by CHARLES BOWMAN

Lord mayor of the City of London

AS LORD MAYOR of the City of London, and one of the principal ambassadors for the UK’s financial and professional services sector, this week I’m in India leading a delegation of UK start-ups on a hugely exciting visit which takes me to Mumbai, Bangalore and New Delhi.

The City of London Corporation that I represent is the governing body of the UK’s Square Mile, the historic centre of London that houses the world’s leading financial and professional services hub.

We are home to over 250 foreign banks, including the State Bank of India, which has been here for nearly 100 years. Every day nearly 500,000 people come to work in the City’s 24,000 businesses, alongside our just over 9,000 residents.

India is an important partner for the City, and we are home to more than 15 Indian financial services firms, and the world’s largest market for rupee-denominated masala bonds.

The City Corporation has a longstanding programme of work in India and opened a representative office in Mumbai 10 years ago. We work hand-in-hand with the UK government and the Indian High Commission in London on a number of programmes, including the Make in India Access India Programme, which works to support UK SMEs expanding into the country.

On my visit to India I’ve brought with me a delegation of some of the best and brightest financial technology companies that the UK has to offer.

Few will deny that India is on the cusp of a revolution in finance, with total financial transactions on retail digital payment platforms projected to explode by 400 per cent to `1 trillion by 2023. This is a huge jump from the current figure of `200 billion and shows just how quickly India’s expertise in ecommerce and mobile payments is developing.

But while the growth of firms like Paytm is impressive, and a welcome development of the Indian e-payments sector, there are still challenges to overcome – 40 per cent of the total population of India remain unbanked and more than 80 per cent of payments in India are still made by cash. There’s also room to build on India’s skills development in cyber security, insurance and regulation.

It’s here where the UK can lend support. We’re a world leader in the field of fintech, which contributes over £5bn to the UK economy each year, and in 2017, UK payment systems dealt with more than 21 billion transactions worth around £75tn. There are 76,500 fintech related jobs in the UK, a number which is set to grow beyond 100,000 by 2030.

Prime ministers Narendra Modi and Theresa May recognised the potential for technological cooperation when they launched the India-UK Tech partnership back in April. Fintech sits within this context, using the latest technology to address problems.

India is routinely among the top five investors in the UK. Currently, there are around 800 Indian businesses in the UK employing 110,000 people. One of the objectives of my visit is to encourage more Indian investment in the UK, be that in fintech, payments or banks – the City, as an international financial centre, is a one stop shop for all industry.

Let’s also not forget about recent developments in India that we should applaud. India Stack, the unified software platform behind Aadhaar, is an incredible achievement, as is the government’s push towards ensuring financial inclusion through its Digital India initiative. And the recent announcement to increase health coverage across the country is an initiative we will follow with keen interest.

Both our countries have much to gain from working together on financial technologies, and indeed, in other areas of financial services. As prime minister Modi stressed, the City of London is of “great importance to India”, and will remain so. I wholeheartedly agree and look forward to hearing how we can take our relationship to the next level.

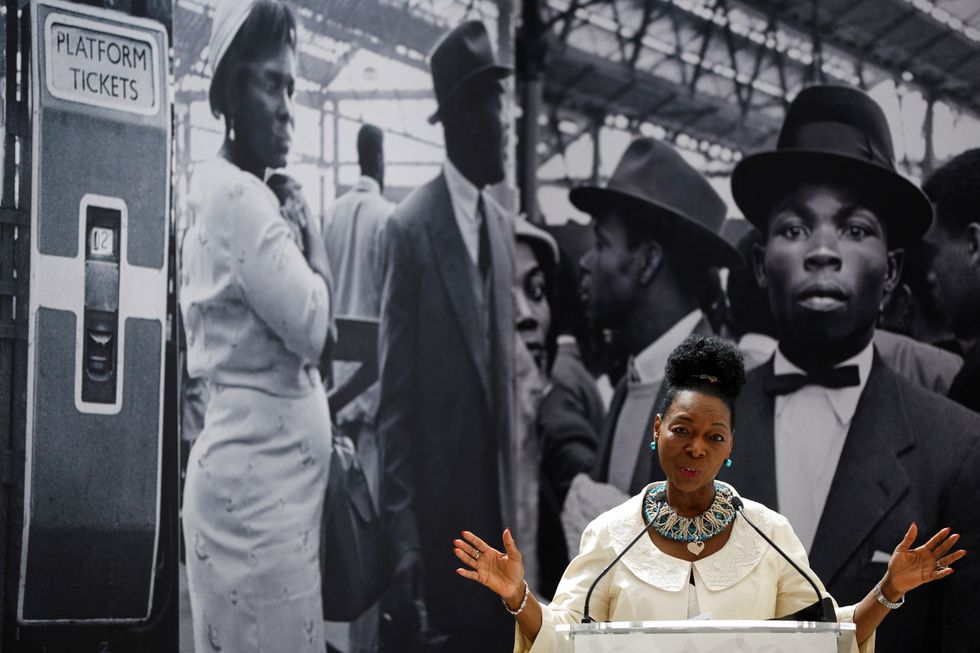

LONDON, ENGLAND - JUNE 22: Baroness Floella Benjamin speaks during the unveiling of the National Windrush Monument at Waterloo Station on June 22, 2022 in London, England. The photograph in the background is by Howard Grey. (Photo by John Sibley - WPA Pool/Getty Images)

