THE INTERNATIONAL Monetary Fund (IMF) said on Monday (22) it has reached an agreement with Pakistan that will help revive a stalled $6 billion (£4.4 bn) funding programme for the south Asian country, which faces growing economic challenges.

Pakistan’s authorities and IMF staff have reached a staff-level agreement on “policies and reforms needed to complete the sixth review", the IMF said in a statement.

It said, "the agreement is subject to approval by the Executive Board, following the implementation of prior actions, notably on fiscal and institutional reforms."

The sixth review has been pending since earlier this year and its completion would make available £750 million in IMF special drawing rights, or around $1 billion, bringing total disbursements so far to about $3 bn (£2.98 bn), the statement said.

Pakistan entered the $6 billion, 39-month funding programme with the IMF in July 2019. However, the funding stalled earlier this year due to issues over required reforms.

Pakistan has been in talks with the IMF for several months to seek relaxation in the terms and conditions of the package.

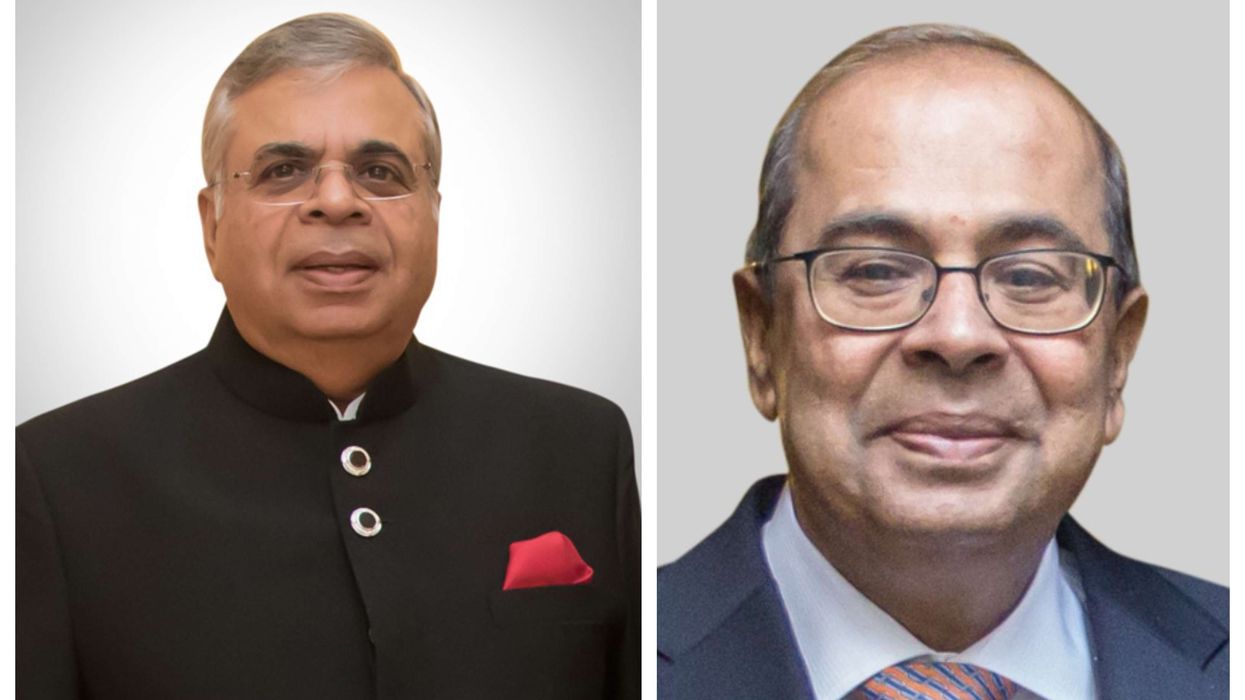

Pakistan’s finance adviser Shaukat Tarin said last week that the country had to complete five reforms before the IMF revived the funding, including legislation on central bank autonomy to ensure its independence over monetary policy and control of inflation, withdrawal of tax exemptions and increased energy tariffs.

The IMF gave around $1.4 bn (£1 bn) extra in April 2020 to help Pakistan address the economic impact of the Covid-19 shock.

A Pakistan finance ministry spokesman said the latest agreement was struck after 45 days of discussions between the finance ministry team and the IMF.

"This will remove a lot of uncertainties," he said.

Despite a difficult environment, progress continues to be made in the implementation of the programme, the IMF said, adding, "All quantitative performance criteria (PCs) for end-June were met with wide margins, except for that on the primary budget deficit."

Pakistan has been grappling with a historical currency devaluation, high inflation, a current account deficit and dwindling foreign reserves. Investors have also become nervous about the outcome of the talks between the government and the IMF.

Ahead of the IMF announcement, the central bank last week warned that a higher than expected primary deficit would likely worsen the inflation outlook and undermine economic recovery.

It also raised its benchmark interest rate by 150 basis points to 8.75 per cent to counter inflationary pressures and preserve stability with growth.

Headline inflation had reached 9.2 per cent in October, up from 8.4 per cent two months earlier, the bank said.

It has also lifted the cash reserve requirement for commercial banks by 1 percentage point, the first such move in more than a decade, in another move to deal with accelerating inflation.

(Reuters)