VACCINE maker the Serum Institute of India is set to invest in facilities in Britain and could even manufacture inoculations in the UK in future, prime minister Boris Johnson said on Monday (3).

Downing Street said the £240 million project would include a sales office, "clinical trials, research and development and possibly manufacturing of vaccines".

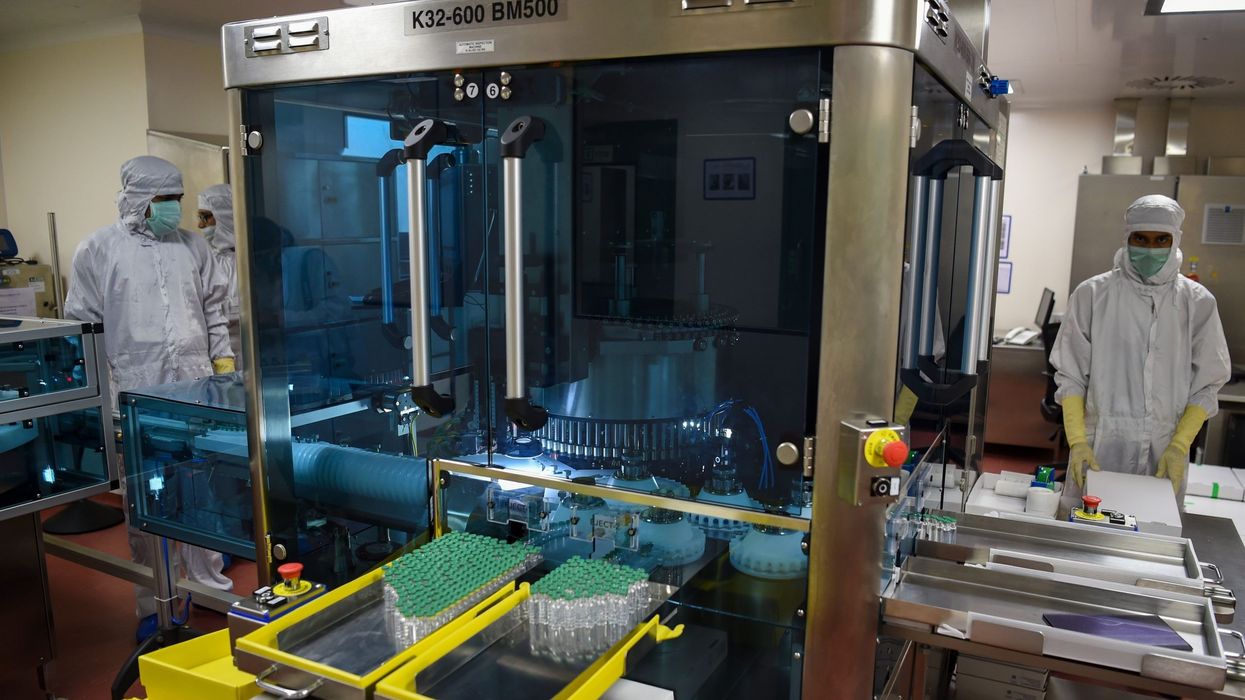

The Serum Institute of India (SII) is the world's largest vaccine maker by volume and has been at the forefront of producing the lower-cost AstraZeneca coronavirus shot.

SII has also begun phase one trials in the UK of a one-dose nasal vaccine for coronavirus.

According to the prime minister’s office, the vaccine maker's plans were part of a wider package of trade and investment deals with India worth £1 billion that it expects to create more than 6,500 jobs.

It was announced ahead of virtual talks between Johnson and India’s prime minister Narendra Modi on Tuesday.

With its massive population and growing economy, India has been high on London's list of trade deal targets since Britain left the European Union last year.

But a surge in Covid-19 cases has left the health system there at breaking point, forcing Johnson to shelve a planned visit this month.

Prior to the current wave, India was exporting tens of millions of SII-made AstraZeneca shots via through the Covax scheme supplying poorer countries.

Last month New Delhi froze exports - including to Covax - to prioritise jabs at home.

SII makes 60-70 million AstraZeneca doses per month and is aiming for 100 million by July.

With its 1.3 billion people, India has become the latest hotspot of the pandemic, even as richer countries take steps towards normality with accelerating vaccination programmes.

Britain said last Sunday (2) it was sending an extra 1,000 oxygen ventilators to India, having already sent 495 oxygen concentrators, 200 ventilators and three larger production units dubbed oxygen factories.

SII, based in Pune, southeast of Mumbai, is a state-of-the-art production facility headed by 40-year-old chief executive Adar Poonawalla, scion of a pharmaceutical dynasty worth an estimated £11 billion.

Under a post-Brexit "Global Britain" strategy, Johnson's government is pivoting its foreign policy priorities towards the Asia-Pacific region, signing trade deals with countries including Japan and Singapore.

The latest "Enhanced Trade Partnership" announcement with India includes lower trade barriers for some UK exports such as fruit and medical devices.

But there are signs India may be reluctant to sign a more wide-ranging trade pact, as Modi pushes his "Made in India" and "Self-Reliant India" agendas.

Last year he abruptly baulked at joining the Regional Comprehensive Economic Partnership (RCEP), a free trade agreement among 15 Asia-Pacific nations, because New Delhi feared its agricultural, dairy and services sectors would be disadvantaged.

Former US president Donald Trump disparaged India as the "tariff king" for its duties on imported goods, hobbling trade talks despite his friendly relations with Modi.

Talks are due to resume between India and the EU on a free-trade deal later this month, eight years after 16 rounds of talks broke up in deadlock.

Trade negotiations are also reportedly set to resume with Canada soon after a gap of four years.