LONDON, ENGLAND - JUNE 22: Baroness Floella Benjamin speaks during the unveiling of the National Windrush Monument at Waterloo Station on June 22, 2022 in London, England. The photograph in the background is by Howard Grey. (Photo by John Sibley - WPA Pool/Getty Images)

Ed Sheeran and Arijit Singh

Ed Sheeran and Arijit Singh Aziz Ansari’s Hollywood comedy ‘Good Fortune’

Aziz Ansari’s Hollywood comedy ‘Good Fortune’ Punjabi cinema’s power-packed star cast returns in ‘Sarbala Ji’

Punjabi cinema’s power-packed star cast returns in ‘Sarbala Ji’ Mahira Khan

Mahira Khan ‘Housefull 5’ proves Bollywood is trolling its own audience

‘Housefull 5’ proves Bollywood is trolling its own audience Brilliant indie film ‘Chidiya’

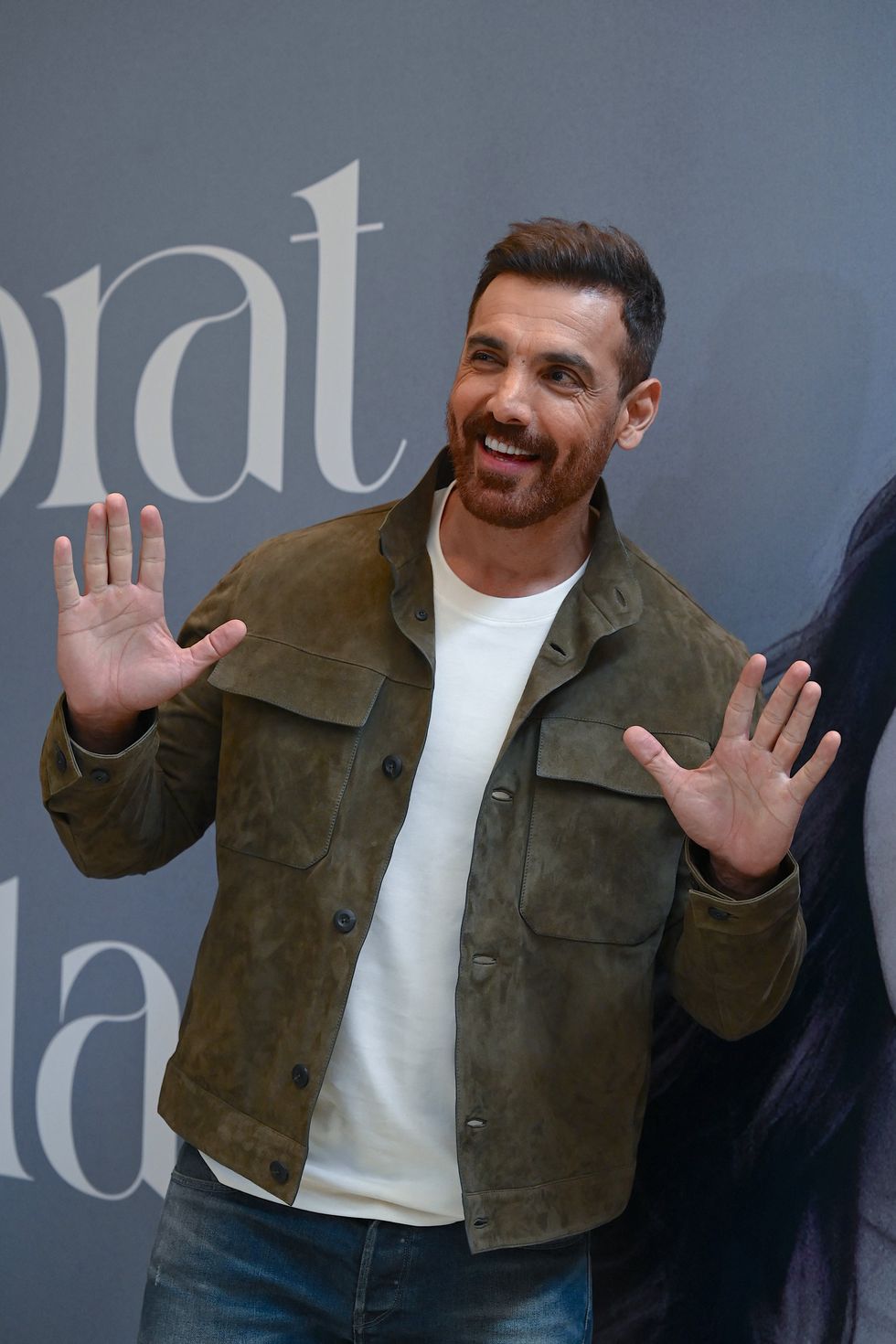

Brilliant indie film ‘Chidiya’  John Abraham

John Abraham Hina Khan and her long-term partner Rocky Jaiswal

Hina Khan and her long-term partner Rocky Jaiswal  Shanaya Kapoor's troubled debut

Shanaya Kapoor's troubled debut Sana Yousuf

Sana Yousuf