India’s yearlong presidency of the G20 came to a climax last weekend as world leaders gathered in Delhi for the annual summit of the world’s leading economies.

Against the perceived odds, India was able to forge consensus among a group of nations increasingly divided along geopolitical fault-lines. The official communique, or “New Delhi Leaders Declaration”, was a triumph of Indian diplomacy - unanimously adopted despite differences over the war in Ukraine - and winning plaudits across the board, including from our own prime minister Rishi Sunak, who hailed the outcome as “historic”.

As well as introducing the African Union as a new member, India was able to shift the focus of the G20 (or now G21) onto a development agenda, consistent with its chosen theme of “One Earth, One Family, One Future”, affording greater prominence to the Global South, and announcing an ambitious new economic corridor across India-Middle East-Europe.

For the UK, the summit also provided an opportune moment to take stock of negotiations on the bilateral Free Trade Agreement (FTA), a key deliverable from the 2030 Roadmap for India-UK relations agreed in May 2021 by our respective prime ministers. Following on the heels of the G20, the Chancellor of the Exchequer, Rt Hon Jeremy Hunt MP, arrived in Delhi to hold the 12th Economic and Financial Dialogue (EFD) with his Indian counterpart, finance minister Nirmala Sitharaman.

A delegation of UK business leaders from the India-UK Financial Partnership (IUKFP) accompanied the chancellor and participated in the EFD. The IUKFP provides a crucial platform for UK-India cooperation on issues of critical importance to our respective financial and related professional services industries. Since it was first initiated in 2014 by late Arun Jaitley and George Osborne, this innovative public-private partnership has delivered tangible benefits for both nations.

During the meetings, the Chancellor welcomed India’s confirmation to explore the London Stock Exchange as a venue for overseas listings of Indian companies. Agreements also included the launch of a partnership to boost cross-market investment by the insurance and pension sectors and an initiative to share expertise in structuring and financing major infrastructure projects.

The news that India will explore potential London listings follows recent changes to Indian regulations to allow domestic companies to access global markets and underlines the UK’s strength as a hub for international capital raising with access to a pool of £11.6 trillion funds under management. It also builds on the strong and growing collaboration with GIFT City (Gujarat International Finance Tec-City), India’s International Financial Services Centre, which enjoys a growing presence from UK financial institutions.

In addition, a new UK-India Pensions and Insurance Partnership will support the growth of the sector in both countries. The partnership will focus on knowledge sharing, growing bilateral investment and diversifying risk, including through pension fund trade missions to encourage increased bilateral investment.

The launch of a UK-India Infrastructure Financing Bridge was also announced. Co-led by Indian public policy think tank NITI Aayog and the City of London Corporation, the initiative will focus on sharing expertise in structuring and financing major infrastructure projects to meet India’s substantial infrastructure needs – smoothing the path for long-term sustainable investment into India and supporting its ambition to become the world’s third largest economy in the coming years.

Meanwhile, other topics discussed included greening our financial systems, enhancing collaboration on financial innovation, and enabling cross-border data flows.

When it was first unveiled, the India-UK Roadmap expressed the joint ambition to double trade by 2030 and this looks firmly on track, with total trade between the UK and India worth £36.6 billion in the last financial year, up over 34% year on year. Investment between the UK and India to date already supports over half a million jobs across both economies, and UK businesses sold goods and services worth around £15 billion to India in 2022.

It is evident that India and the UK are natural partners, especially on financial and professional services. However, the benefits of any free trade agreement would be limited without proper incorporation of services into the liberalisation measures given that this sector contributes more than 80% of UK GDP.

Similarly, the benefits of accessing capital and investment flows from the UK will be constrained without a credible Bilateral Investment Treaty, offering customary investor protections. After 12 rounds of negotiations, the “UK-Bharat” FTA is tantalisingly close - but still needs goodwill and creative thinking on both sides to create a truly ambitious outcome worthy of the citizens in both our great countries.

