By Radhakrishna N S

INDIA’S position as a critical trading partner is set to enhance further as the UK adopts an independent trade policy after Brexit, a leading India-UK business expert has said.

What makes India attractive is its huge market size and its even larger potential for growth, he said.

India is the world’s fifth-largest economy and is set to become the third-largest by 2030, providing British businesses ample opportunities to expand and invest, he noted.

Commenting on the India-UK relations, the UK India Business Council (UKIBC) Chief Executive Officer Richard Heald told Eastern Eye: “In the long-term, the size of the Indian market, the growing workforce, and the improving education and health indicators mean that India will remain an attractive destination for British trade and investment.

“The India-UK bilateral economic relations have remained strong, notwithstanding the uncertainty over the past three years surrounding Brexit.”

The UKIBC supports UK businesses with the insights, networks, policy advocacy, services, and facilities needed to expand in India.

Sharing his views on the efforts taken by the Indian government to provide an opportunity for its businesses, the business council boss mentioned: “The Indian government has introduced a number of measures aimed at stimulating the economy and consumer demand.

“UKIBC are expecting more measures to come, including resolving the underlying issues within the NBFC (non-banking financial company) sector. We are looking forward to the budget to be released in February next year.”

The business council expects the federal government and the central bank, Reserve Bank of India, to take the necessary measures to solve the pervasive shortage of credit caused by the lack of liquidity and bad debt provisioning held by banks and NBFCs.

He further noted that the resultant fall in consumer spending in large and important sectors such as automobiles has certainly contributed to the recent uncertainty. “This loss of confidence and a drying up of cash extends into the corporate sector, both in SMEs (small and medium enterprises) and the larger companies, leading to a slowdown in investment/debt repayments and/or a sale of assets to reduce debt. The NPAs (non-performing assets) of the state-owned lenders and NBFCs are compounding these problems.”

The Indian banking sector has been saddled with NPAs for many years now, and lenders have been sitting on bad loans to the tune of Rs 9.4 trillion, as on March 31, 2019, according to official figures.

“At the same time, financial analysts are projecting a recovery of some one per cent in economic growth during the next financial year,” he added.

Properly calibrated stimulus packages will enhance this positive momentum in one of the fastest-growing economy in the globe and “if India is to achieve its ambitious growth target of $5 trillion by 2025, it will need to encourage more growth and foreign investment from the UK and other countries,” the expert pointed out, emphasising that foreign investments were required to witness significant growth in the long run.

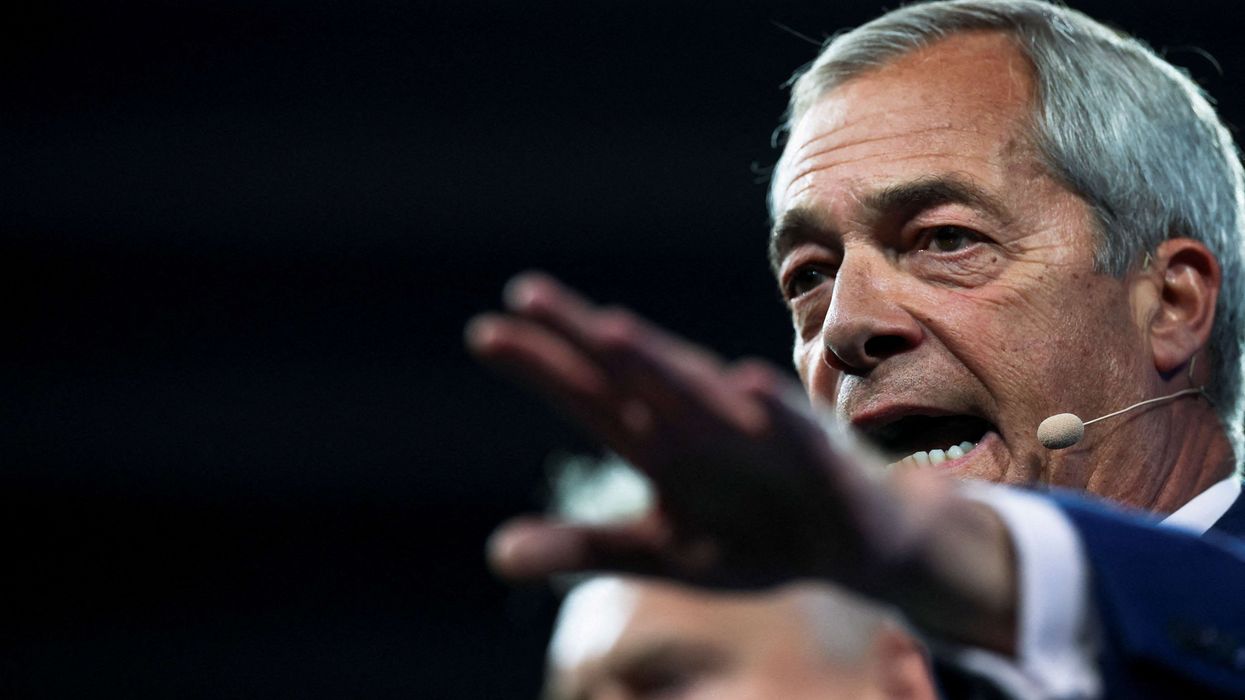

Richard Heald

The UK businesses have invested some $26.7 billion in foreign direct investment (FDI) alone over the past years. The figure is higher than that of the US, Germany and France’s industries combined.

