BARCLAYS on Tuesday (24) unveiled a 16-per cent drop in net profit for the third quarter on souring loans and rising costs, and flagged more cutbacks ahead.

Profit after tax slid to £1.3 billion in the June-September period, down from £1.5 bn in the third quarter last year, Barclays said in a statement.

Pretax profit dipped four per cent to £1.9 bn, but revenues climbed five per cent to £6.3 bn on higher interest rates.

However, credit impairment charges set aside for expected bad loans reached £433 million, hit partly by rising rates and weaker house prices. That compared with £381m a year earlier.

Income from corporate and investment banking fell six per cent as financial markets volatility led to lower customer activity.

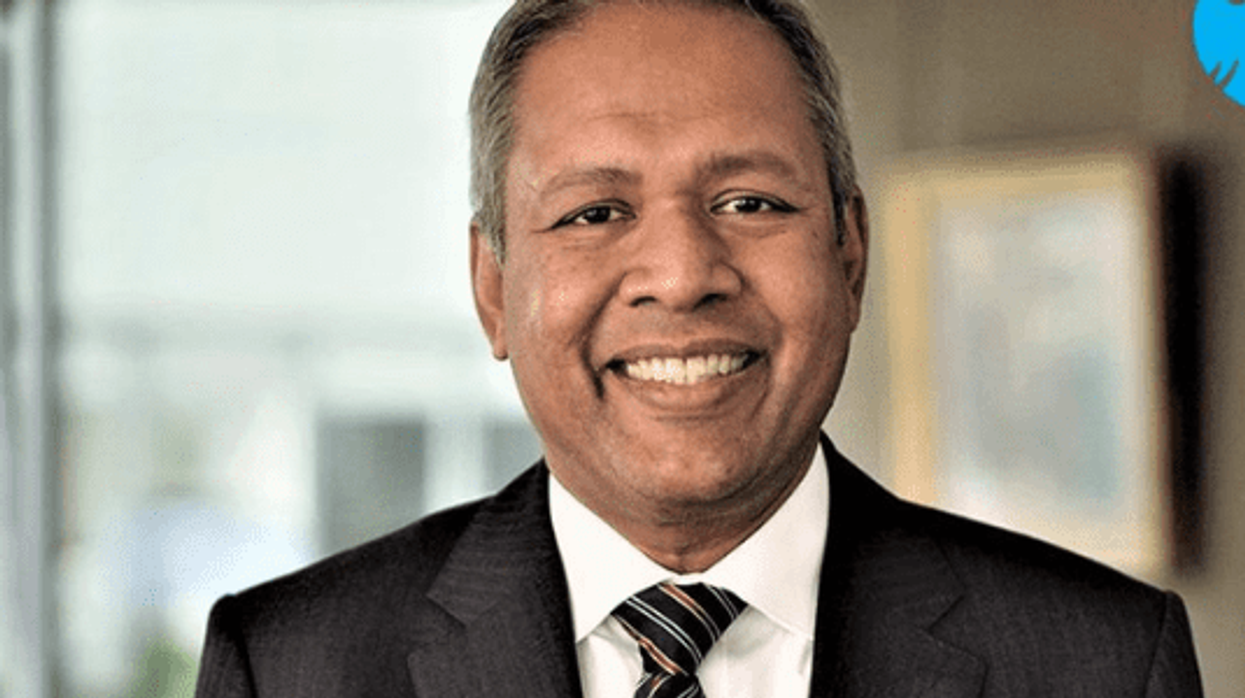

Barclays chief executive CS Venkatakrishnan said in a statement that the lender was managing credit well and remained "disciplined" on costs.

"We see further opportunities to enhance returns for shareholders through cost efficiencies and disciplined capital allocation across the group," he added.

(AFP)

Barclays profit hit by costs, impairments

Chief executive CS Venkatakrishnan says the lender is managing credit well