BRITISH firm Oxford Biomedica on Wednesday (22) said that Serum Institute of India (SII) will invest £50 million ($68m) in the company to help fund the development of a plant that manufactures Covid-19 shots.

Serum - the world's largest vaccine manufacturer by volume - and Oxford Biomedica both produce AstraZeneca's Covid-19 vaccine.

Serum Life Sciences Ltd, a unit of India-based SII, will pick up a 3.9 per cent stake in Oxford Biomedica as part of the deal.

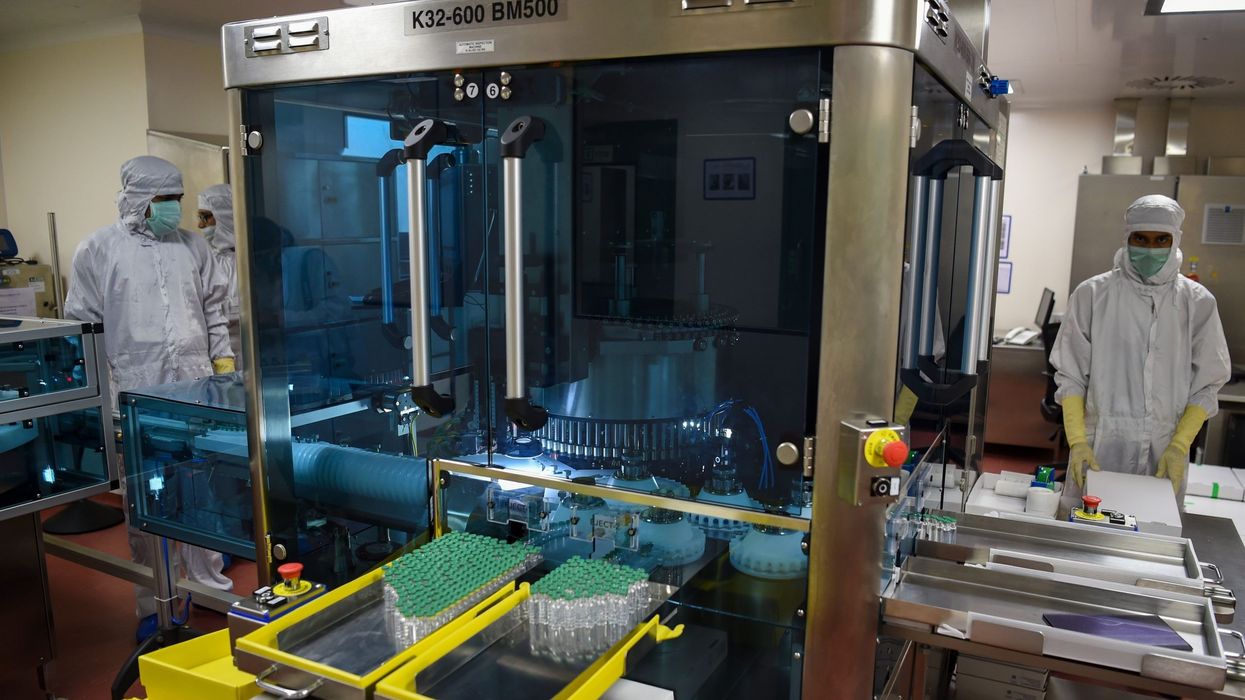

Oxford Biomedica, spun off from Oxford University in 1995, said it would use the funds to develop the fallow area at its Oxbox plant into a manufacturing space expected to come online in mid-2023.

The Oxbox plant currently makes Covid-19 shots, and the new space is expected to include a capacity to produce viral vector-based products including vaccines, Biomedica said.

Shares of the British firm were up 5 per cent on the London Stock Exchange on Wednesday.

Serum's investment comes four months after Oxford Biomedica doubled its sales estimates from the AstraZeneca shot to more than £100m by 2021-end.

A representative for SII did not immediately respond to Reuters' request for a comment.

For Serum, the deal is the second in as many weeks, following its planned purchase of a 15 per cent stake in Indian drugmaker Biocon's biologics unit.

The Oxford-based company said on Wednesday it swung to a profit after its half-yearly revenue more than doubled.

(Reuters)