Highlights

- Media Land "bulletproof" hosting service enabled attacks on UK telecoms and businesses.

- Cyber-attacks cost British economy £14.7 bn in 2024, accounting for 0.5 per cent of GDP.

- Ringleader Alexander Volosovik linked to notorious groups including Evil Corp and LockBit.

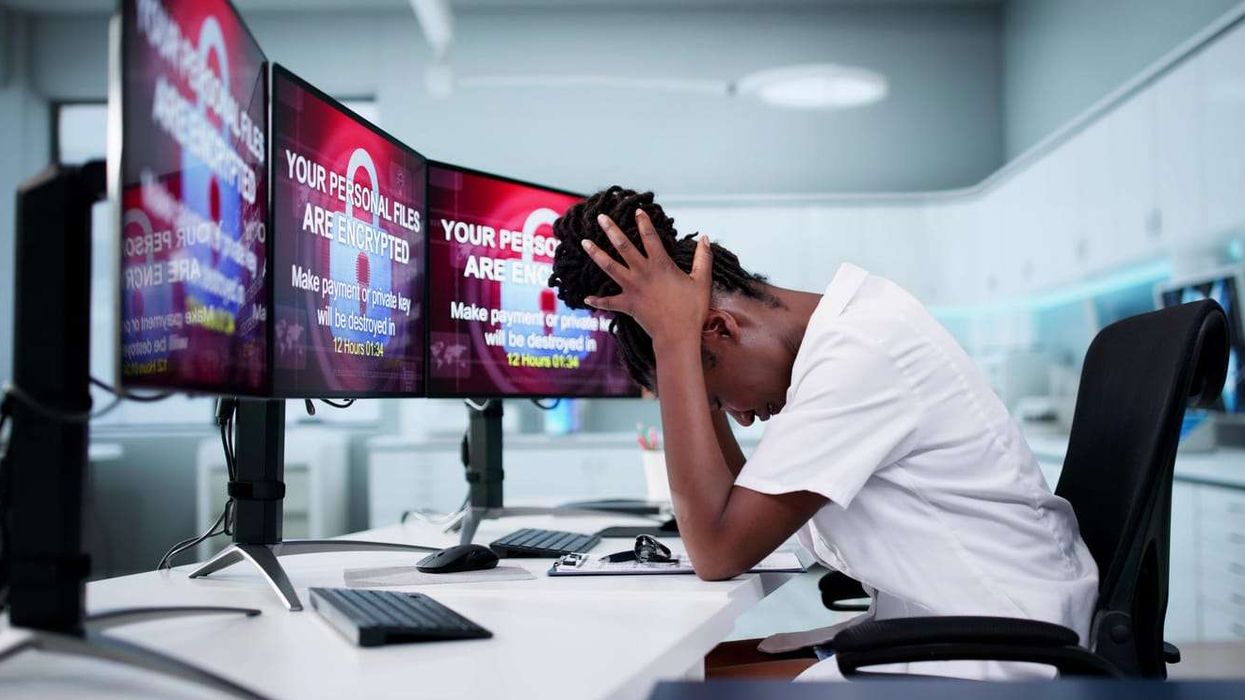

The coordinated action with the US and Australia targets Media Land, one of the world's most significant "bulletproof" hosting providers, shadowy online networks that allow cyber criminals to operate ransomware, phishing, and malware campaigns with perceived impunity.

Cyber attacks cost British businesses £14.7bn in 2024, accounting for 0.5 per cent of GDP and growing every year.

"Cyber criminals think that they can act in the shadows, targeting hard working British people and ruining livelihoods with impunity," Cooper said. "But they are mistaken, together with our allies, we are exposing their dark networks and going after those responsible."

Russia under Putin has become a haven for these cyber criminals, nurturing a murky criminal network closely linked to the Kremlin

Major blow to Russian cyber ecosystem

The sanctions directly target Media Land's ringleader Alexander Volosovik, known online as Yalishanda, who has operated in the cyber underground since at least 2010.

Intelligence shows Volosovik has collaborated with some of the world's most notorious cybercrime groups, including Evil Corp, LockBit, and Black Basta.

Cyber criminals using Media Land's services have attacked UK telecommunications infrastructure and launched malware campaigns targeting British taxpayers. Evil Corp also targeted health, government, and public sector institutions across Britain.

The UK also sanctioned Aeza Group LLC, another "bulletproof" provider found to be supporting Russia's Social Design Agency, a disinformation operation previously sanctioned by Britain in 2024 for attempts to destabilise Ukraine and undermine democracies worldwide.

Building on previous crackdowns

Today's action builds on Britain's October 2024 sanctions against 16 members of Evil Corp, a prolific Russian hacker group with strong ties to the FSB and Russian military intelligence.

That operation, also coordinated with the US and Australia, targeted the group's leader Maksim Yakubets, who has a $5 m US bounty on his head.

Earlier this year, Britain sanctioned Dmitry Khoroshev, leader of the LockBit ransomware group, in another trilateral action with Australia and the United States. The National Crime Agency collaborated with international law enforcement on investigations, demonstrating Britain's commitment to using the full range of government tools against cybercrime.