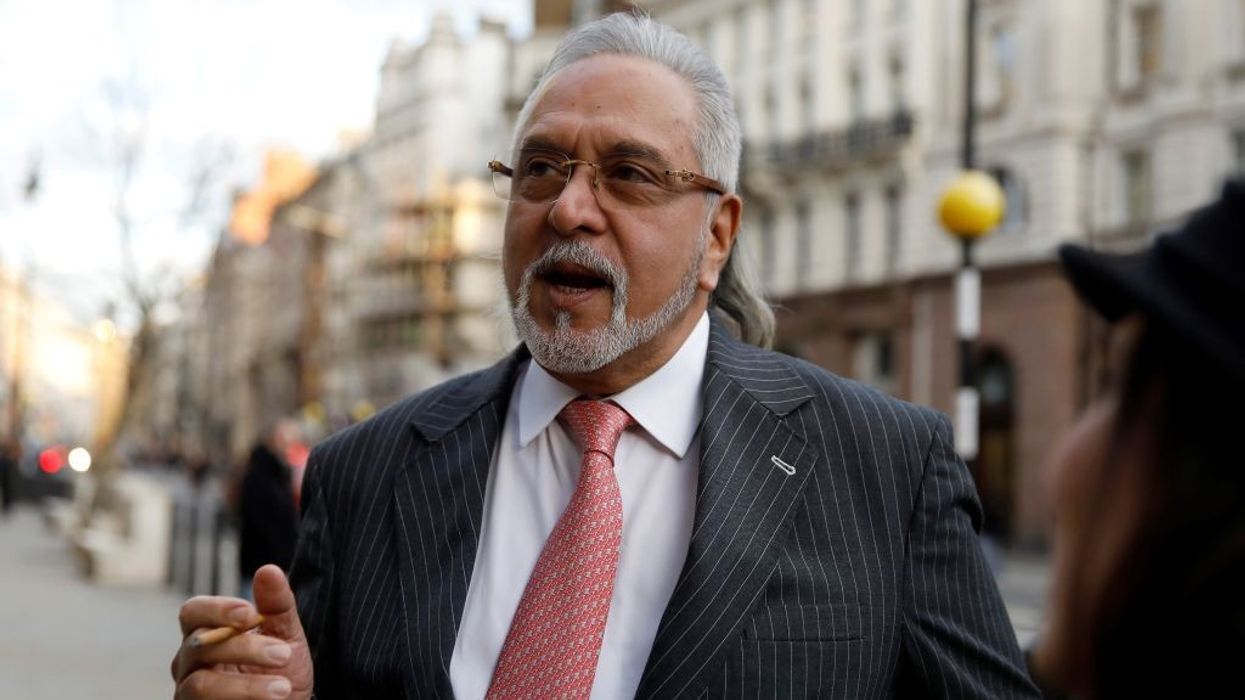

VIJAY MALLYA has lost his appeal against a bankruptcy order issued by London’s High Court over a debt exceeding 1 billion pounds owed to lenders, including the State Bank of India.

The Indian businessman, who resides in the UK, has been involved in a prolonged legal dispute with Indian banks and authorities following the collapse of Kingfisher Airlines in 2012.

In 2017, a group of banks secured a judgment in India for more than 1 billion pounds against Mallya, who had personally guaranteed the loans taken by Kingfisher Airlines. The judgment was registered in the UK later that year, which led to a bankruptcy order against him in 2021.

Mallya challenged the bankruptcy order in a hearing held in February. His legal team argued that the banks had already recovered assets equivalent to the debt amount. However, the appeal was dismissed on Tuesday.

Judge Anthony Mann, in a written ruling, said, “The bottom line ... is that the bankruptcy order stands.”

Mallya’s lawyers said in a statement that he would continue efforts to overturn the bankruptcy order.

Mallya, who was also a co-owner of the Formula One team Force India, is separately contesting extradition to India, where he faces fraud charges linked to Kingfisher Airlines. His most recent appeal against extradition was rejected in 2020.

Judge Mann noted in his ruling that the extradition order “has still not been enforced.”

“Apparently Dr Mallya is still resisting extradition on other bases which have yet to be resolved,” he added.