PRIME MINISTER Boris Johnson will address lawmakers on Tuesday (7) on his plans to fix Britain's social care system, with many in his own party furious that he wants to pay for it by hiking taxes in a clear breach of his election pledges.

After splurging on the Covid-19 pandemic, Johnson is now trying to address Britain's creaking social care system, whose costs are projected to double as the population ages over the next two decades.

For years, British politicians have been trying to find a way to pay for social care, though successive Labour and Conservative prime ministers have ducked the issue because they feared it would anger voters and their own parties.

Johnson wants to raise the National Insurance (NI) tax paid by around 25 million working people to subsidise care for pensioners, including wealthy retirees, according to British media.

The prime minister will chair a cabinet meeting on Tuesday (7) morning and is afterwards expected to address parliament at around 1130 GMT. Johnson, his finance secretary Rishi Sunak and health minister Sajid Javid will then hold a news conference.

"We must act now to ensure the health and care system has the long-term funding it needs to continue fighting Covid and start tackling the backlogs, and end the injustice of catastrophic costs for social care," Johnson will tell parliament, according to extracts released by his office.

"My government will not duck the tough decisions needed to get NHS (National Health Service) patients the treatment they need and to fix our broken social care system."

Like many other Western leaders, Johnson is facing demands to spend more on welfare even though government borrowing has ballooned to 14.2 per cent of economic output - a level last seen at the end of World War Two.

For Johnson, who helped win the 2016 Brexit vote and then as prime minister presided over Britain's exit from the EU, fixing social care "once and for all" offers a possible way to broaden his domestic legacy.

In 2019, Johnson said he had a plan for social care and promised to prevent the elderly having to sell their houses to pay for care.

But his plan is a gamble.

Though Johnson won the biggest Conservative majority since Margaret Thatcher, many of the party's lawmakers worry his government lacks both a big-picture reform plan for the United Kingdom and the talent to implement one.

TAX RISE

Although the next national election is not due until 2024, many Conservatives say that raising taxes will hurt their positioning as the party of low taxation.

"A tax rise suggests ministers are increasingly conscious that the country cannot live on fantasy money. That, at least, is to be welcomed," said William Hague, a former Conservative Party leader.

"The reality of reduced take home pay to deal with a problem out of sight of most people will be unwelcome when it bites," Hague said, adding that fringe parties would benefit from the tax rise.

Johnson's office and the finance ministry have repeatedly refused to detail financing plans, but British media have reported that the prime minister wants to raise NI, paid by working people and employers.

Many Conservative lawmakers worry this will hurt younger, low-income workers and breach his 2019 election guarantee not to raise the tax.

The alternatives to raising national insurance are increasing income tax or imposing a wealth tax of some kind.

Under the current care system, anyone with assets over £23,350 ($32,305) pays for their care in full. This can lead to spiralling costs and the complete liquidation of someone's assets.

The Telegraph newspaper said lawmakers could face a snap vote on the social care plans later this week.

(Reuters)

Daniel Craig poses as James BondGetty Images

Daniel Craig poses as James BondGetty Images  James Bond casting shortlist revealed with Tom Holland Jacob Elordi and Harris Dickinson in leadGetty Images

James Bond casting shortlist revealed with Tom Holland Jacob Elordi and Harris Dickinson in leadGetty Images Is this the youngest James Bond yet as Tom Holland Harris Dickinson and Jacob Elordi lead casting rumoursGetty Images

Is this the youngest James Bond yet as Tom Holland Harris Dickinson and Jacob Elordi lead casting rumoursGetty Images

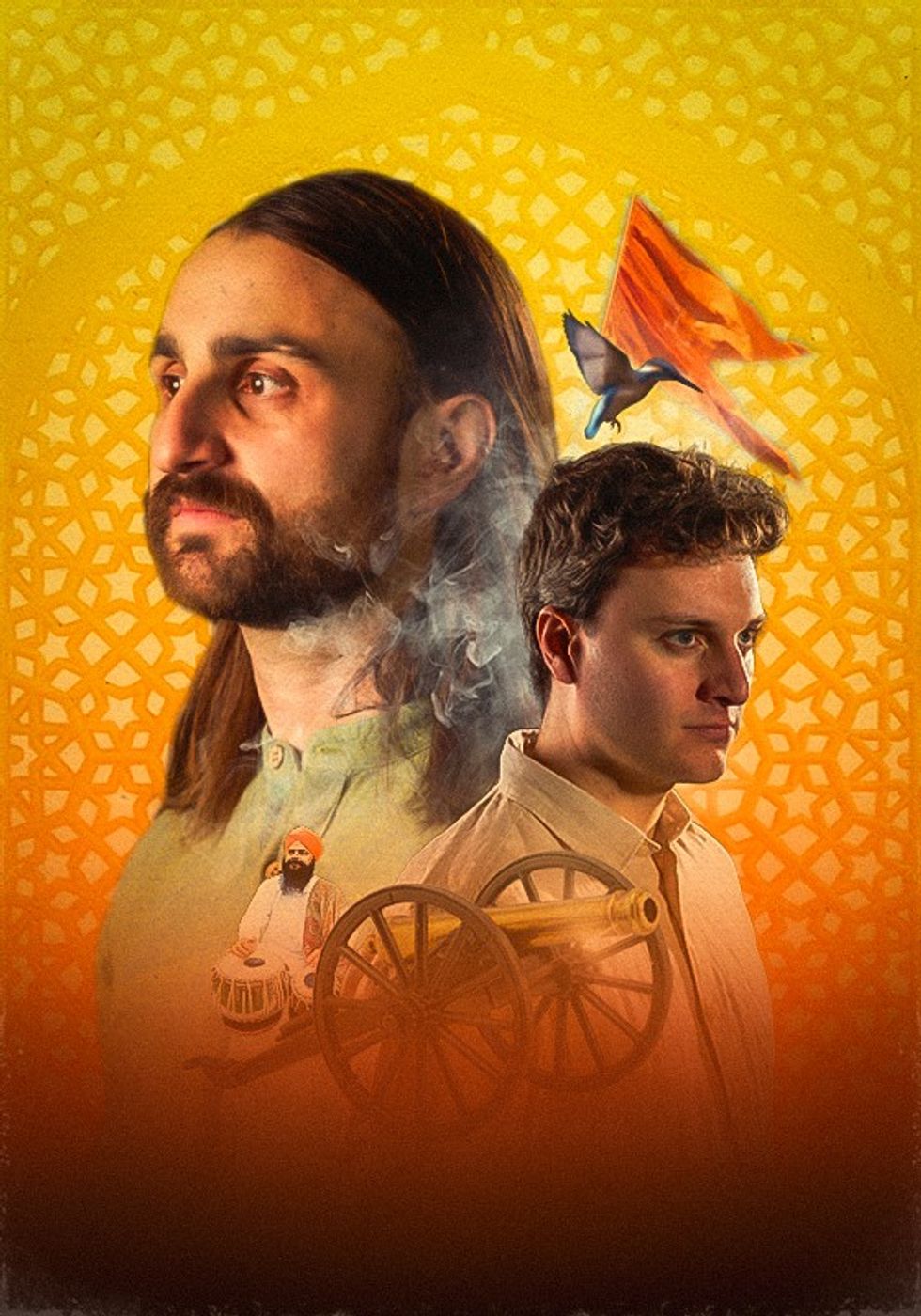

An explosive new play that fuses biting satire, history and heartfelt storytellingPleasance

An explosive new play that fuses biting satire, history and heartfelt storytellingPleasance

Police may probe anti-Israel comments at Glastonbury