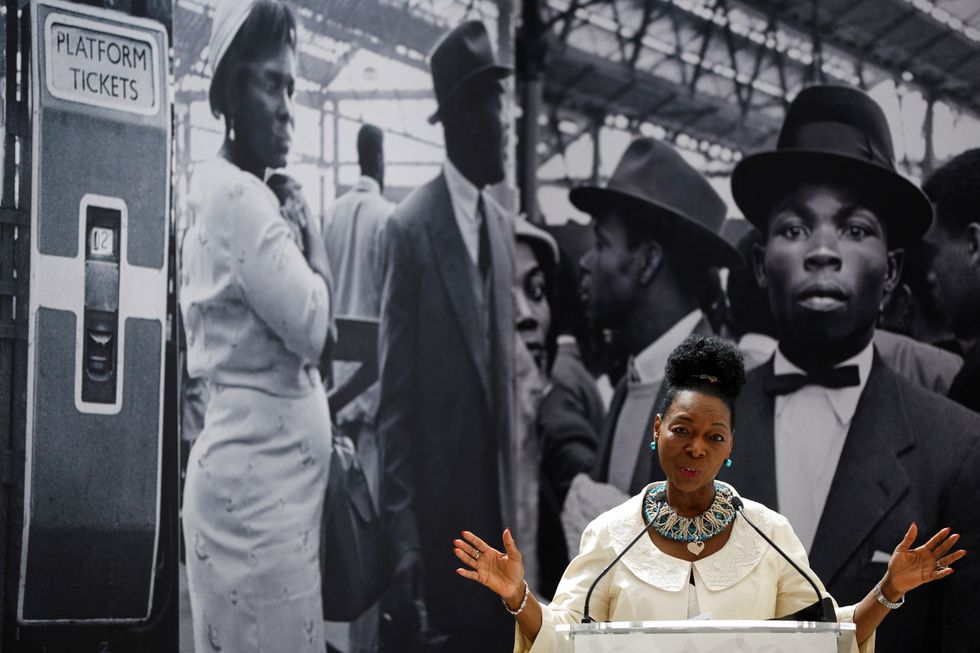

LONDON, ENGLAND - JUNE 22: Baroness Floella Benjamin speaks during the unveiling of the National Windrush Monument at Waterloo Station on June 22, 2022 in London, England. The photograph in the background is by Howard Grey. (Photo by John Sibley - WPA Pool/Getty Images)

LONDON, ENGLAND - JUNE 22: Baroness Floella Benjamin speaks during the unveiling of the National Windrush Monument at Waterloo Station on June 22, 2022 in London, England. The photograph in the background is by Howard Grey. (Photo by John Sibley - WPA Pool/Getty Images)

Ed Sheeran and Arijit Singh

Ed Sheeran and Arijit Singh Aziz Ansari’s Hollywood comedy ‘Good Fortune’

Aziz Ansari’s Hollywood comedy ‘Good Fortune’ Punjabi cinema’s power-packed star cast returns in ‘Sarbala Ji’

Punjabi cinema’s power-packed star cast returns in ‘Sarbala Ji’ Mahira Khan

Mahira Khan ‘Housefull 5’ proves Bollywood is trolling its own audience

‘Housefull 5’ proves Bollywood is trolling its own audience Brilliant indie film ‘Chidiya’

