By Bina Mehta

Partner and chair of KPMG UKMUCH of my time at KPMG has been spent in corporate finance and restructuring which, together with three overseas moves to India, the US and Canada, have made for an exciting and varied career.

My international experience and financing expertise have led me to head up the broader trade and investment agenda and, more recently, to supporting entrepreneurs, in particular, fast-growth technology businesses.

The UK today finds itself with a myriad of new trading relationships which also influence the foundations for inward investment opportunities – particularly for our fast-growth, innovative businesses. Attracting investment and access to new emerging markets are integral to their growth.

KPMG’s latest Venture Pulse report highlighted a record amount of investment in 2020, with more than £11.7 billion of venture capital going into UK scale-up businesses. I expect that to continue as the UK nurtures globally relevant innovators in sectors such as clean tech, health tech and fin tech. The UK continues to lead, with six of the 10 largest European deals in the final quarter of 2020 involving UK scale-ups, and the chancellor is expected to put this exciting sector centrestage in his budget.

There are rumours of a fresh UK visa scheme to help tech firms attract more global talent, and investment of £375 million in fast-growing UK technology companies, as part of an initiative called Future Fund: Breakthrough. Working with fast-growth, scale-up businesses has also shone a spotlight on under-represented talent, some of whom have been included in the Top 100 Asians in Tech.

I have met some truly inspirational entrepreneurs, and have taken great pleasure in working with female founders. There is still a long way to go to ensure we get investment to these important and dynamic female-led businesses.

As a member of the HM Treasury and BEIS co-sponsored Council for Investing in Female Entrepreneurs, I recently contributed to a report, written by investors for investors, which offers guidelines on diversity and inclusion in the investment industry. The best practice guidelines have been designed to help increase investment in under‐represented founders and drive diversity and returns across the investment sector.

It came about following Alison Rose’s Review of Female Entrepreneurship which found that only 13 per cent of senior people on UK investment teams are women, and almost half (48 per cent) of investment teams have no women at all. Fewer than one per cent of UK venture funding goes to all-female teams.

Encouraging the investment community to support our under‐represented entrepreneurs and business founders could provide a massive boost to the UK economy. There is a huge amount of talent to be unlocked from focusing on widening diversity across the investment community and beyond.

As we now look to be turning the corner from the pandemic, the next 12 months are set to be challenging. Our fast-growth businesses will play a vital role as the UK looks to re-skill its workforce and continue to be world-leading in trade, innovation, creativity and finance.

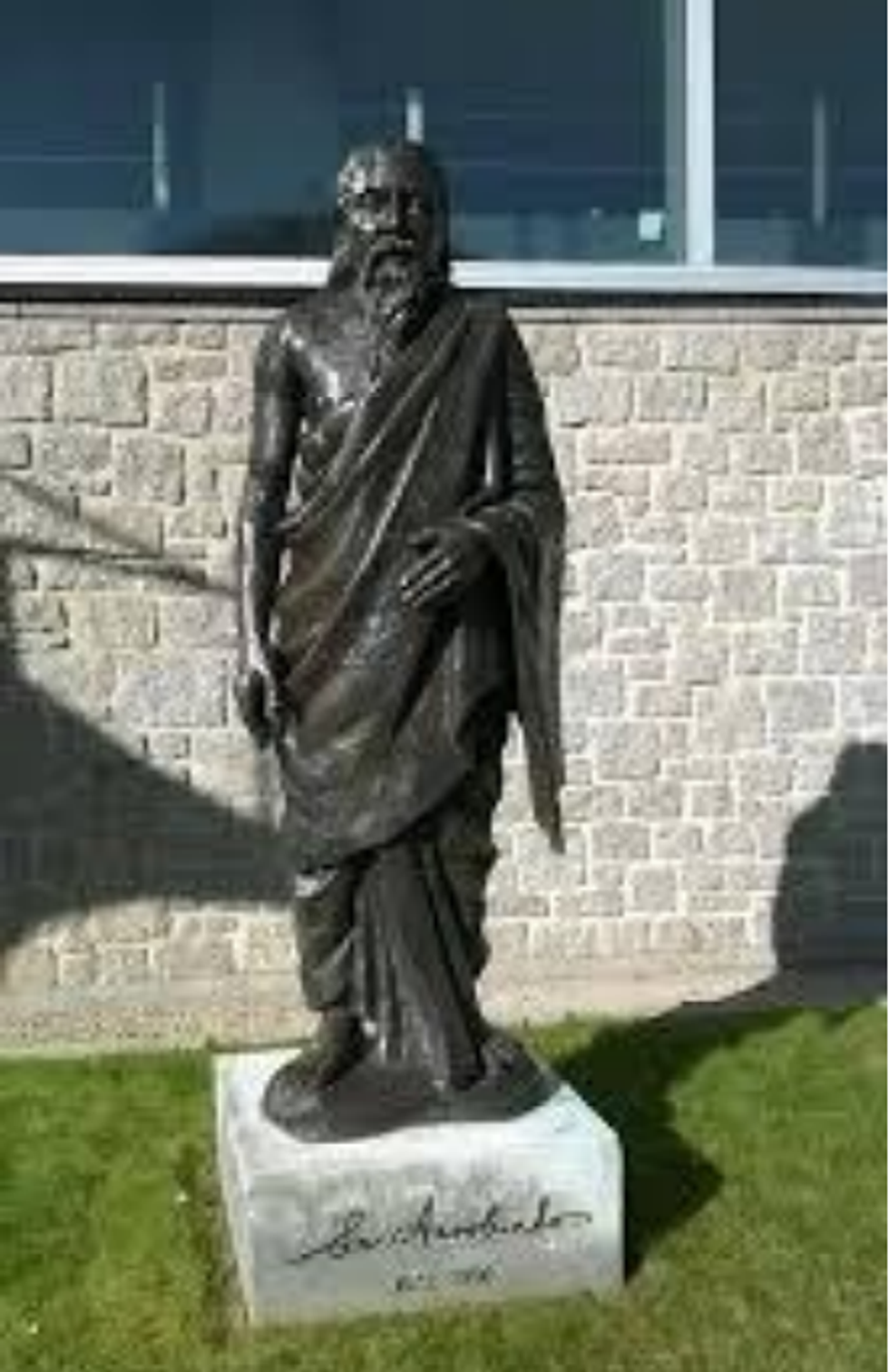

Heehs describes two principal approaches to biographyAMG

Heehs describes two principal approaches to biographyAMG

David Beckham wearing a David Austin Roses "King's Rose" speaks with King Charles III during a visit to the RHS Chelsea Flower Show at Royal Hospital Chelsea on May 20, 2025Getty Images

David Beckham wearing a David Austin Roses "King's Rose" speaks with King Charles III during a visit to the RHS Chelsea Flower Show at Royal Hospital Chelsea on May 20, 2025Getty Images

‘Investing in inclusion will boost UK economy’