Highlights

- Uber rewrites driver contracts to avoid VAT on most UK fares outside London.

- London passengers will pay 20 per cent VAT on rides under Transport for London rules.

- Treasury's £700m annual tax protection estimate now uncertain following Uber's restructuring.

Uber has circumvented paying millions of pounds in tax to the UK government after rewriting contracts with its drivers, following new following the new "taxi tax" VAT rules introduced in chancellor Rachel Reeves's November budget.

The American ride-hailing company has restructured its business model outside London to operate as an agent rather than a supplier of transport services, effectively avoiding the 20 per cent VAT that would have applied to entire fares from January 2026.

Under the updated terms, drivers now contract directly with passengers, meaning they must charge VAT only if their annual bookings exceed £90,000.

Since most Uber drivers earn below this threshold, the majority of fares outside the capital will not attract the sales tax, preventing price increases for passengers.

London VAT divide

The changes do not apply in London, where Transport for London regulations prohibit the agency model. Consequently, passengers in the capital will pay VAT on their complete fares, making rides in London more expensive than elsewhere in Britain.

The move undermines the Treasury's projection that the VAT adjustment would protect approximately £700m in tax revenue annually.

Reeves announced the changes to Parliament in November, aiming to close what officials described as a "niche tax scheme" used by online minicab firms.

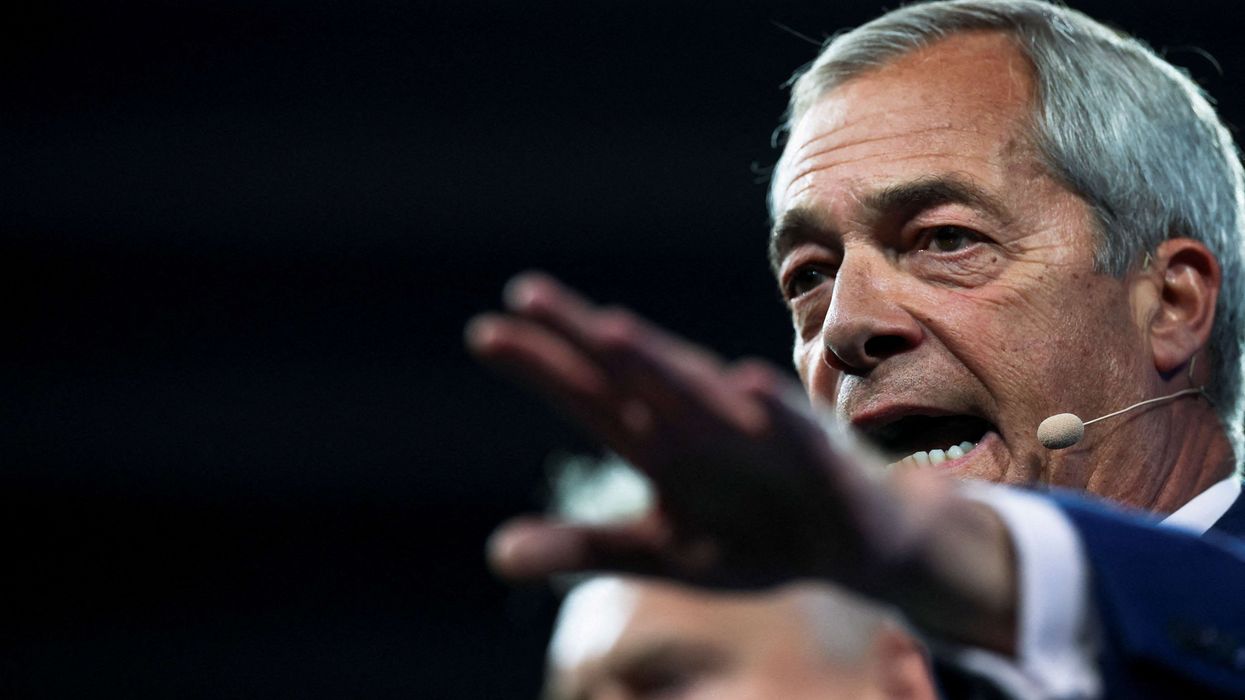

Andrew Brem, Uber's regional general manager for the UK, criticised the policy following the budget announcement, stating it would mean "higher prices for passengers in London, and less work for drivers, when people are already struggling with the cost of living."

Brem highlighted the inconsistency created by the rules, noting they establish "the absurd situation where a trip in London will be taxed at a different rate than a trip anywhere else in the UK."

A Treasury spokesperson defended the policy, saying it aims to benefit traditional taxi drivers through "a fairer tax system" while raising funds to support government priorities including reducing living costs, waiting lists, and national debt.

However, the Treasury declined to comment on whether Uber's contract restructuring would affect its £700m revenue protection estimate, leaving uncertainty over the policy's financial impact.