IN a parliamentary hearing on Thursday (18), MPs scrutinised freeholders for establishing a "rentier structure" in England and Wales, accusing them of imposing "exorbitant" ground rents, reaching £8,000 annually in some instances.

The scrutiny unfolded as a freeholder group resisted proposed changes to leasehold laws amidst the ongoing parliamentary examination of the government's leasehold reform bill, The Guardian reported.

The much-anticipated bill aims to simplify and reduce costs for leaseholders seeking lease extensions and acquiring freeholds. Additionally, it proposes a ban on leaseholds for newly constructed houses, excluding flats, in England and Wales.

The bill is currently in the committee scrutiny stage, with MPs from the public bill committee questioning representatives from leaseholder and freeholder groups, legal experts, and executives from the Competition and Markets Authority.

During the hearing, Jack Spearman, the head of leasehold at the Residential Freehold Association, representing freeholders for one million leasehold apartments, opposed housing secretary Michael Gove's proposals to cap ground rents on existing leases.

He expressed concerns that such caps would deter investors, citing a Savills report indicating a need for £250 billion in housing-related investments within the next seven years.

He also emphasised the importance of capital infusion into the housing sector, arguing that pension funds would be a vital source.

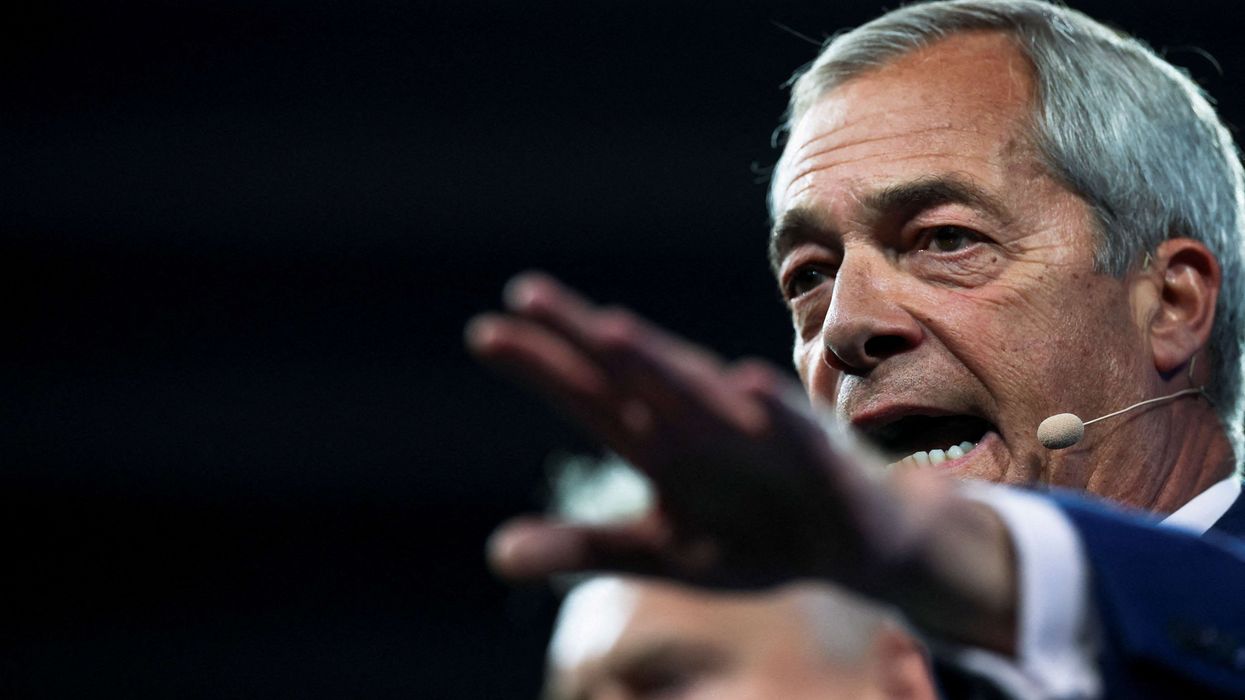

Labour MP Barry Gardiner, currently working on a documentary about the leasehold system, dismissed the notion that the housing market would collapse without revenue extraction from ground rents by pension funds.

Gardiner accused freeholders of creating a rentier structure over the past 15 years, extracting exorbitant revenues, some reaching £8,000 annually, without providing any services.

The Department for Levelling Up, Housing, and Communities refuted claims, stating that less than one per cent of pension fund assets were invested in residential property. Spearman acknowledged the need to address onerous and egregious ground rents but defended those that did not escalate rapidly over the years.

The government's initiative to reform leaseholds gained momentum following a scandal involving exorbitant ground rents, prompting an investigation by the Competition and Markets Authority in 2019.

Although ground rent for new leases was abolished in the summer of 2022, a substantial number of leaseholders still face significant increases in the coming years.

The proposed peppercorn cap, estimated to save leaseholders £5.1bn in ground rent over a decade, has faced opposition. The government contends that no compensation will be paid to freeholders for capping ground rents, a stance contested by the British Property Federation, raising concerns about compliance with the European Court of Human Rights and potential legal challenges.

The debate continues as MPs prepare to publish their findings on February 1.