Prime minister Theresa May’s government has no idea what to do about Brexit and Britain risks sowing serious political and economic uncertainty unless it makes its policy clear soon, a senior British lawmaker said.

The June 23 vote took many investors and chief executives by surprise, triggering the deepest political and financial turmoil in Britain since the Second World War and the biggest ever one-day fall in sterling against the dollar.

Britain’s allies fear that its exit from the EU could mark a turning point in post-Cold War international affairs that will weaken the West in relation to China and Russia, undermine efforts towards European integration and hurt global free trade.

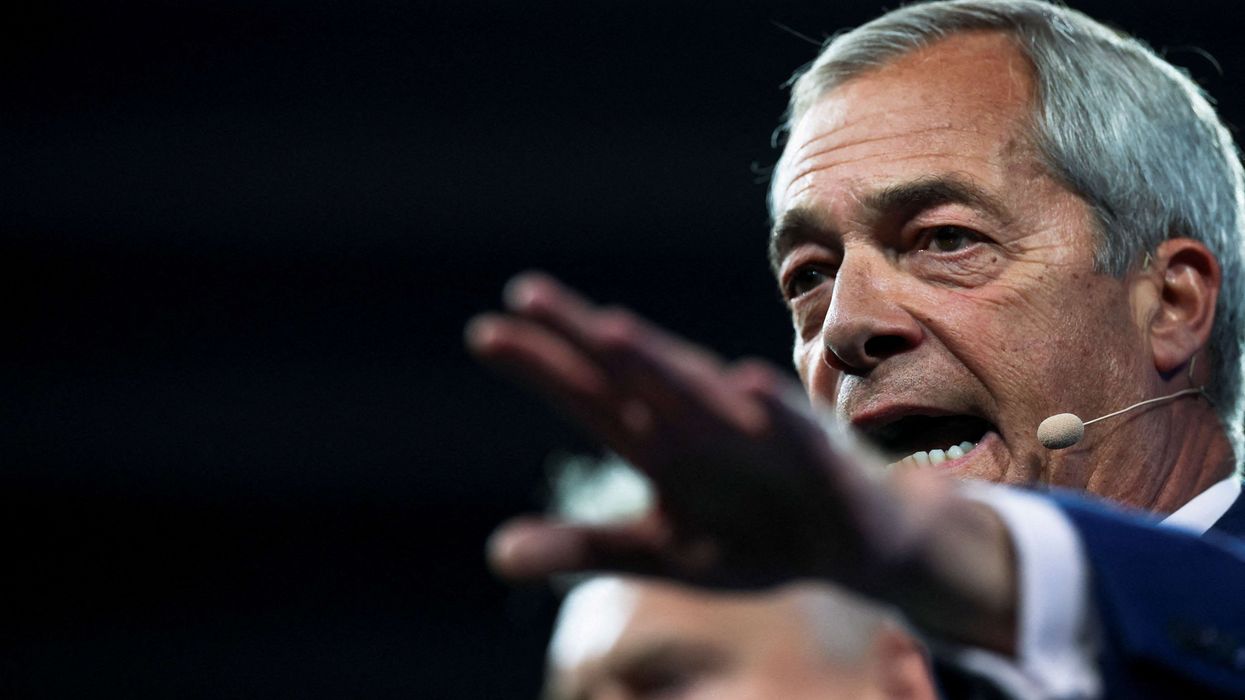

“Nobody in the government has the first idea of what they’re going to do next on the Brexit front,” Conservative lawmaker Kenneth Clarke, 76, a former British finance minister, told The New Statesman magazine.

“Serious uncertainty in your trading and political relationships with the rest of the world is dangerous if you allow it to persist,” he was quoted as saying.

May has said she will not trigger the formal EU divorce this year and will get a good deal for Britain, though elections next year in France and Germany could complicate negotiations on an exit deal.

She has repeatedly said “Brexit means Brexit” and that the government is working out its negotiating position while it prepares to trigger the formal EU divorce.

“Theresa May has had the misfortune of taking over at the most impossible time,” Clarke was quoted as saying. “Nobody has the foggiest notion of what they want us to do.”

Clarke, who was this year caught on camera saying that May was a “bloody difficult woman”, said she faced a difficult problem in trying to get three major Brexit supporters in her cabinet to agree on a policy.

He said May would find it difficult to get foreign secretary Boris Johnson, Brexit minister David Davis and trade secretary Liam Fox to agree on a Brexit policy.

Clarke, who is pro-EU membership, said Brexit would do serious damage to Britain, that eventually parliament would have to debate the issue and that former prime minister David Cameron made a “catastrophic decision” by calling the EU referendum.

“He will go down in history as the man who made the mistake of taking us out of the European Union ...,” Clarke said. “I think it’s going to do serious damage.”