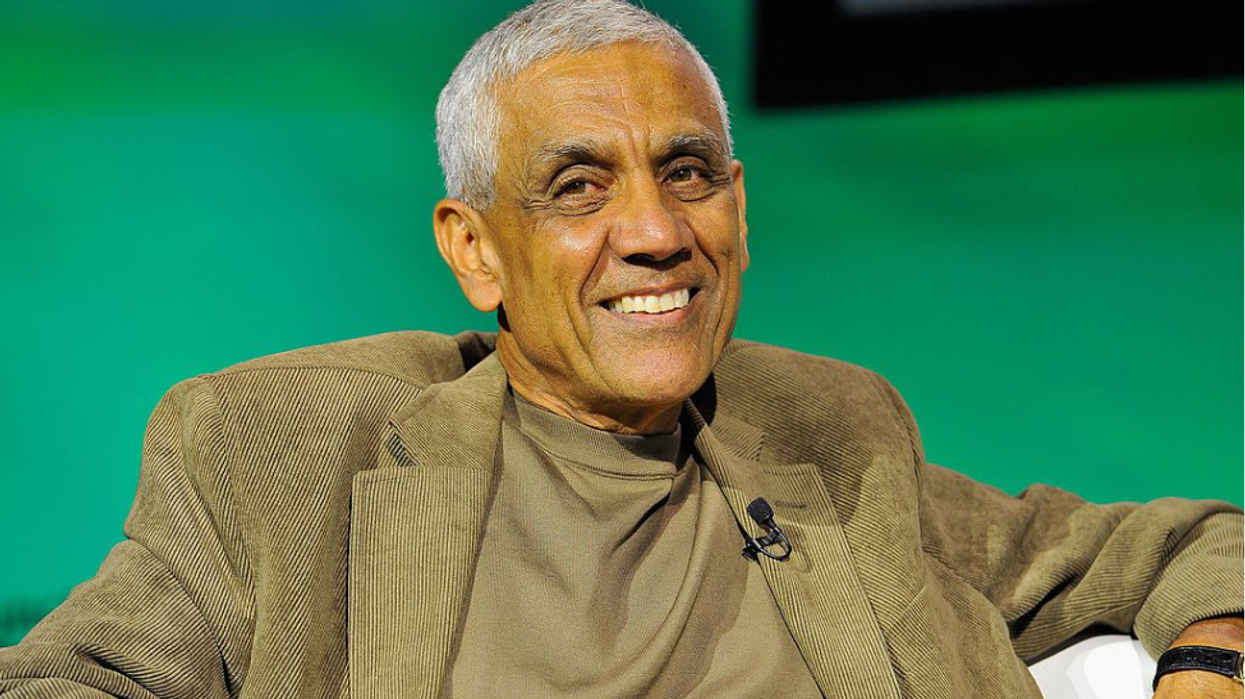

BILLIONAIRE venture capitalist Vinod Khosla has warned that the current rush of investment in overvalued artificial intelligence start-ups risks potential losses.

But the early backer of the ChatGPT chatbot creator OpenAI predicted that AI would revolutionise the world soon and there would be “a billion bipedal robots in 20 years”.

“We will have the ability to make work optional. People will not need to work. They will work because they want to work, not because they need to,” he said at a technology conference in Laguna Beach, California this month.

Khosla invested $50 million in OpenAI in 2019 when the firm raised funds at a valuation of $1 billion. But now the company is reportedly seeking a valuation of around $86 bn.

ChatGPT’s success in a short time - it was launched in November last year - has led to an investment frenzy in generative AI start-ups with many investors seeking to find the next big development in big tech.

“Most investments in AI today, venture investments, will lose money,” Khosla said.

Venture capitalists’ investment in AI companies globally went up four-fold to $21.5 bn till September end this year from $5.1bn in the whole of 2022, according to PitchBook.

The market data provider said AI startups were still catching “sky-high valuations” due to bets by big tech companies such as Amazon, which invested $4 bn in Anthropic last month.

Canada’s Cohere was valued at $2.1 bn this summer while the French start-up Mistral AI raised $111m when the company was just a month old.

Khosla, 68, compared the general hype and heightened investment in the AI startups to the flow of money last year into cryptocurrency firms, some of which have failed.

Many investors hoped that bets on highly valued companies would pay out because others would invest later at an even greater valuation, the Khosla Ventures founder told the Financial Times.

According to the Indian-American businessman, many later entrants were “investing because everybody else is investing, that is what’s happening in AI”.

He indicated that he would not invest when AI startups went for later stage fundraising.

“We invest in the fundamentals . . . which is different from investing in momentum, which is [what] most of the management community [does],” the co-founder of Sun Microsystems said.

“We are very, very active but very selective,” said Khosla whose firm has also invested in online grocery delivery firms Instacart and DoorDash as well as fintech companies Stripe, Block and Affirm.

He expressed concerns about the possible use of AI technology in the presidential election in the US next year.

“There will be millions of bots interfering with our election next year . . . nation states — which means China mostly — influencing the election next year and attempting to make democracy dysfunctional,” he said.

Vinod Khosla warns against investment frenzy in AI startups

The early backer of OpenAI predicts there will be a billion bipedal robots in 20 years