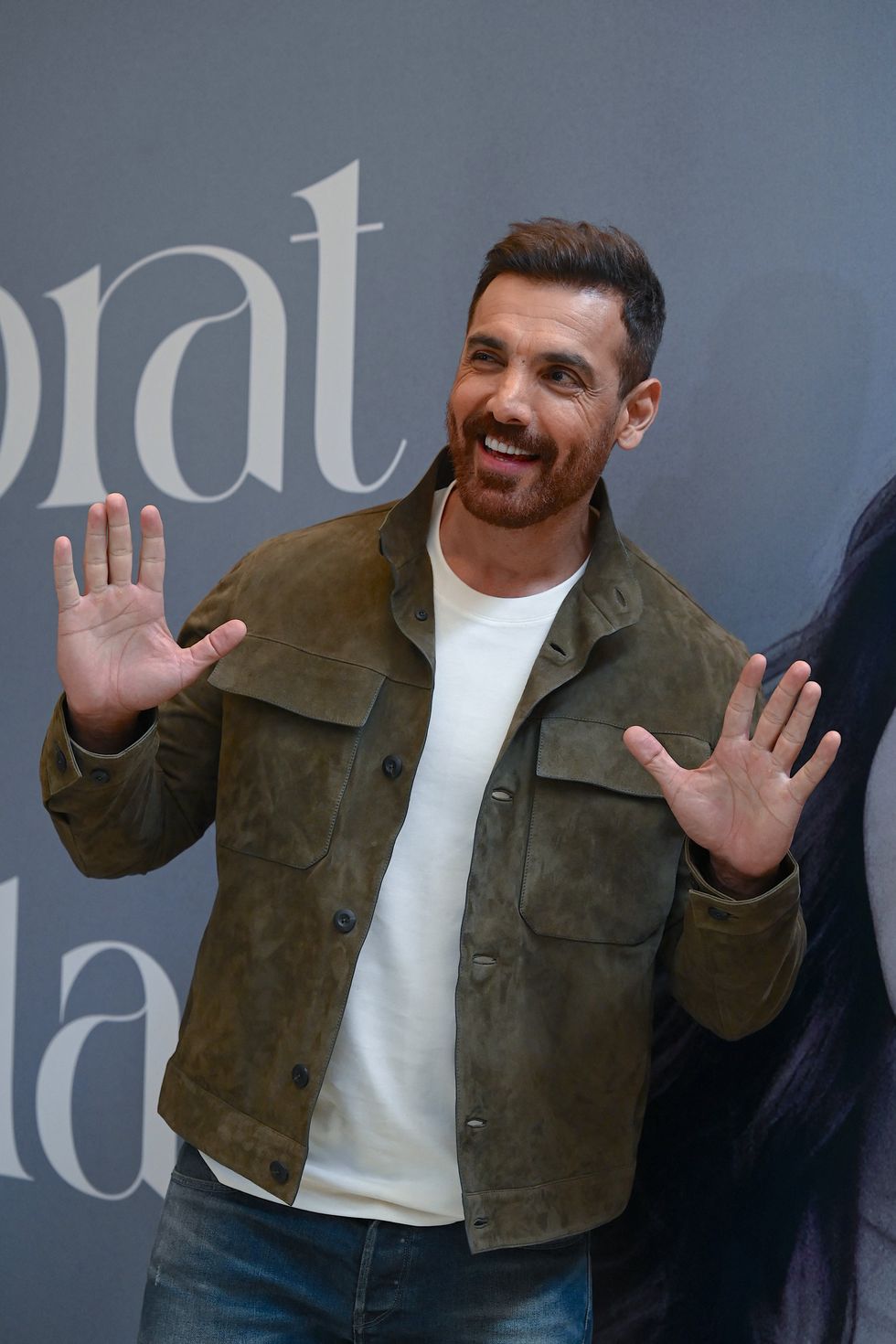

Brilliant indie film ‘Chidiya’  John Abraham

John Abraham Hina Khan and her long-term partner Rocky Jaiswal

Hina Khan and her long-term partner Rocky Jaiswal  Shanaya Kapoor's troubled debut

