INDIA's Supreme Court on Wednesday (3) said the Adani Group does not need to face more investigations beyond the current scrutiny of the market regulator, a major relief for the conglomerate hit hard by a US short-seller's allegations of wrongdoing.

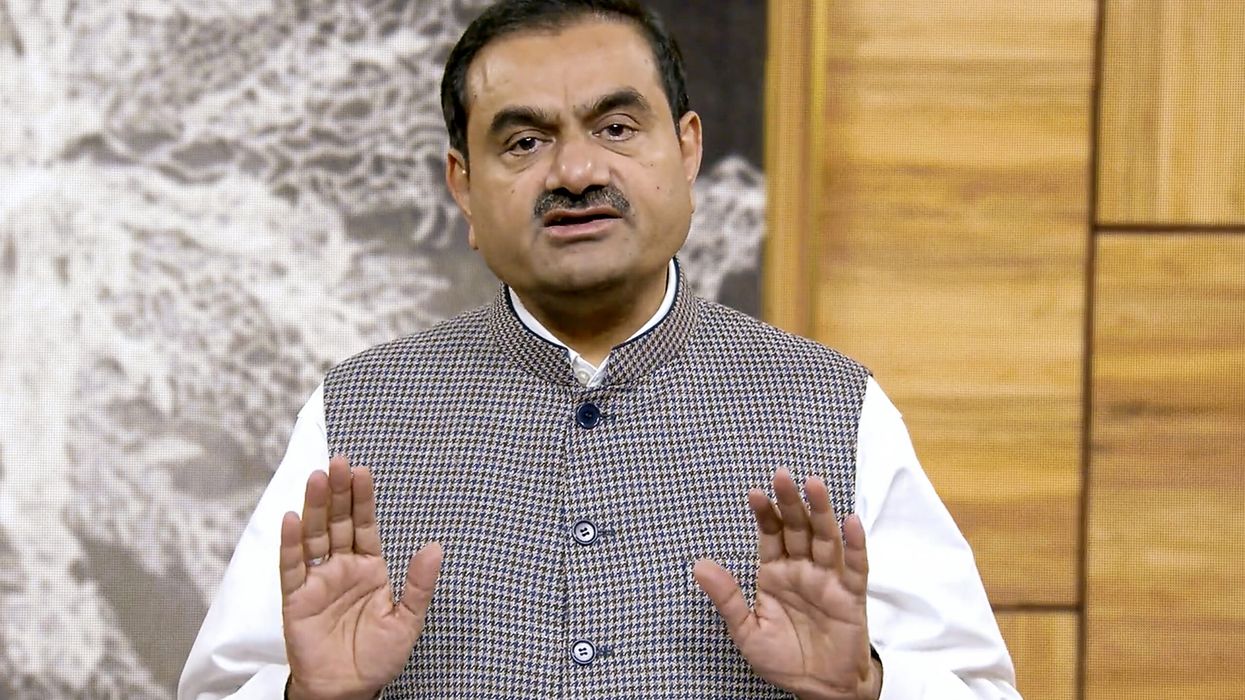

The Securities and Exchange Board of India (SEBI) has been probing the Adani group, led by billionaire Gautam Adani, after Hindenburg Research in January 2023 alleged improper use of tax havens and stock manipulation by the group.

The Adani Group denied those allegations, but Hindenburg's report still chopped £120 billion off its stock market value. Though some investor confidence returned in recent months as Adani won the backing of bankers and investors, the Hindenburg saga and the regulatory scrutiny have weighed on the group's business dealings and reputation.

The Supreme Court, which was ruling on cases brought by public interest litigants seeking a special investigation team to probe the matter, said "the facts of this case do not warrant" such a change, even though the court had the powers to transfer the investigation.

The verdict signals there will not be increased regulatory or legal risk on the Adani group beyond the current SEBI investigation.

Reflecting that view, shares of various Adani Group companies closed higher, with Adani Energy Solutions up 11.4 per cent, Adani Total Gas surging 10 per cent, Adani Green Energy jumping 5.8 per cent and the flagship business Adani Enterprises rising 2.4 per cent.

The court, which was overseeing the SEBI probe, also said there was no need for it to order any changes in the country's disclosure rules for offshore funds. Hindenburg had alleged Adani's offshore shareholders were used to violate certain SEBI rules, even though the company maintained it complies with all laws.

The regulator had previously informed the Supreme Court that it would take appropriate action based on the outcome of its investigations. The court on Wednesday gave SEBI three months to complete its probes.

India's opposition Congress party said in a statement the Supreme Court ruling was "extraordinarily generous to SEBI" by giving it more time. SEBI didn't respond to a request for comment.

Amid the Hindenburg fallout and ahead of India's 2024 election, political opponents have increased pressure on Prime Minister Narendra Modi's administration, accusing it of favouritism toward Adani in government decisions. Modi and Adani, who both are from western Gujarat state, have denied impropriety.

After the Supreme Court ruling, Gautam Adani said on social media platform X that the court's judgment shows truth has prevailed and the group's "contribution to India's growth story will continue."

Deven Choksey, managing director of KRChoksey Shares and Securities Pvt Ltd, said after the verdict "global investors will have more confidence in investing in the shares of the company".

Though Wednesday's ruling will bring some relief to Adani, the company still faces some challenges.

Politicians have been staging protests on Adani's plans to redevelop one of Asia's largest slums, Dharavi in Mumbai, amid allegations that Modi's allies gave it undue favours in allotting the overhaul contract.

Adani is separately also facing a federal investigation into alleged over-invoicing of coal imports. The company denies wrongdoing in both matters.

On Wednesday, the Supreme Court also said that it does not need to intervene in the current regulations governing offshore investors of Indian companies. SEBI tightened those regulations in June by making disclosures more stringent to bring clarity to opaque corporate structures.

Under Indian law, every company needs to have 25 per cent of its shares held by public shareholders to avoid price manipulation, but Hindenburg alleged that some of Adani's offshore shareholders were used to violate this rule. Adani has said it complies with all laws.

"The procedure followed in arriving at the current shape of the regulations does not suffer from irregularity," the court said in backing SEBI's regulatory position.

(Reuters)