Highlights

- Major streaming platforms experience substantial market share shifts throughout 2025 with Amazon Prime Video losing 4 percentage points.

- Disney+ and Apple TV+ emerge as biggest gainers, each growing 2 percentage points annually as competition intensifies.

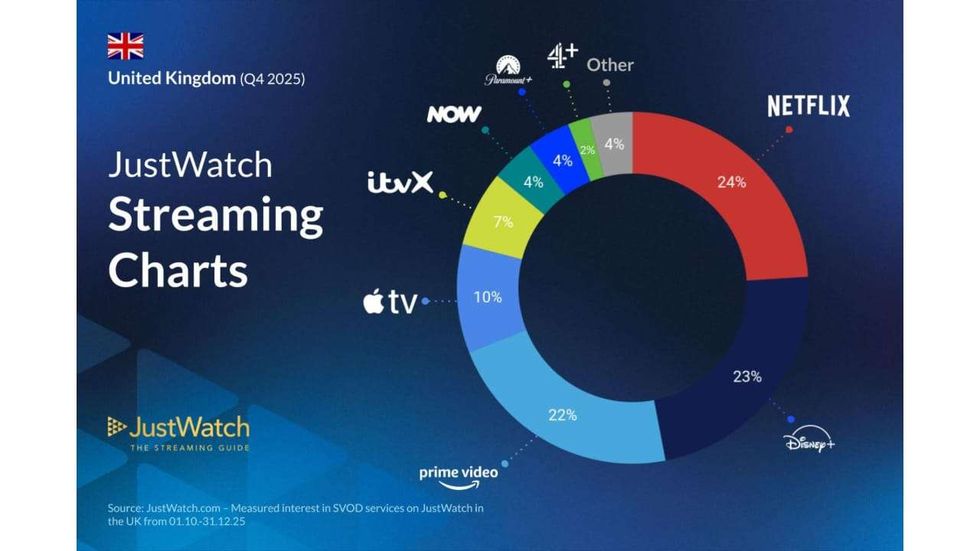

- Netflix maintains market leadership at 24 per cent despite declining 3 percentage points year-on-year in increasingly crowded UK market.

The UK streaming landscape has undergone major transformation throughout 2025, with platforms experiencing substantial shifts in market share as competition for viewers intensifies, according to latest data from JustWatch.

The streaming guide, which tracks user engagement from over 3 million UK users monthly, reveals a volatile market where established players are losing ground while newer platforms gain momentum.

Amazon Prime Video "experienced the most significant challenges during 2025," according to the report, losing 4 percentage points throughout the year described as "the steepest decline among major platforms" to fall to 22 per cent market share.

Netflix retained its position as market leader with 24 per cent share in the fourth quarter of 2025, though the platform has declined 3 percentage points year-on-year.

The report notes this represents "a notable drop for the streaming giant that has dominated the UK market."

Disney+ and Apple TV+ were identified as "the biggest gainers of 2025," each growing 2 percentage points annually.

Disney+ now commands 23 per cent of the market, while Apple TV+ reached 10 per cent. The JustWatch data shows these platforms successfully challenging established competitors, with Apple TV+ maintaining "its position as the fourth most-used platform in the UK."

Free streaming service ITVX showed growth, rising to 7 per cent market share with a 1 percentage point gain both quarterly and annually. The platform was described as "among the few streaming platforms to grow its UK market share" during the final quarter.

Paramount+ demonstrated "strong annual performance," gaining 2 percentage points to reach 4 per cent market share. According to the report, this growth was "likely driven by the popularity of its exclusive titles like South Park and MobLand."

NOW held steady at 4 per cent quarter-on-quarter but declined 1 percentage point annually, while Channel 4+ maintained 2 per cent share.

Data and outlook

The JustWatch report tracks market development across all major platforms, with data showing that combined "other SVOD platforms" accounted for 4 per cent of the market, growing 3 percentage points year-on-year.

The insights are derived from streaming activity tracked across JustWatch's UK user base, including "clicking on a streaming offer, adding a title to a watchlist, and marking a title as 'seen.'"

The data is collected from more than 60 m movie and television show fans per month and updated daily across 140 countries and 4,500 streaming services.

The report's findings highlight intensifying competition among streaming platforms, with market volatility throughout 2025 suggesting the UK streaming landscape "remains far from settled".