INDIAN oil-to-telecoms giant Reliance Industries reported quarterly earnings that beat analyst estimates, helped by a strong recovery across its diversified businesses.

The conglomerate, which is owned by Asia's richest man, Mukesh Ambani, reported a net profit of Rs 36.8 billion ($1.8bn) between July and September, 43 per cent higher than the same period last year.

Revenues from operations increased 49 per cent year-on-year, aided by both its legacy energy business and newer ventures like retail.

"As the pandemic retreats, I am pleased that Reliance has posted a strong performance," chairman and managing director Ambani said in a statement following the results.

"This demonstrates the inherent strengths of our businesses and the robust recovery of the Indian and global economies. All our businesses reflect growth over pre-Covid levels," the billionaire added.

Revenues from the oil, gas and petrochemicals business -- which accounts for nearly 70 per cent of Reliance's total income -- jumped 58 per cent year-on-year, as global energy demand recovered.

Revenues from Reliance's retail business recovered more sharply than expected, rising 17.8 per cent compared to the previous quarter, which was badly hit by Covid-19.

Earlier this month, Reliance opened its first 7-Eleven convenience store in Mumbai, ahead of a "rapid rollout" planned across the country as the firm seeks to boost its retail presence in the country of 1.3 billion.

Ambani is locked in a high-stakes battle with Jeff Bezos, the world's richest man, as Amazon and Reliance fight for a share of India's massive e-commerce market.

The two firms are engaged in a row over Ambani's acquisition of domestic retail giant Future Group, which Amazon has sought to delay.

Earlier on Friday, a Singapore-based arbitration panel upheld a year-ago ruling to halt the $3.4-billion deal.

Reliance's multi-billion-dollar fortune has been powered by oil and petrochemicals businesses, but the company has diversified into areas including telecoms and retail in recent years.

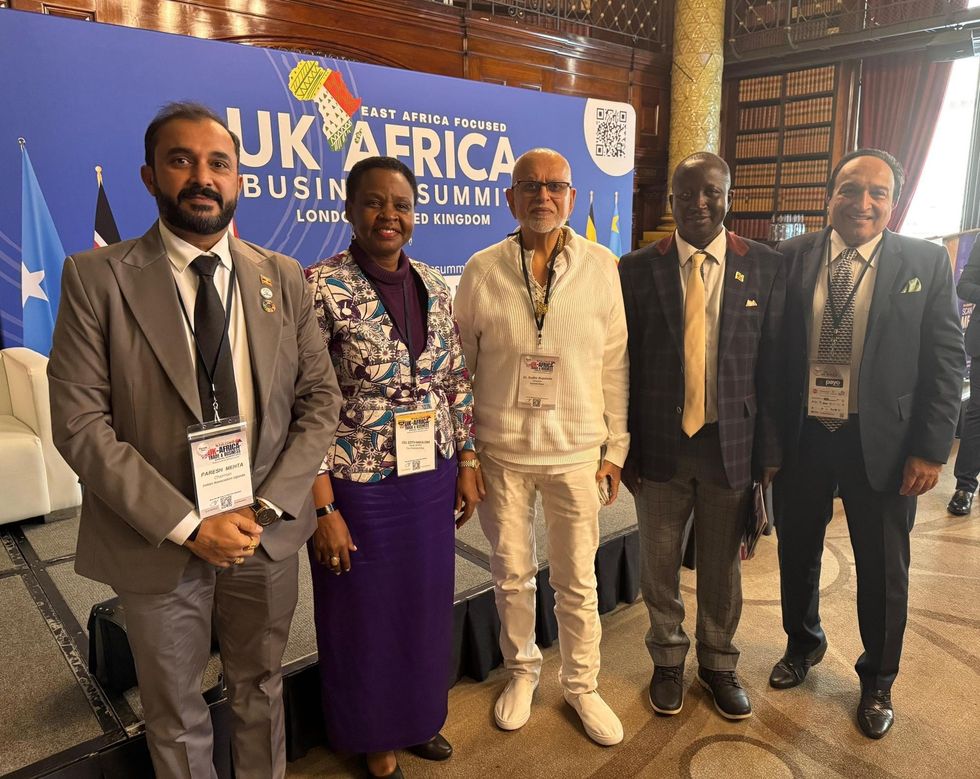

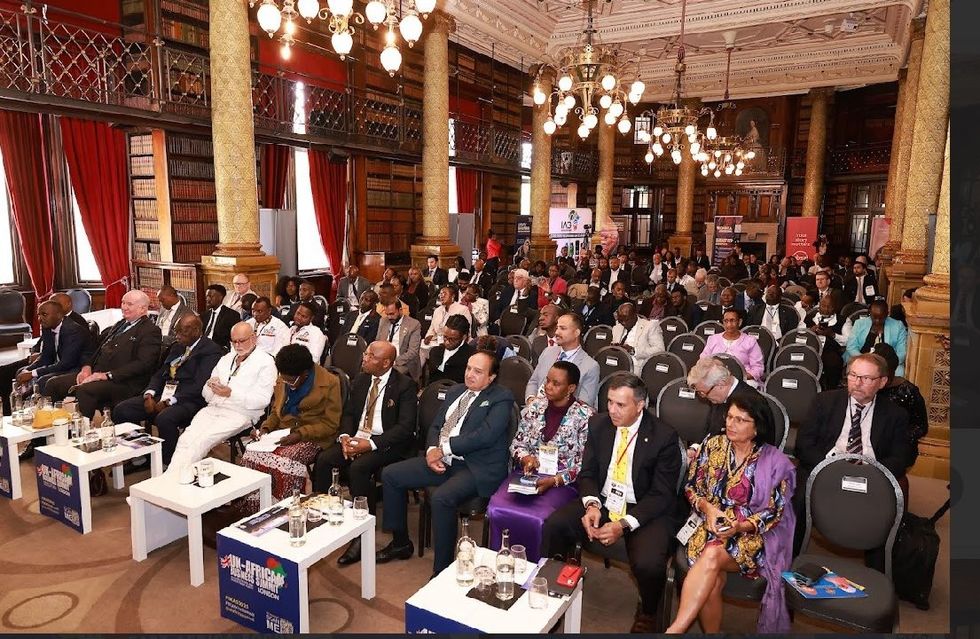

UK–Africa business summit 2025

UK–Africa business summit 2025  UK–Africa business summit 2025

UK–Africa business summit 2025 UK–Africa business summit 2025

UK–Africa business summit 2025 Spiritual leader Sant Trilochan Darshan Das Ji, head of Das Dharam-Sachkhand Nanak Dham, graced the summit as Honorary Chief Guest

Spiritual leader Sant Trilochan Darshan Das Ji, head of Das Dharam-Sachkhand Nanak Dham, graced the summit as Honorary Chief Guest UK–Africa business summit 2025

UK–Africa business summit 2025