INDIAN shares fell for the fifth consecutive session on Friday, marking their worst weekly performance in more than two years. Concerns over the growing conflict in the Middle East and rising foreign outflows weighed on investor sentiment.

The Nifty 50 index dropped by 0.93 per cent, closing at 25,014.6, while the S&P BSE Sensex fell 0.98 per cent to finish at 81,688.45. For the week, both benchmarks lost approximately 4.5 per cent, their steepest decline since June 2022, driven mainly by a 2 per cent drop on Thursday.

The escalating conflict in the Middle East raised fears that crude oil supplies from the region could be disrupted, pushing up prices. This is a concern for net oil-importing countries like India.

"Geopolitical landscape remains an active risk, with any further escalation potentially disrupting markets, leading to resurgence in inflation and prompting further correction," said Mahesh Patil, chief investment officer at Aditya Birla Sun Life Asset Management Company.

Analysts also linked the market decline to increased foreign selling. Thursday saw a record high in foreign outflows as investors shifted funds into China following its recent stimulus measures.

Except for metals, led by gains in JSW Steel after multiple brokerage upgrades, all major sectoral indexes posted weekly losses. Realty, auto, and energy were the hardest-hit sectors during the week.

Small and mid-cap stocks, which are more focused on the domestic market, fell 2.5 per cent and 3.2 per cent for the week, respectively.

Reliance Industries, the second-largest stock in the Nifty 50, dropped by 9.2 per cent this week, contributing significantly to the index's losses.

On Friday, Bajaj Finance declined by around 3 per cent, making it one of the top five losers on the Nifty 50. Jefferies noted that the non-banking financial company's pre-earnings report showed a slowdown in assets under management, with a 12 per cent sequential decline in new loan bookings.

Mahindra and Mahindra Financial Services fell by about 6.6 per cent after reporting a drop in disbursements for the September quarter.

(With inputs from Reuters)

Pedro Pascal addresses fan backlash over playing Reed Richards at 50Getty Images

Pedro Pascal addresses fan backlash over playing Reed Richards at 50Getty Images

Kangana Ranaut speaks on equality and her role as a ParliamentarianGetty Images

Kangana Ranaut speaks on equality and her role as a ParliamentarianGetty Images  Kangana Ranaut calls equality a flawed idea, claims it’s ruining work ethic in today’s youthGetty Images

Kangana Ranaut calls equality a flawed idea, claims it’s ruining work ethic in today’s youthGetty Images Kangana Ranaut says belief in equality has created a ‘generation of morons’ in viral Times Now interviewGetty Images

Kangana Ranaut says belief in equality has created a ‘generation of morons’ in viral Times Now interviewGetty Images Kangana Ranaut blames equality for entitlement culture, says no two people are equalGetty Images

Kangana Ranaut blames equality for entitlement culture, says no two people are equalGetty Images

Actress Bella Thorne and Charlie Puth attend the Y100's Jingle Ball 2016Getty Images

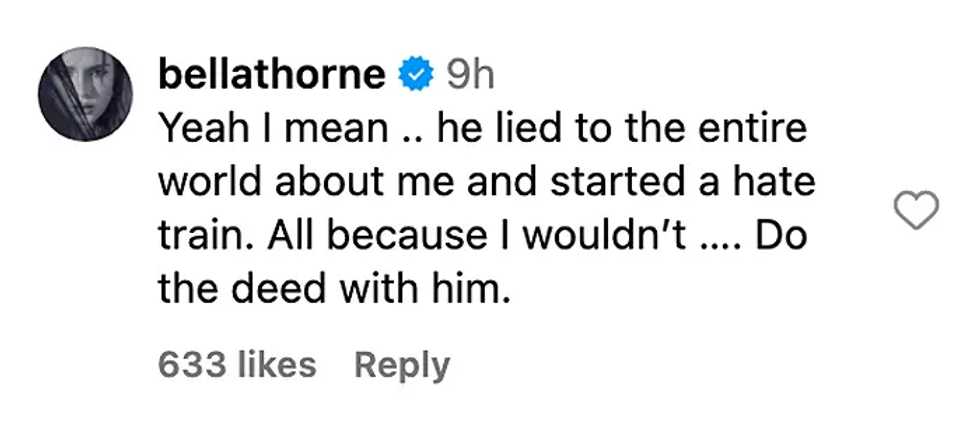

Actress Bella Thorne and Charlie Puth attend the Y100's Jingle Ball 2016Getty Images  Bella Thorne's commentInstagram Screengrab

Bella Thorne's commentInstagram Screengrab  Charlie Puth performs onstage at an interactive global eConcert liveGetty Images

Charlie Puth performs onstage at an interactive global eConcert liveGetty Images  Bella Thorne and Mark Emms attend a red carpet for the movie "Priscilla"Getty Images

Bella Thorne and Mark Emms attend a red carpet for the movie "Priscilla"Getty Images Charlie Puth and Brooke Sansone attend the 10th Breakthrough Prize CeremonyGetty Images

Charlie Puth and Brooke Sansone attend the 10th Breakthrough Prize CeremonyGetty Images