Shanaya Kapoor's troubled debut Sana Yousuf

Sana Yousuf

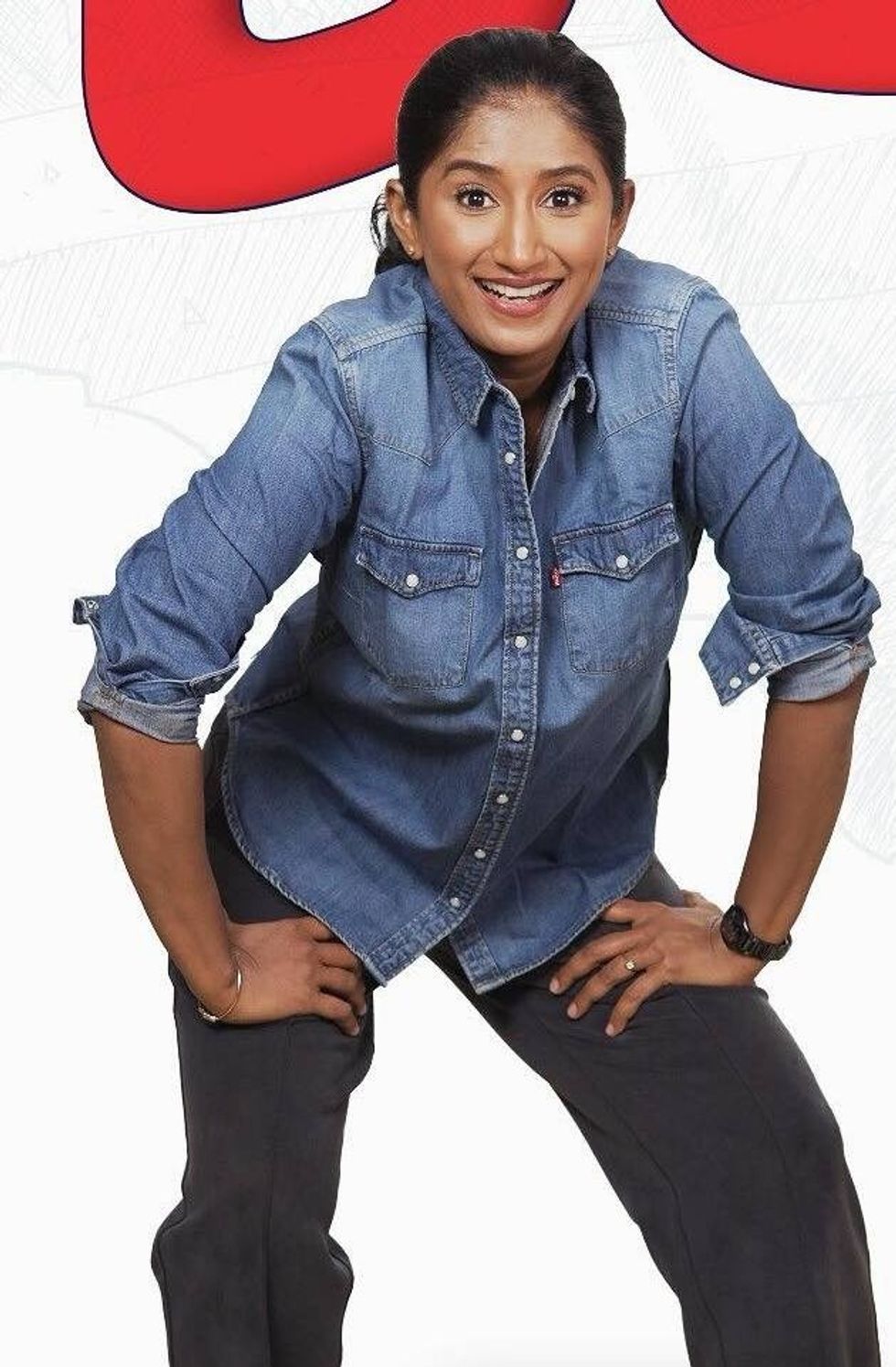

Shraddha Jain

Shraddha Jain Arundhati Roy

Arundhati Roy William Dalrymple and Onjali Q Rauf

William Dalrymple and Onjali Q Rauf Ravie Dubey and Sargun Mehta

Ravie Dubey and Sargun Mehta Money Back Guarantee

