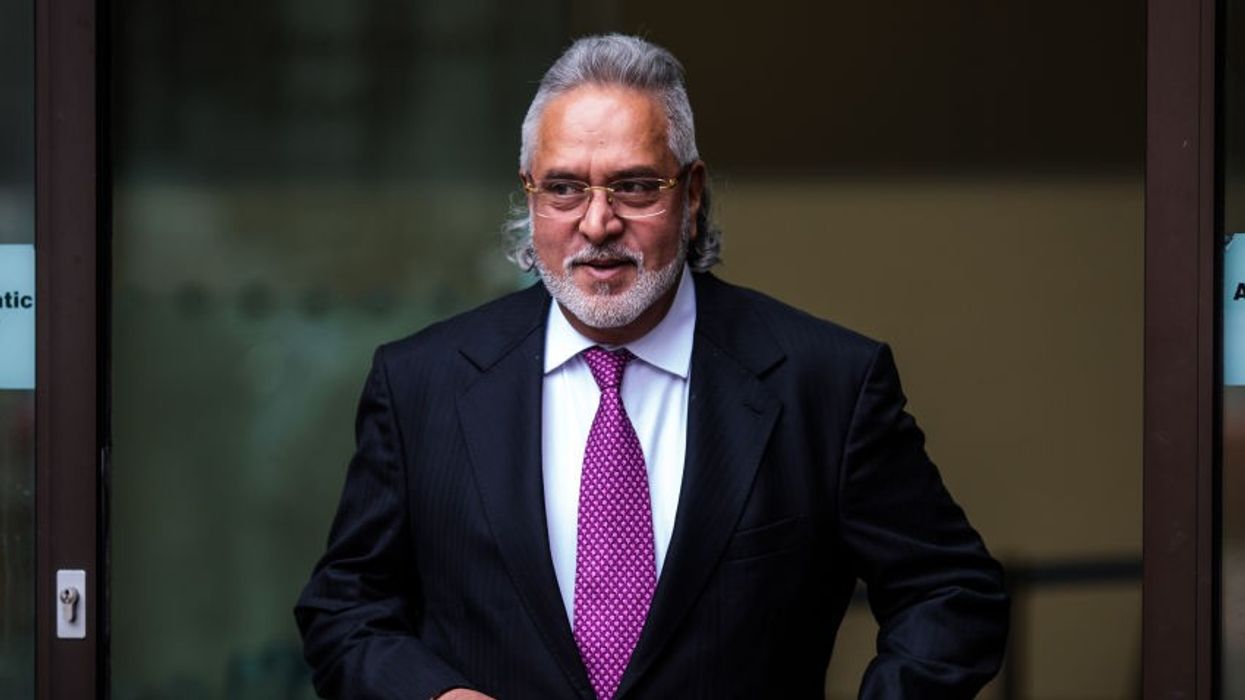

FUGITIVE tycoon Vijay Mallya has said he may consider returning to India if he is assured of a fair trial.

He spoke to Raj Shamani on a four-hour-long podcast released on Thursday.

When asked if his situation worsened because he didn’t return to India, Mallya said, “If I have assurance of a fair trial and a dignified existence in India, you may be right, but I don’t.” Asked if he would consider coming back if given such an assurance, he responded, “If I am assured, absolutely, I will think about it seriously.”

He added, “There are other people who the government of India is targeting for extradition from the UK back to India in whose case, they have got a judgment from the high court of appeal that Indian detention conditions are violative of article 3 of the ECHR (European Convention on Human Rights) and therefore they can’t be sent back.”

On being labelled a “fugitive”, Mallya said, “Call me a fugitive for not going to India post-March (2016). I didn’t run away, I flew out of India on a prescheduled visit… fair enough, I did not return for reasons that I consider are valid… but where is the ‘chor’ (thief) coming from… where is the ‘chori’ (theft)?”

The Indian government has not responded to Mallya’s claims.

In April, Mallya lost an appeal against a London high court bankruptcy order in a case involving over ₹11,101 crore (approx. £95.7 million) debt to lenders including the State Bank of India.

In February, he moved the Karnataka High Court seeking details of loan recoveries. His legal counsel said banks had recovered ₹14,000 crore (approx. £120.7 million) despite the original dues being ₹6,200 crore (approx. £53.4 million). The court issued notices to banks and loan recovery officers.