Leaks surrounding the upcoming Google Pixel 10 have started surfacing, offering a first look at the tech giant’s next flagship device. Spotted on a public beach in Vancouver, Canada, the phone was reportedly being filmed for a TV advert, giving passers-by an unexpected preview. From design changes to new features and colour options, here are seven key things we’ve learnt from the leak.

1. Pixel 10 caught on camera during filming

The Pixel 10 Pro (or possibly the Pixel 10 Pro XL) was seen in public during what appeared to be a promotional shoot for Google. A video production crew was spotted working on a beach, where a bystander was able to view the phone and even the storyboard for the shoot — a rare, unguarded glimpse into Google’s plans.

2. New AI-powered camera feature: ‘Google Add Me’

The storyboard revealed an upcoming feature called Google Add Me, an AI tool designed to enhance group photography. The feature will allow users to add people to the same photo after it’s taken, such as including the photographer in the final image. This builds on Google's continued use of AI in the Pixel’s camera software.

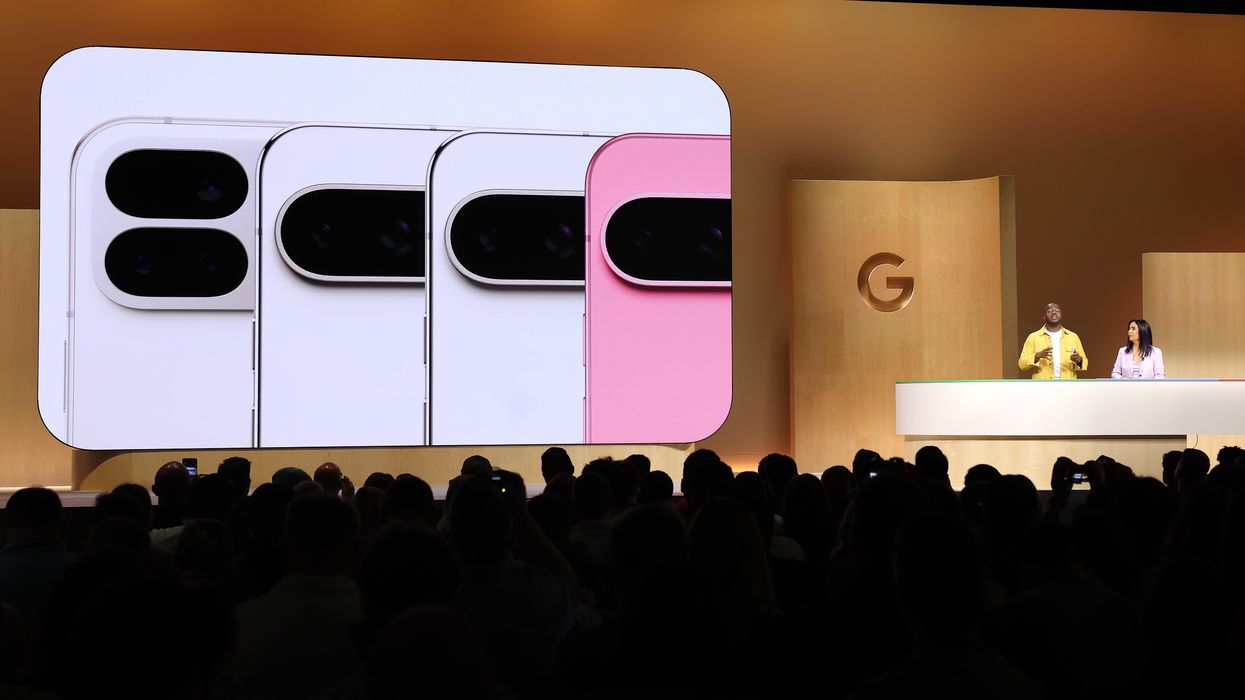

3. Refined camera design continues

The Pixel 10 appears to maintain the camera design introduced in previous models, a horizontal camera bar with a black oval housing the sensors. However, the leaked phone shows a slightly larger protruding oval with additional space, presumably for the LED flash, suggesting some refinement in the hardware layout.

4. Colour options revealed

New colour variants were also uncovered in the leak. The Pixel 10 will reportedly come in:

- Obsidian (Black)

- Blue

- Iris (Purple)

- Limoncello (likely Yellow)

Meanwhile, the Pixel 10 Pro and Pro XL models are expected in:

- Obsidian

- Green

- Sterling (Grey)

- Porcelain (White)

5. Blue model spotted in the wild

The device seen on the Vancouver beach appeared to be the Blue version of the Pixel 10, indicating Google will lean into bolder colours this time around. This adds visual variety compared to the typically muted palette of previous Pixel phones.

6. Possible multiple Pro models

The leak mentions both Pixel 10 Pro and Pixel 10 Pro XL, suggesting Google may release two larger flagship models. If true, this would mark a return to the XL naming convention, which had been previously dropped in favour of the regular and Pro distinction.

7. Expected launch in August

While the Pixel line traditionally launched in October, Google moved up the release of the Pixel 9 series to mid-August 2024. Based on the filming timeline and consistent patterns, it’s likely the Pixel 10 series will also launch around August 2025, maintaining this revised schedule.

With a mix of AI-powered features, new colours, and potential model variants, the Pixel 10 is shaping up to be one of Google’s most anticipated releases. The official launch is expected within the next few months.