Reliance Capital’s lenders have decided to vote on a resolution plan submitted by a Hinduja Group company.

Indusind International Holdings Ltd (IIHL) offered around Rs 100 billion (£960 million) to buy the company which went into administration in November 2021 after defaulting on a debt repayment of Rs 240 bn (£2.31 bn).

The Hinduja entity earlier week submitted its resolution plan for the financial services company which is lower than its liquidation value estimated between Rs 125 bn (£1.20 bn) and Rs 130 bn (£1.25 bn), media reports said.

Other bidders, including Torrent Investments, Oaktree Capital and Piramal Capital did not submit detailed plans before the deadline set by the lenders, the Economic Times reported.

Without naming IIHL, Reliance Capital administrator Nageswara Rao Y said the committee of creditors “deliberated the resolution plan received from one of the prospective resolution applicants” at their meeting on Wednesday (7).

The resolution plan would be put for e-voting under the insolvency and bankruptcy code, he said in a filing to the Bombay Stock Exchange.

At least two-thirds of the creditors need to favour the plan to take it forward to the National Company Law Tribunal for approval.

If it passes the hurdles, the resolution plan further requires approval from the Reserve Bank of India - the banking regulator.

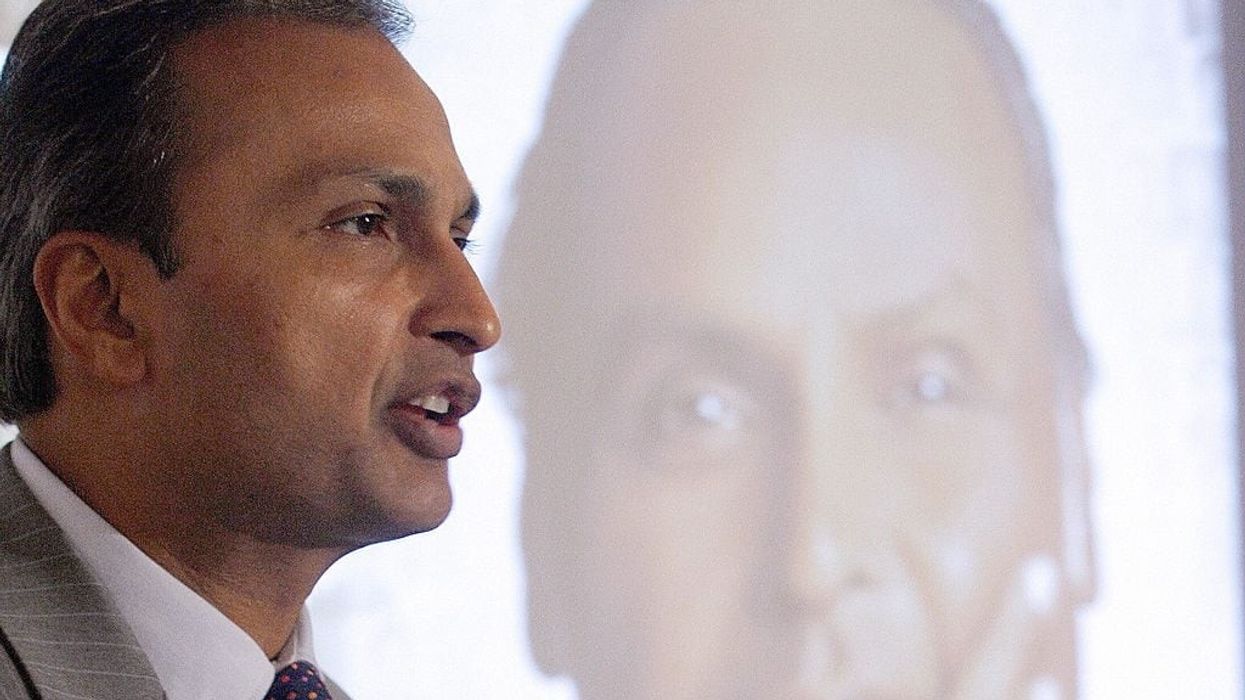

The sale of the company is subject to the Supreme Court's decision on a suit filed by Torrent Investments over the extension of the deadline for the auction of Reliance Capital, which was once controlled by Anil Ambani.