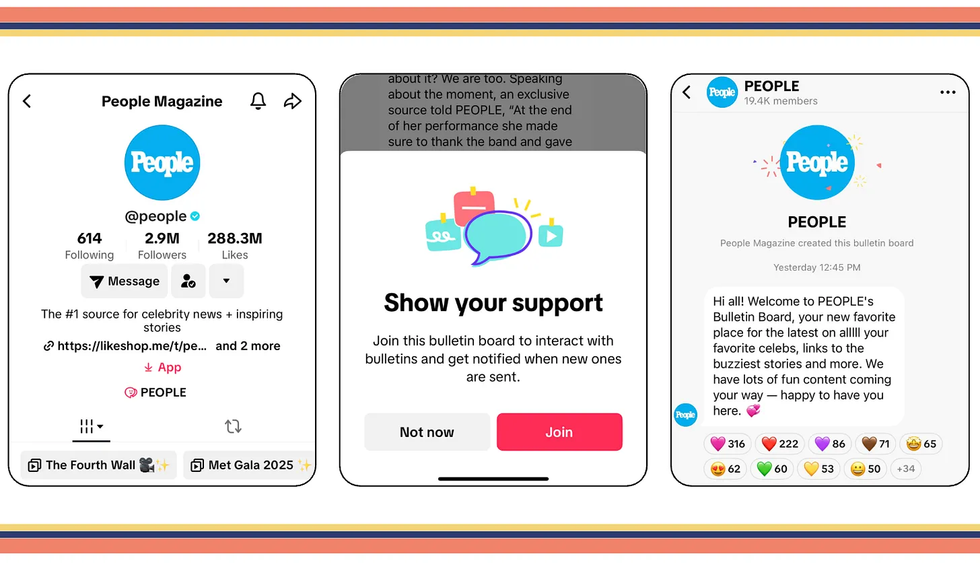

People's Bulletin boardICYMI

People's Bulletin boardICYMI