Money Back Guarantee Homebound

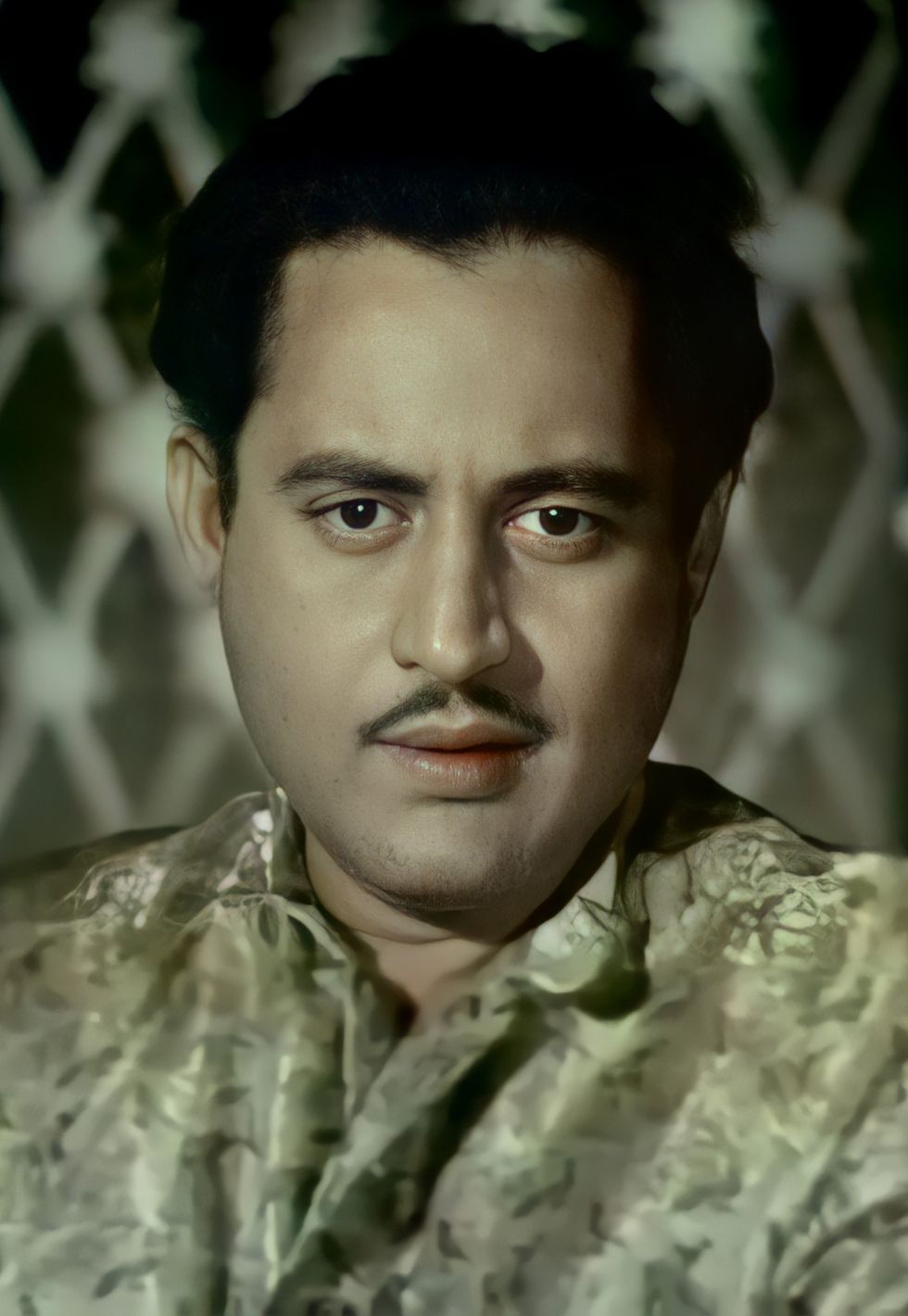

Homebound Guru Dutt in Chaudhvin Ka Chand

Guru Dutt in Chaudhvin Ka Chand Sarita Choudhury

Sarita Choudhury Detective Sherdi

Detective Sherdi

Police may probe anti-Israel comments at Glastonbury