THE Bank of England on Thursday (7) said it was cutting its key interest rate further after UK inflation hit a three-year low and signalled more reductions.

As widely expected, the BoE trimmed borrowing costs by 25 basis points to 4.75 per cent at a regular policy meeting, its second reduction since August. The US Federal Reserve is set to reduce rates later in the day.

"We have been able to cut interest rates again" after UK annual inflation fell below the BoE's target, the central bank's governor Andrew Bailey said in a statement.

The Consumer Prices Index in Britain stands at 1.7 per cent, the lowest level since 2021 and below the two-per cent target.

"We need to make sure inflation stays close to target, so we can't cut interest rates too quickly or by too much," Bailey cautioned.

"But if the economy evolves as we expect it's likely that interest rates will continue to fall gradually from here."

Major central banks started this year to cut interest rates that had been hiked in efforts to tame inflation, which had soared following the end of Covid lockdowns and Russia's invasion of Ukraine.

Sweden's central bank slashed borrowing costs by 0.5 basis points Thursday -- its fourth this year and biggest reduction in a decade -- while Norway made no change.

The Fed is later expected to trim by 25 basis points in a decision unlikely to have been influenced by Donald Trump's return to power, according to analysts.

The BoE update follows a maiden budget last week from the new Labour government that featured tax rises and increased borrowing.

In August, the BoE reduced it key rate for the first time since early 2020, from a 16-year high of 5.25 per cent as UK inflation returned to normal levels.

But it decided against a second reduction in a row in September. There was no October meeting.

The BoE hiked borrowing costs 14 times between late 2021 -- when they stood at a record-low 0.1 per cent -- and the second half of last year.

(AFP)

Pedro Pascal addresses fan backlash over playing Reed Richards at 50Getty Images

Pedro Pascal addresses fan backlash over playing Reed Richards at 50Getty Images

Kangana Ranaut speaks on equality and her role as a ParliamentarianGetty Images

Kangana Ranaut speaks on equality and her role as a ParliamentarianGetty Images  Kangana Ranaut calls equality a flawed idea, claims it’s ruining work ethic in today’s youthGetty Images

Kangana Ranaut calls equality a flawed idea, claims it’s ruining work ethic in today’s youthGetty Images Kangana Ranaut says belief in equality has created a ‘generation of morons’ in viral Times Now interviewGetty Images

Kangana Ranaut says belief in equality has created a ‘generation of morons’ in viral Times Now interviewGetty Images Kangana Ranaut blames equality for entitlement culture, says no two people are equalGetty Images

Kangana Ranaut blames equality for entitlement culture, says no two people are equalGetty Images

Actress Bella Thorne and Charlie Puth attend the Y100's Jingle Ball 2016Getty Images

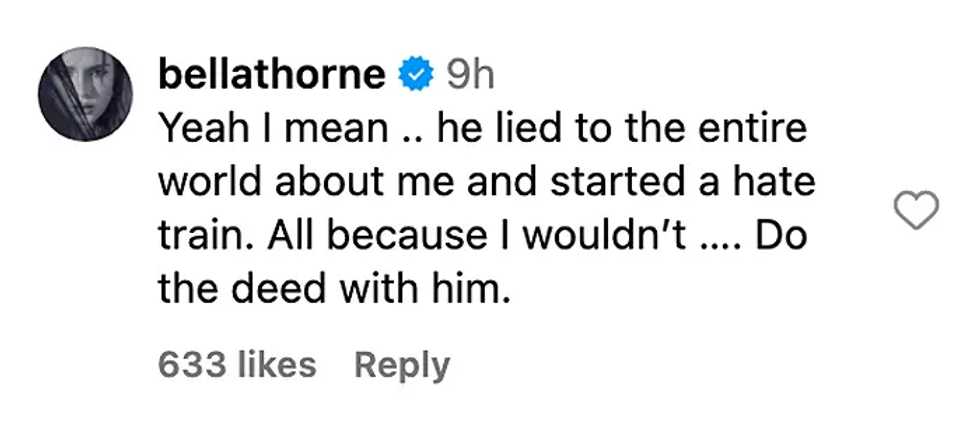

Actress Bella Thorne and Charlie Puth attend the Y100's Jingle Ball 2016Getty Images  Bella Thorne's commentInstagram Screengrab

Bella Thorne's commentInstagram Screengrab  Charlie Puth performs onstage at an interactive global eConcert liveGetty Images

Charlie Puth performs onstage at an interactive global eConcert liveGetty Images  Bella Thorne and Mark Emms attend a red carpet for the movie "Priscilla"Getty Images

Bella Thorne and Mark Emms attend a red carpet for the movie "Priscilla"Getty Images Charlie Puth and Brooke Sansone attend the 10th Breakthrough Prize CeremonyGetty Images

Charlie Puth and Brooke Sansone attend the 10th Breakthrough Prize CeremonyGetty Images