THE HINDUJAS on Saturday (27) welcomed the Reserve Bank of India (RBI)’s move to allow promoter holding of up to 26 per cent in private-sector lenders.

IIHL Mauritius, the Hindujas' entity which is the promoter of IndusInd Bank, had applied to the RBI, seeking to increase its holding to 26 per cent from the previous cap of 15 per cent.

It sought parity after promoters of rival Kotak Mahindra Bank were permitted to have their holding at 26 per cent.

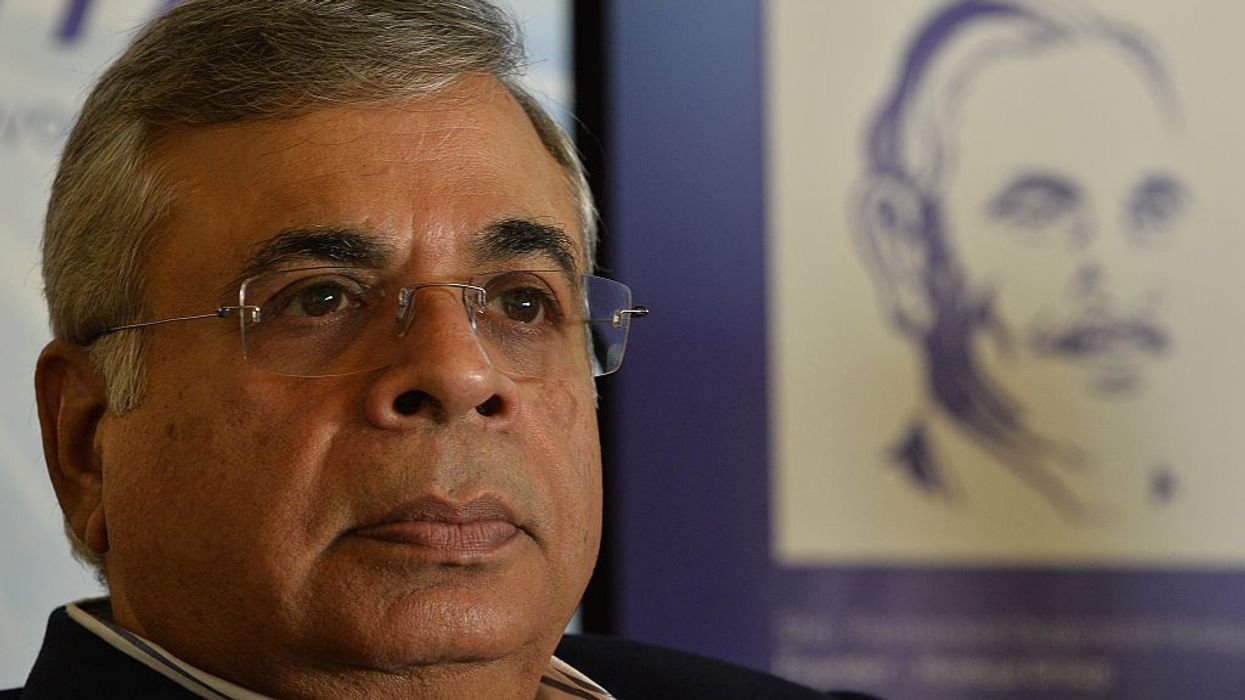

"We believe this measure of increased promoter holding will be of benefit to all stakeholders: the regulator, the banking institution and its clients, particularly at this time when the Indian economy is poised for exponential growth," Ashok Hinduja, the chairman of IIHL, said.

The RBI on Friday (26) came out with revised guidelines on private sector banks, allowing 26 per cent promoter ownership but did not go ahead with an internal working group's recommendation to allow corporates to promote banks after protests from various quarters including former governors.

Hinduja said IIHL now awaits operational guidelines as it allows the promoters to inject capital to increase stake up to 26 per cent.

The increased promoter holding will lead to an enhanced financial strength of the bank and its clients will be protected, he added.

(PTI)