INDIA's central bank kept interest rates at record lows on Friday (4) and announced additional bond purchases to support the economic recovery, at risk of being derailed by a devastating second wave of Covid-19 infections.

The Reserve Bank of India's (RBI) monetary policy committee (MPC) voted unanimously to hold the repo rate, its key lending rate, at four per cent and kept the reverse repo rate, the borrowing rate, unchanged at 3.35 per cent.

The central bank also promised to keep its policy accommodative for as long as necessary, as it downgraded the growth forecast for the 2021-22 fiscal year and said current inflation pressures would likely be transient.

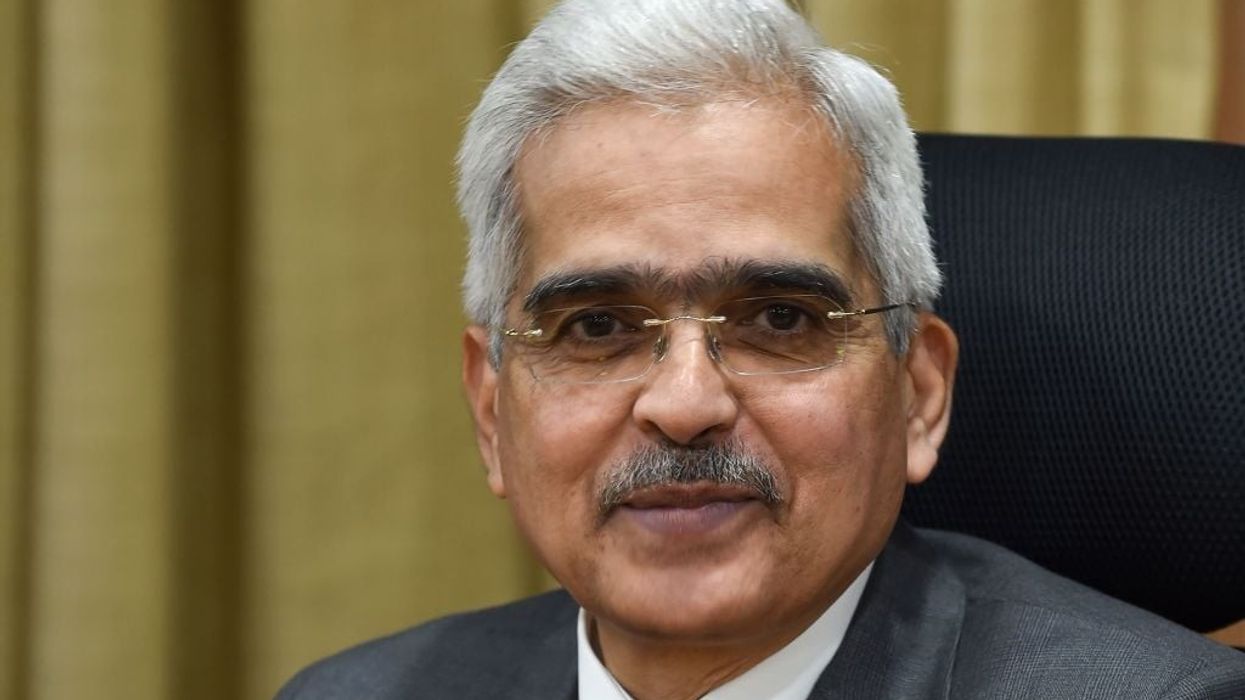

"At this point of time the MPC has very consciously taken the decision to focus on growth," said RBI Governor Shaktikanta Das during a press briefing.

"The MPC was of the view that at this juncture policy support from all sides is required to gain the momentum of growth that was evident in the second half of 2021 and to nurture the recovery," Das said earlier in a statement.

India's annual economic growth rate picked up in January-March compared with the previous three months, but economists are increasingly pessimistic about the June quarter after a huge wave of Covid-19 cases triggered lockdowns in several states.

Das said RBI will buy Rs 1.2 trillion rupees ($16.44bn) worth of bonds in the September quarter on top of the quantitative easing programme announced in April. The RBI said then it would buy Rs 1 trillion rupees worth of bonds under the G-SAP 1.0 programme.

Economists said the government would also need to step up and announce fiscal measures in an effort to aid the recovery as monetary policy alone will not prove adequate.

Growth forecast downgraded

The RBI's monetary policy committee downgraded its growth forecast for the 2021-22 fiscal year to 9.5 per cent from 10.5 per cent previously but did not expect the fallout from the current coronavirus restrictions to be as bad as the impact of a national lockdown last year.

"The sudden rise in Covid-19 infections and fatalities has impaired the nascent recovery that was underway, but has not snuffed it out. The impulses of growth are still alive," Das said.

Das said normal monsoons will augur well for the agriculture sector and, alongside supply side interventions from the government, should help keep inflationary pressures in check.

But supply constraints due to coronavirus curbs and rising input costs, on the back of higher commodity prices, could fuel inflation, the RBI said.

Retail inflation is seen at 5.1 per cent in 2021-22 and RBI deputy governor Michael Patra said the MPC's view is that inflation is not "persistent".

"Their insistence on ignoring the inflationary build up due to rising commodity and food prices is extremely intriguing and could pose financial stability risk at some stage," said independent adviser and market expert Sandip Sabharwal.

The central bank has slashed the repo rate by a total of 115 basis points (bps) since March 2020 to soften the blow from the pandemic, following 135 bps worth of rate cuts since February 2019.

"We will continue to think and act out of the box, planning for the worst and hoping for the best," Das said. "The need of the hour is not to be overwhelmed by the current situation but to collectively overcome it".