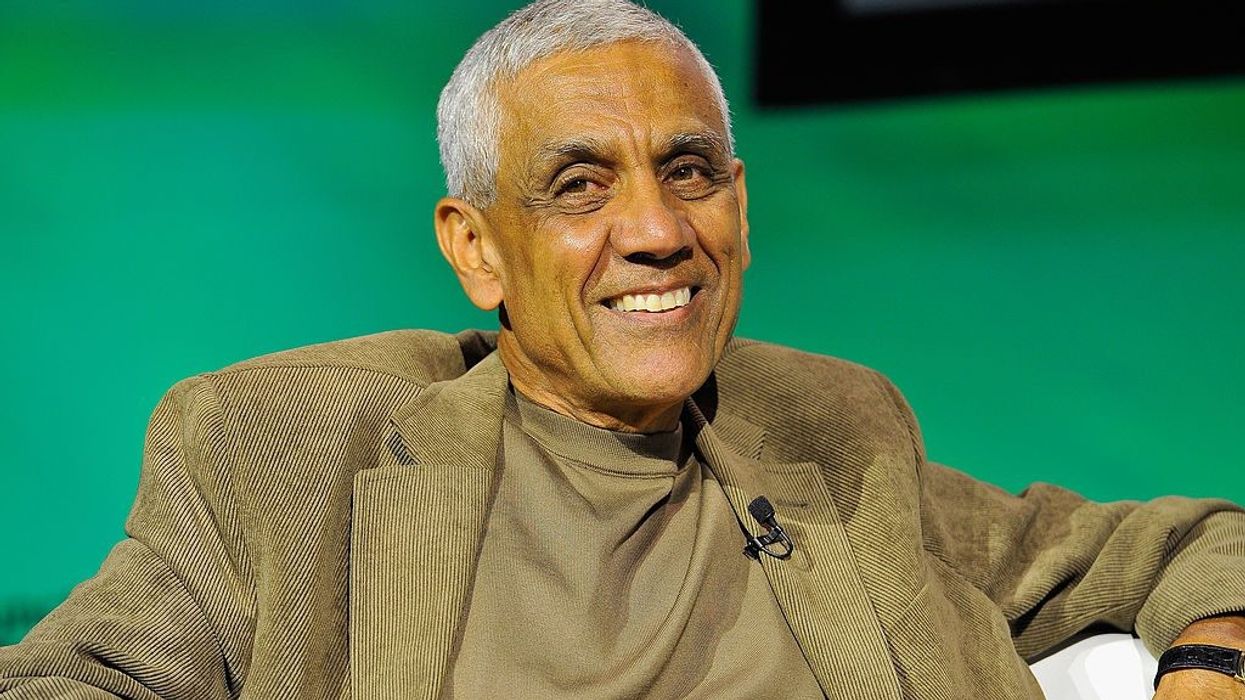

Indian startups are experiencing funding winter after a phase of copious easy money but billionaire venture capitalist Vinod Khosla finds a lot of positives in the situation.

The co-founder of Sun Microsystems said the tightening liquidity has led to the separation of wheat from the chaff in the startup sector and this will ultimately help the firms with strong fundamentals.

According to him, good startups will continue to get funding, though at lower valuations but “the not-so-good” ones will go bust which will mean less competition for the robust ones going forward.

The availability of funds at low-interest rates before the current tightening led to astronomical valuations of several startups, some of them becoming so-called unicorns quickly although profitability eluded them.

But as central banks worldwide have steadily increased interest rates to combat inflation, the flow of easy money into startups has petered out and the recent events in the banking sector have only compounded the situation for new tech firms.

In 2022, there was downward re-appraisal for many startups, something mirrored in the erosion of the valuations of companies listed after the onset of the pandemic.

Khosla, who has invested in several tech firms, told the BBC that it was easy earlier for startups "to get a billion-dollar valuation which made no sense.”

Valuations built up because prominent funds poured money into India, said the founder of the California-based Khosla Ventures which has invested in the semiconductor, biomedicine, big data, and robotics spaces.

He argued that as weak startups cannot survive the funding crunch, there will be fewer but larger start-ups which will not have to compete with smaller firms.

Khosla said technology has significantly contributed to the expansion of the US GDP and India is getting similar opportunities as government policies are “supportive”.

"There is long-term opportunity in India as a major developing country with lots of GDP growth to be captured by start-ups," the Silicon Valley veteran, who studied at the Indian Institute of Technology Delhi and Stanford University, said.

"India Stack, UPI (Unified Payments Interface) and others are good infrastructure for the start-up ecosystem to develop on," the Indian American businessman told the BBC.

Funding winter will ultimately help strong startups: Vinod Khosla