Expressing his confidence over India’s growth record and the future business opportunities for foreign investors, Heald said: “The Indian economic slowdown might not be welcome in the short-term, but as our members and business clients tell us, the arguments for the fundamental attractiveness of India for UK trade and investment remain in place.”

UK-India business relations in areas such as the defence and insurance sectors are catalysing more UK investment to India, stimulating growth, and creating good quality jobs.

Heald further remarked that the future of India was a key focus of the UK higher education sector.

“For example, in our latest Higher Education Report: Futureproofing the UK India Partnership, UKIBC found that more than 78 per cent of universities put India in their top five countries to engage with, and 90 per cent put India in the top 10.”

Meanwhile, speaking on the business confidence of the Indian firms on the UK economy, he referred to a survey that was conducted of Indian businesses in the wake of the Brexit vote, and explained that most of these companies operating in the UK did so for specific reasons, such as British business or academic links, and access to upstream technology and processes in key areas such as financial services, engineering, alternative energy, and pharma.

“Indian companies have continued to invest in the UK during the intervening period indicating that the commercial attractions remain in place,” he added.

Between 2015-2018, the total trade between the UK and India has increased by 27 per cent.

Trade between the two countries totalled over £20bn last year, an increase of 13.6 per cent compared with 2017, according to the Office for National Statistic (ONS) data.

The UK exports to India increased by 19.3 per cent between 2017 and 2018, amounting to £8bn in total.

India’s exports to the UK grew from $2.2bn in 2001 to $6.7bn in 2017, where as Indian shipments to Britain touched $9.8bn in 2018, a rise of three per cent.

India has maintained a trade surplus with the UK, with total exports at $9.78bn and imports at $7.05bn in 2018, according to official figures.

India’s goods and services tax (GST) was introduced in 2017, which attracted both criticism and support by the Indian business.

Sharing his views on GST and its impact on foreign business in India, Heald hailed the tax reform. “Aligning the tax systems of its states has made the Indian market an easier place to do business – for which we have collected evidence, as in the last three years calls for reform from UK companies have fallen dramatically in our Doing Business in India Report series, from 55 per cent of companies calling for reform in 2016 to just 16.9 per cent in 2019.

“As a complex market of various regulations, laws and cultures, the rollout of a homogeneous tax structure will help to open the entire Indian market to trade and investment, compared to complications in the past in paying taxes when companies were active in multiple states.”

He further noted: “The rollout of GST in 2017 initially caused some disruption, particularly among SMEs who struggled to come to terms with the new tax structure. GST has hampered the small businesses more than demonetisation by forcing them to withhold inventory until they migrate to the GSTN or the GST Network and become compliant with the numerous rules and regulations that are part of this tax. However, the short-term implications of GST should be outweighed by future gains.”

Responding to India’s recent efforts to boost economic activity, Herald said decreasing the country’s corporate tax rate from 30 per cent to 25.17 per cent might incur short-term losses.

But in the long run, low tax rates, which showcase the South Asian country’s openness for FDI, is expected to attract increased trade and investment, and ultimately push the economic activity forward.

In UKIBC’s recently published 5th annual Doing Business in India Report, when asked to UK companies, whether the UK’s exit from the European Union would impact their business with India, around 55.8 per cent of respondents said it would have no impact and 25.98 per cent said it would encourage them to increase their business activities with India.

“No one company said that Brexit would cause them to rein back their engagement with India,” according to UKIBC.

Speaking on the internal issues of the south Asian country, UKIBC chief added: “Over the last two decades, India’s GDP growth rate has moved within the range of five per cent and nine per cent.

“The current slowdown is not universal across every sector or, indeed, every state in India. India remains a domestically driven economy. The percentage of economic activity that is export-related is small relative to other major economies.”

Sharing his views on the Indian government’s move that banned high value currency notes in the denomination of Rs 500 and Rs 1,000 in 2016, Heald pointed out: “Demonetisation shocked consumers – particularly in the rural areas – changing their previous habits of spending on consumer goods preferring to hold liquid assets.

“Demonetisation also led to job losses with concomitant decline in incomes and consumption being focused on essential goods and services.”

At the same time, India is not immune to external influences - in particular the simmering of the aggravating global trade disputes of which the most prominent are the disagreements between the US and China.

“However, there are some positives to take away. India is undergoing substantial structural reforms and is evolving quickly. A rebalancing of an economy as large and diverse as India’s is not simple, all the more so since it is based on a large and dynamic federal political democracy,” Heald concluded.