BESTWAY Wholesale is marking its 50th anniversary in 2025. Founded in 1975, the company opened its first warehouse in Acton, West London, and has since grown into one of the UK’s largest independent wholesalers.

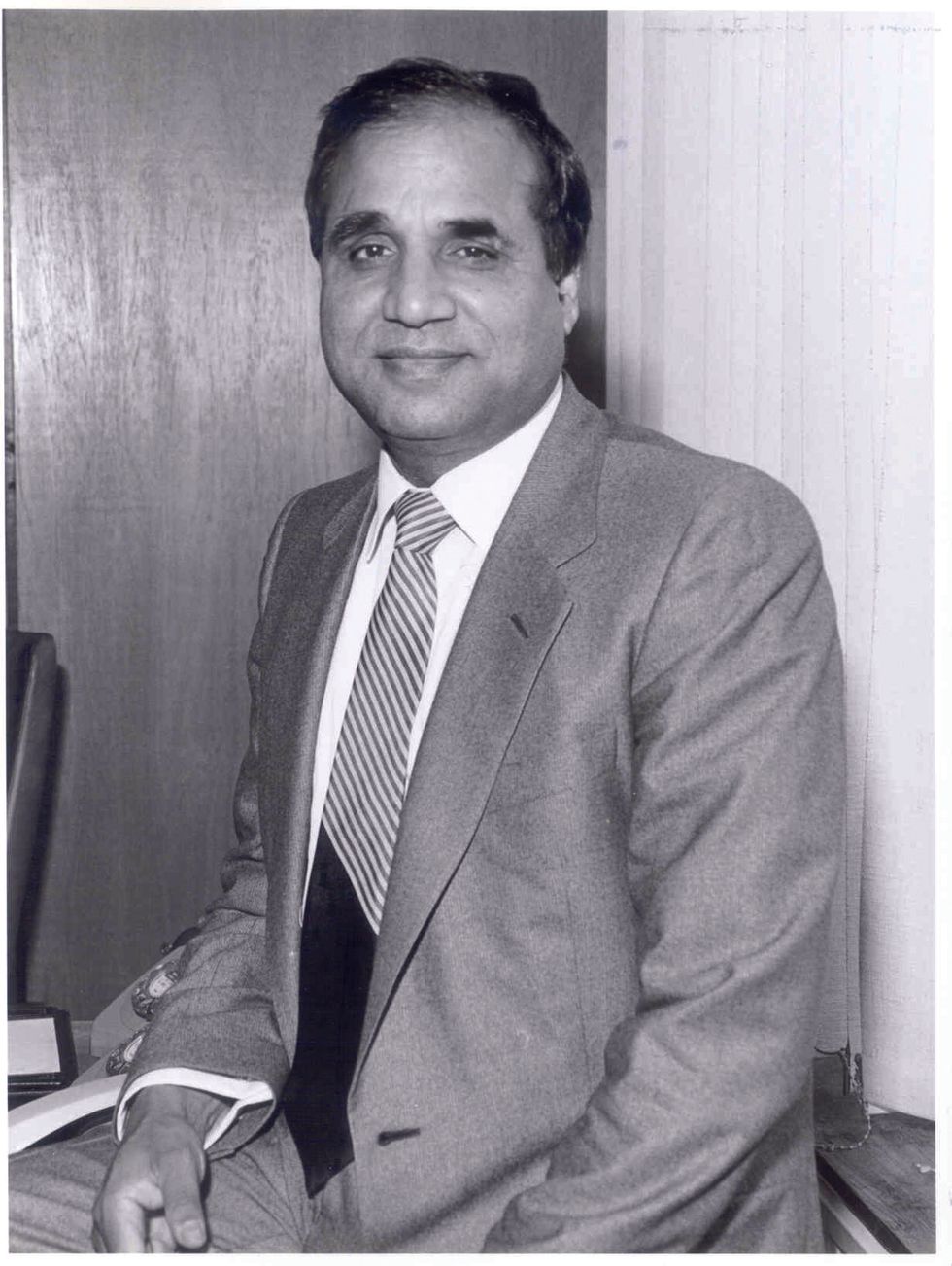

The business was started by Sir Anwar Pervez. He was awarded a knighthood in 1999 for his contributions to the food wholesale sector. Under his leadership, Bestway achieved £12 million in turnover within its first 18 months, launched the best-one symbol group in 2002, acquired Batley’s in 2005, Costcutter Supermarkets Group in 2020, and Adams Foodservice in 2024.

Managing Director Dawood Pervez said: “It’s incredible to reflect on how far we’ve come – from modest beginnings to becoming one of the UK’s leading wholesalers. This milestone – celebrating half a century in business – is a testament to the hard work, integrity, and entrepreneurial spirit that runs through the business.

“My father’s vision was simple but powerful: to offer greater value through lower prices and better availability – a mission that remains at the core of everything we do today.

“He created a business that is an engine for social mobility and an opportunity for migrant communities seeking to build a life in the UK – offering them purpose, a path to prosperity, and the chance to add lasting value to British society.”

Pervez added: “Thanks to the vision of my father and his family partners, the business rapidly grew through both organic development and strategic acquisitions. Today, we are proud to be the 7th largest family-owned business in the UK and the 13th largest privately owned company.”

Bestway began its anniversary year in January with its annual ‘Thank You’ campaign, offering deals on products in-store and online. It includes 50 weekly trade campaigns with offers, discounts, competitions and promotions. These will conclude in December with a Christmas-themed promotion featuring 50 one-day festive deals.

A celebration event is scheduled for July at the Royal Albert Hall, hosted by Sir Anwar Pervez and Lord Choudrey. Supplier partners supporting the campaign include Coca-Cola Euro Pacific, Cadbury’s, Red Bull, Carlsberg, Heineken, Mars Wrigley, Walkers, Budweiser Brewing Group, and others.